This article is obsolete and no longer maintained.

Trading style: Asian session scalping on AUDCAD. It opens up to 7 positions at once (all of them having the same lot size) using different strategies and acting somewhat like a grid.

Currency pairs: AUDCAD

Timeframe: M1

Price: $179

License: 1 live account, 1 demo account

NFA compliance: yes

Refund policy: 90 days via Click2Sell (note: vendor claims there are no refunds but that’s against the Click2Sell policy)

Read more at the ACTrader website

Buy ACTrader Scalper

Note: this EA is a scalper and it is very sensitive to spreads and slippage. You should only use it on brokerages who have an average spread lower than 4 pips during the Asian session.

Birt’s forward test

Settings: default, risk 3

Started: 27.08.2012

Stopped: 14.06.2014 (no longer available for sale, no longer authenticates)

Broker: PrivateFx

Account type: live, micro

Starting balance: $300

Current EA version: 1.5

Official accounts

Settings: default

Started: 14.06.2012

Broker: Pepperstone

Account type: Standard live

Starting balance: AUD 98

Settings: max spread 3.7, risk 20

Started: 27.08.2012

Broker: Pepperstone

Account type: Razor live

Starting balance: AUD 194

Settings: max spread 3.7

Started: 25.06.2012

Broker: ThinkForex

Account type: live

Starting balance: AUD 247

Backtests

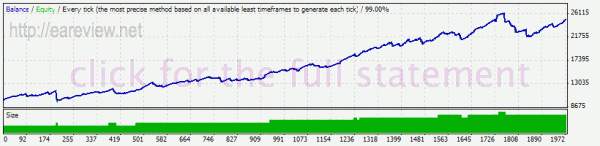

Dukascopy tick data

The Dukascopy data features rather awful historical spreads for most cross pairs including AUDCAD, so I chose to test using a fixed spread of 4.0 because the default value for the max spread built in the EA is 4.1.

The backtests were performed using v1.3 which does not have a news filter. The newer version – v1.4 – features a server-based news filter and should (in theory) show better results live.

Since I recently added the slippage simulation feature to the Tick Data Suite, I figured I should also give it a try here. I configured a slippage of max 1 pip with a 25% chance to get slipped in our favor.

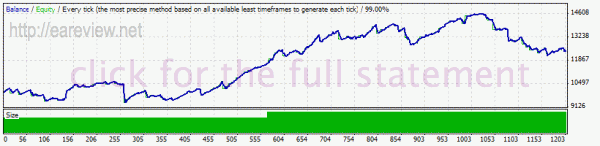

MB Trading tick data

Since the spread for this data was more acceptable, I decided to use the real spread when generating the FXT files. To make the conditions even worse, I used a commission of $6/lot. It’s worth mentioning that the spread during the EA operational hours (for the whole period covered by the data) was fluctuating mostly between 3-5 pips with an average of around 3.8. Also, the spread filter is based on the MarketInfo() function with MODE_SPREAD which does not work properly in backtests so some of the trades were definitely opened when there were spread conditions worse than the EA would normally allow.

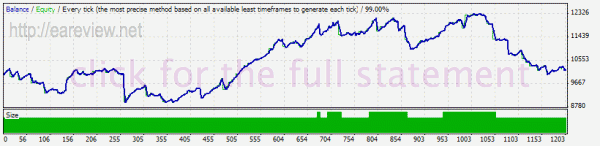

To make it endure even harder circumstances, I also ran a backtest with slippage enabled just like I did with the Dukascopy data.

Bottom line is that the EA is clearly very sensitive to spread and execution and you should be very careful with your choice of brokerage if you intend to use ACTrader Scalper.

Comments are closed.