This article is obsolete and no longer maintained.

A rather uninspired name at the first glance, turns out to be taken from some “Fau 2” German rocket created in WW2. Perhaps I might be lacking the background, but to be entirely honest I’m not a very big fan of world wars, much less their exact history and event dates, while at the same time weapons of any magnitude completely fail to impress me in a positive way. Turns out that the rocket in cause has been used to attack the British and more research on it was supposed to make it viable for an attack against the United States. Luckily, the war ended before that. Apparently, the research was later used for a space program, but that doesn’t change the fact that it was developed as a weapon to begin with. I can see an EA named AK-47 that’s supposed to open lots of trades just like the well-known weapon shoots lots of bullets really fast; however, the meaning of V2 is totally lost when it comes to being suggestive. At best, the first impression is that it’s named v2 because v1 failed miserably.

The EA is supposed to run on any intraday chart (I assume that means any pair using any timeframe) but the author recommends M30 and implies that changing that would involve changing the EA parameters in obscure, undocumented ways. It is also recommended that the EA be run only on four pairs, namely EURUSD, GBPUSD, USDCAD and USDJPY.

The EA “calls home” to validate the account it’s being run on. The protection used is very rudimentary, obviously the author didn’t really care whether his EA was pirated or not.

Strategy

No explanation is provided about the method of entering trades, other than the fact that it’s “mathematical logic”. It’s basing the entries on some obscure indicator and I’m not in the mood to look deeper into it. Bottom line, it opens positions when it thinks it’s a good idea and the customer has absolutely no clue of what the EA is doing. The exit is somewhat more interesting: it closes a part of the order at different profit levels (e.g. if a 10 lot position was opened, it might close 1 lot only at each level), following with a trailing stop and moving the stop loss at the break even as soon as it is slightly in profit.

To me, this sounds like a recipe for disaster: when hitting stop loss, the full position hits it; when taking profit, only a small part of the initially opened position eventually reaches the take profit target (if any; normally it will be closed a lot earlier by the trailing stop). But let’s not rush to conclusions and see what happens in backtesting.

Due to the exit strategy employed, I’ll categorize this as an EA that attempts to trade trends.

Website

The distribution point is Dr. Chuckie’s Trading Tools. What strikes me is that the author prefixes his nickname by “Dr.”, I can’t help but wonder whether he is a medical doctor. It’s commendable that he does have the guts to post his name and picture of himself, that actually looks like a picture of himself and not some web actor. Please note that I refrained from making any evil comments about his appearance or the surroundings.

Overall, the page looks cheap. It’s using the free Google hosting, you’d think the author can afford at least a domain name if the claims about his previous employment are true. The design and organization leaves the distinct impression that it was done in a hurry with the default settings of the content management interface offered by Google.

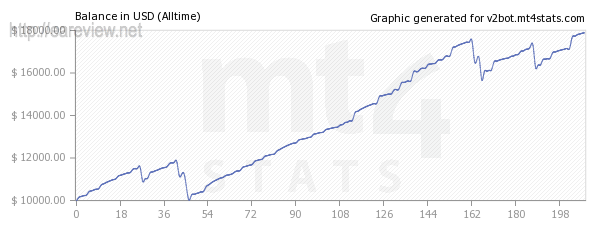

All the documentation is there and of note is a live statement, called “live trade results” that’s obviously on a demo account and that mysteriously stops on 16.07.2009. Come to think of it, the mt4stats “badge” (publishing material thing) does not indicate the last date an account was used so it can easily be abused to mislead. I have to make a habit of clicking these and double checking. It’s worth noting that the first trade is using a position size of 7 lots, which is an absolutely insane risk for the 10k starting balance, but more about this live statement later.

Getting back to the documentation, pretty much everything that you might want to know but were afraid to ask about the EA is there, including a description of the original (yes, I’m being sarcastic when I say this) “Jumping Stop” – which is actually a combination of moving the stop at break even then using a trailing stop.

It is mentioned that the EA shouldn’t be run on days when big news are released (hello mr. developer, here’s FFCal, implement something like that if you don’t want your EA to trade during news) and it is also mentioned that the EA will not open trades that increase the potential risk when running in portfolio mode with the opposite symbols configured.

I guess that’s more ranting about the website than you wanted to read, so let’s move on.

Parameters

The EA comes with some defaults and it’s recommended that the customer not change them. However, the money management parameters are a total mess and they do require you to completely understand the description posted on the website if you want to modify them in a meaningful way.

Basically, the risk-based automatic lot allocation is useless: the EA will allocate the lot based on the percentage you input, but it will not adjust how much of the position is closed at each profit level. Without an automatic calculation of this, I see no point to having the lots calculated as a function of the balance value.

Backtesting

Since this EA is using relatively large numbers for it’s take profit and stop loss targets, it’s not necessary to test it on tick data and I will perform the test using the history center data in an Alpari MT4 client.

For all the backtests, I configured its FixedLot parameter at 1, the SizeStep at 0.1 and the ClosePortion at 1, giving it 10 potential profit levels.

Not that it matters, but for the curious, the spread employed was 1.6 pips for EURUSD, 2.5 pips for GBPUSD, 3.4 pips for USDCAD and 2.0 pips for USDJPY.

