This article is obsolete and no longer maintained.

Edit 30.10.2012: PipRider appears to no longer exist as a product. Its forward test was discontinued.

Believe it or not, I got acquainted with PipRider over 7 months ago. At first, I thought it was just another scam because it used to have a “sales letter” webpage, but the performance displayed was quite good so I asked for a copy to backtest it myself. I received it and needless to say, my preliminary backtests convinced me it’s not a scam, but I ran into another problem: its backtesting speed can easily be qualified as snail-paced.

I wanted to write a review at that time, but after running the backtest for 3 days (which put it around 2004, starting from 1999), I started having power problems and my UPS was dying, which led to a nifty reset of my computer during the backtest. The same power problems persisted for a while and this eventually led me back to hosting the forward tests on a VPS instead of my personal server, this time using SWVPS (which I’ve kept as my provider ever since) instead of ForexVPS.

The winter holidays came and passed and in January I made another pass at it. So, I started a backtest using history center data and after some 10 days of continuous running, it reached 2008 and it seemed to be going even slower than in previous years, probably due to the volume increase. Just to give you some completely unnecessary background info, I have a very noisy quad core for a Windows PC and since this was happening before I moved, even though the PC was in a different room I went to sleep on a tune of buzz-buzz from the fans which have the annoying habit of resonating with the computer case at different frequencies over time, preventing the sound from cleanly fading to the background. Picture having a tractor in your living room with a slightly sunburned driver wearing a sleeveless shirt, looking strikingly evil and pushing the acceleration pedal every now and then while you’re desperately trying to fall asleep. I would’ve closed the doors between my room and my office but then my gigantic white cat would’ve gone meow-meow-meow in the middle of the night. Anyway, after the 10 day ordeal my fiancee won: I shut down the computer and decided to drop the review since it wasn’t feasible for me to backtest it.

Things changed some three months ago when I added the Watchlist page. As you can imagine, the backtesting slowness is caused by the elaborate protection that the EA employs, so I came up with the idea to ask the author to perform a few backtests for me. So I emailed support, asked nicely and after they agreed to do it, I prepared a couple of archived MT4 installations with pre-generated data. They were kind enough to do it in a couple days (I imagine they ran their in-house speedy version) and I promptly got the results back in my email, but I was a bit short on time back then and didn’t get to write the article immediately. One thing led to another, I had a bad flu, then the Easter holidays came up, then I kept delaying it due to an important work project and eventually I woke up to an archive of 6 week old backtests, at which point I was too embarrassed to email the author again to ask for a new set of backtests and at the same time hesitant to write an article with slightly older material.

Finally, all’s well that ends well. I worked up the nerve to email the author about the issue, was informed that the behavior in the last two months was very much in line with the past results and proceeded to write this without bothering him for a new set of backtests.

Uh, I just realized that I went in detail a bit more than I originally intended; hopefully I didn’t incur an excessive boredom upon you, but before I get to more juicy details, I must explain why this is on the Watchlist and not a full-featured review: it’s simply because I wasn’t able to do the backtests myself. Well, that and the fact that there would have been no issues if I ran them (more about this below) plus I probably would’ve liked to run some more scenarios.

Strategy

According to its homepage, PipRider employs a relatively ancient strategy, little known but proven to work over decades (so I guess it predates the age of computers). What it actually does is look for an established trend on the H1 timeframe, then look for a retracement and finally open a position when the price reaches a certain level. Interestingly, the EA trades mostly during the US and Asian sessions and is inactive throughout the better part of the European session (07-15 GMT). The EA is actually a retracement scalper: it attempts to take a profit of up to 13 pips on such trend retracements, with a stop loss value that is adjusted based on the recent ranges.

The really interesting part is that the EA uses a risk parameter that expresses the amount risked per trade as a percent of the account balance. Since the stop loss distance from entry varies from a trade to another, this results in wildly different lot sizes. While it’s a perfectly valid strategy, this makes it pretty much impossible to calculate an exact risk/reward ratio per trade; if I were to calculate the average win:average loss report using the 11 year history center data backtest, I would land on 1:2.40. This is caused by the fact that like many other modern EAs, it is able to manage ongoing trades and close the vast majority of the losing trades way before they hit stop loss: the PipRider homepage claims only 3% of trades actually hit SL, figure that I have been able to verify in the same 11 year backtest mentioned above. The figures about the winning and losing trades displayed on product website are also accurate – the advertised approximate 83% win ratio perfectly matches the 82.58% that I witnessed in the 11 year backtest.