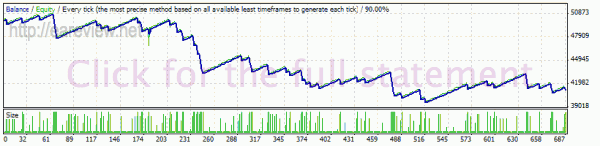

EURUSD 2009

Probably just like the “Fau 2” rocket that inspired the title, the EA’s balance curve has a really hard time going up, but man, falling down is sooo easy. I can actually picture a cartoon rocket farting a jet, going up a bit, falling down when the jet stops, eventually managing to scrape some more fuel and fart some more jet in a pathetic struggle to avoid the final ground impact.

My earlier assessment of the EA turns out to be entirely true. When the stop loss is hit, it’s hit with a vengeance. After I started the backtest and January was over, I had to stop the backtest and restart it using 50000 as start balance because I was afraid the 10k I used would not be enough to get it to October with the selected lot size. It turns out I was wise to do that, seeing that the EA eventually fell below 40k balance.

Comparing the backtest with the “live statement” mentioned above, we can easily see similarities in the trades taken (taking into account the GMT difference):

- The backtest opened a short trade on 16.06.2009, 15:21 at 1.38765; the live statement features a short trade on 16.06.2009, 13:23 at 1.38760; that’s 2 minutes and half a pip difference, making it essentially the same entry

- The backtest opened a long trade on 29.06.2009, 08:11 at 1.39907; the live test features a long trade on 29.06.2009, 06:12 at 1.39887; a few pips difference, but again almost the same entry

- The backtest opened a long trade on 08.07.2009, 05:00 at 1.39095; the live test opened a trade on 08.07.2009 at 1.39096; 0.1 pips difference this time and it was opened the same minute

And the list could go on. Some of the trades in the backtest can not be found in the live statement and vice versa, but I attribute that to the fact that the live statement was done using an earlier version. However, what’s noticeably missing from the “live trade results” is absolutely ALL the losing trades where the stop loss was hit. I’m having a really hard time believing that all of them were during news releases, so I go ahead and check the calendar for the period. Of course, my suspicion is confirmed and most of the losing positions have nothing to do with news releases.

My conclusion: the live forward test displayed on the website of the EA is manually edited, which also explains why the test stops at 16.07 – the author probably got bored of manually editing the statement and ultimately configured a cronjob to automatically upload the version from 16.07 to mt4stats endlessly. That is, unless mt4stats endlessly keeps an account that’s not updated, which I doubt.

Even though the EA is obviously a scam, offering the potential buyer false information, I go forward with testing the other pairs to see if we can confirm the EURUSD results. Due to the fact that it’s painfully slow in backtesting, I only test it for the period of the “live trade results”.

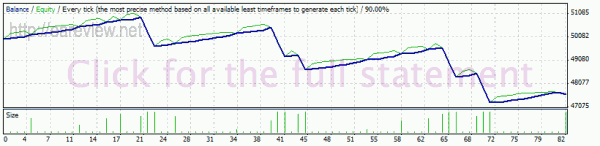

GBPUSD June – July 2009

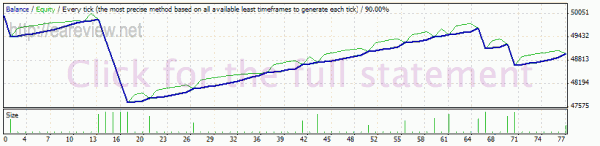

USDCAD June – July 2009

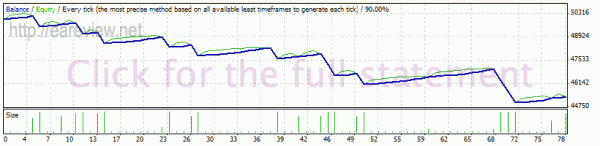

USDJPY June – July 2009

Of course, yet again we have trades that are similar and yet again, those that hit stop loss mysteriously fail to make their way into the “live” statement.

Since the 2009 results are as bad as can be seen above, I see absolutely no point to run it on previous years.

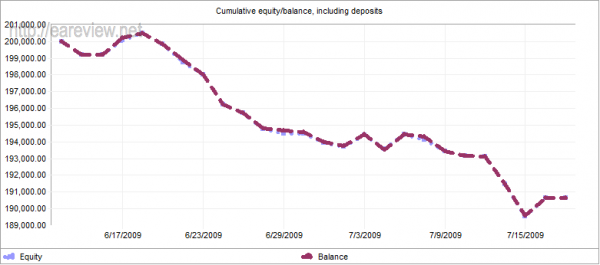

To give you a more clear picture, I re-ran the EURUSD backtest for exactly that period and merged the results to have a clear comparison:

And this is what the “live statement” balance curve looks like, for the exact same period:

I even tried a few tests with different settings, but as it turns out, unless you use extreme values (such as stop loss 5000 or so, that will eventually get hit, probably wiping any profit made plus more) the EA remains a loser.

Conclusion

As mentioned in the first part of the review, the EA is a recipe for disaster. Run it for long enough and it’s pretty much guaranteed it will bring you a significant loss. If you didn’t buy it yet but were thinking to, steer clear of it. Not only is it bad, but it is also very expensive, selling for $299. If you bought it already, it’s probably too late to request a refund since the condition for that is to ask for it within one week since buying it and to prove that your real mini/standard account did not make at least $300 running it.

Details

Version tested: 20090814 (there are no versions to speak of, only dated releases)

Homepage: Dr. Chuckie’s Trading Tools

Pairs & timeframes:

- EURUSD M30

- GBPUSD M30

- USDCAD M30

- USDJPY M30