Regarding the varying stop loss, to give you an idea of the range, the average is around 94 pips with a minimum value that seems to be capped at 65 pips and with a maximum as high as 500 pips.

Finally, it’s worth mentioning that the EA is fully compliant with both the hedging and the FIFO NFA rules as it never opens more than a single position at one time, with a frequency of about 7 trades per week.

Parameters

The EA is designed to be as foolproof as possible. There are only a few parameters that you can configure:

- Risk, which is defined as the percent of the current balance that would be lost if a trade would hit its stop loss. I do not recommend increasing this past the default of 3.5, which is what I am going to use in my forward test.

- UseHiddenTP which can obviously be enabled or disabled and is mostly meant for brokers that have high stop levels (the minimum distance between the current price and the desired stop loss/take profit).

- MaximumLotSize, a parameter that can come in quite handy given the fact that PipRider opens different lot sizes based on the recent ranges. You can effectively place a cap on the lot size it opens by using this parameter.

- MaximumSpread which is set by default to 2.5, supposed to be a spread at which the EA performs good. It’s mentioned that it runs well with spread 3, too, but the performance decreases. I guess we shall be able to verify this statement, seeing that my forward test account at LiteForex has a fixed spread of 3 pips.

Once you’re done with the parameter configuration which should in most cases equate to a click on the OK button after pasting the product key, you will see a chart display that tells you exactly what the EA is doing. When the EA is out of its trading hours, it simply displays that, while within its trade hours it will tell you at which exact price level it is looking to open a position and whether it will go long or short if the price gets there. Furthermore, when the ticket is open, it will display the adjusted risk (which can be different from your configured value depending on the combination of account balance with minimum lot size of your broker) and it will also display the hidden take profit level where the trade is to be closed if the setting for this is enabled.

Website

Like I said at the beginning of this writeup, half an year ago the website consisted of what I would call unfriendly marketing, but this has all changed in the meantime and the current PipRider home page is clean and very informative, displaying relevant data akin to one of my reviews. There are several backtests, some of which are the backtests featured in this very article.

For some reason, the live test is not published through an independent site such as myfxbook, but instead a statement is uploaded to the website and a custom charting package is employed. It’s worth noting that the first trade in the statement occurs on April 1st at the time of this writing, which is probably caused by MT4 displaying only the last 3 months and it makes it impossible to determine if it’s a live account or demo (I tend to believe it’s demo because the name on the account says “PipRider” and I strongly doubt Alpari would allow such a name for a customer, although the age of the account would seem to suggest otherwise and it’s quite possible that the statement could be changed after its upload). For easier reference, I’m going to shamelessly steal the code that publishes the results and post it here, hoping it doesn’t get changed anytime soon:

Finally, as expected, there is a section where customers can download the latest version of the EA and a special page for reassigning the license to a different computer.

Backtesting

In case you skipped over the rather long introductory paragraphs, you should know that these backtests were not performed by me; they were done by the PipRider author using full MT4 directories provided by me, with prepared FXT and HST files.

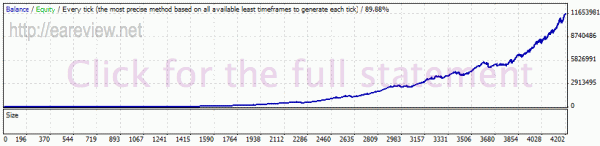

As usual, the first thing I want to see when checking out an EA is the history center data backtest spanning the interval between 1999 and today. This backtest was using the default parameters, including the risk which was set to 3.5. This backtests ends early (09.07.2010) due to the 2 GB limit in MT4.

I already described much of the behavior exhibited in this particular backtest in the strategy section above, but there are some more things that I should point out. First of all, the drawdown was a bit over 19% – not extremely good but not too bad either. The profit factor was 1.64 and the resulting annualized growth 108%, but the interesting thing is the lot sizes: you can find positions with a lot size different by a factor of 4 next to each other (e.g. a position of 11.04 lots immediately followed by a position of 2.58 lots), depending on the stop loss distance.

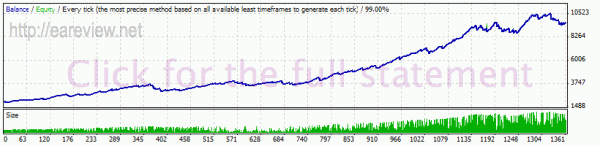

Moving on, the next backtest I requested was a tick data backtest using fixed spreads, once again with the default settings. Unfortunately, due to an oversight on my part this backtest stops some 5 months earlier than it should (around 25.10.2010). I failed to provide a separate FXT file for this and it was conducted with the same FXT as the real spreads backtest, which lead to the test stopping early (for those interested in the details, the real spread is stored in the volume in the FXT and if the spread is 0, the file can’t be used for backtesting past that point unless real spread is enabled in my patch).

The performance using tick data is pretty much in line with the history center data backtests but as usual slightly worse on tick data. We have a drawdown of a bit over 20% (versus 19% previously), a profit factor of 1.44 (vs 1.64) and 80% profitable trades (vs about 83%). What is clearly visibile here is the variable lot size: the green bars at the bottom of the chart spike up and down continuously.

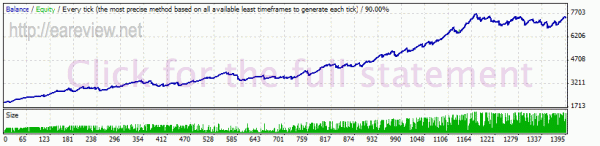

The author also volunteered a history center data backtest that starts in April 2007, almost at the same time as the tick data backtest. This should serve both as a straight comparison to the tick data, fixed spread backtest as well as some kind of a finale to the 11 year backtest that ends prematurely.

Comparing the two backtests, PipRider behaves on history center data very much like it does on tick data and I’ve randomly tried to match three trades from the two backtests, succeeding in two of the three cases. This suggests that this EA might trade not too different from one broker to another, but that’s hard to say judging from backtests alone. It’s also worth noting that the last 6 months of the backtest were spent recovering from a drawdown. Unfortunately, due to the limited range of the forward test data displayed on the PipRider site, I can only match a single trade in the backtest with a live trade since one of them ends on 01.04 while the other begins on the same date.

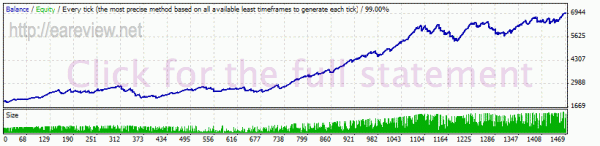

The last backtest was a tick data, real spread backtest:

Luckily, this one had no problems at all, it ran the full length perfectly. Doing an optical comparison (that is to say I eyeballed the two balance charts), the performance here matches the performance witnessed on the forward test account on the EA website. The profit factor was 1.32, the relative drawdown close to 25% and the percent of winning positions was a bit over 78%.

I was also going to run a Monte Carlo simulation, but given the lot size issues, I’m not even sure how I could run it reliably, so I will just refrain from it. The author did it by normalizing the lot size but I’m pretty sure that’s not really accurate; nonetheless, you can check it out by navigating to the test results page on the PipRider website. Speaking of that, something noteworthy is posted there and I’m going to quote it here:

The simulation also showed that there was a 27.5% probability that the account balance would not drop below the initial deposit. This means that 72.5% of users would probably see their account balance dip below the value of their deposit before returning a profit.

Keep in mind that if I’m not mistaken, that is the result from the 11 year backtest, so if the same thing was running on the tick data real spread backtest, in all likelihood the results would have been worse.

Running the tick data real spread backtest through MT Intelligence, I ended up with an annualized growth of about 36%, which translates to 2.58% per month. Quite a difference from the 108% obtained in the history center data backtest, this one should be much closer to what one should expect when running the EA with a risk of 3.5.

Conclusion

This will definitely not constitute the backbone of the inheritance you’re going to leave behind, but it does show some promise and in my opinion it might be worthy of getting added to an existing EA portfolio. PipRider is priced at $127 and that gives you a 3 month subscription, after which a monthly fee of $10 kicks in. There is also a possibility to pay only the monthly fee if you sign up with AvaFX through the author’s introducing links. The terms and conditions specify that in order to be eligible for a refund, within the first two months since purchase a customer must present a statement of the EA running for 30 days and failing to bring profits.

Bottom line, I find PipRider interesting and I’m going to run my own forward test.

Forward test

Started on 23.06.2010 on a LiteForex account, it’s using default settings except the MaximumSpread which was increased to accommodate the fixed spread of 3 pips.

Details & Links

Version used: 1.4 in backtests, 1.5 when starting the forward test

Pairs and timeframes: GBPUSD H1

PipRider homepage

Comments are closed.