This article is obsolete and no longer maintained.

I guess there’s no better way to start this blog than reviewing the widely known FAP Turbo.

Rumored to have sold in excess of 43000 copies (together with FAP Turbo Evolution, which is meant to be run on the Dukascopy JForex platform), it’s most certainly leading the best seller EA top by far. Come to think of it, if that’s true and not some marketing bullshit released to the press (I tend to believe the number is exaggerated), the authors made more money selling it than they could ever hope to make by trading forex – 43000 times 149 equals over 6.4 million US dollars. Yes, you read correctly, that’s six point four million. Granted, not all of that pile of money would have made its way into the authors’ accounts, but still, a very good percentage of it should’ve ended up there. I can see how everyone wants to sell EAs nowadays and why there are so many scams… To my knowledge, this is a unique claimed performance (to date, at least), it’s quite impressive – if true – and it provides a very good motivation as much for the potential programmers as for all the scammers out there. Just for reference, FAP stands for Forex Auto Pilot, not for what you’re thinking.

Homepage

Heavily loaded with marketing gimmicks, such as “threats” to increase the price after the next X copies are sold or affirmations such as “special launch price” while the EA has been launched almost 11 months ago. It’s almost blinding me. Videos, testimonials, a font that’s so huge it seems to want to get out of the monitor and bite my cat on the nose. It’s pretty much a trap for the random internaut who knows nothing about forex and stumbles upon this make-money-while-you-sip-cocktails and live happily ever after solution.

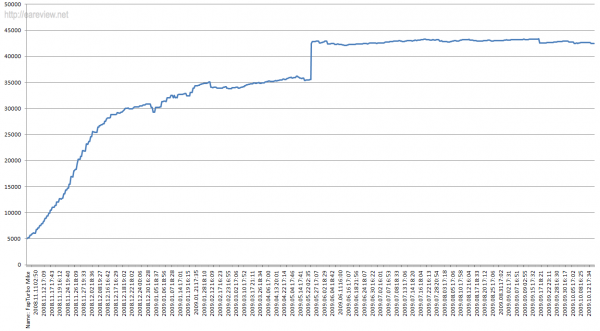

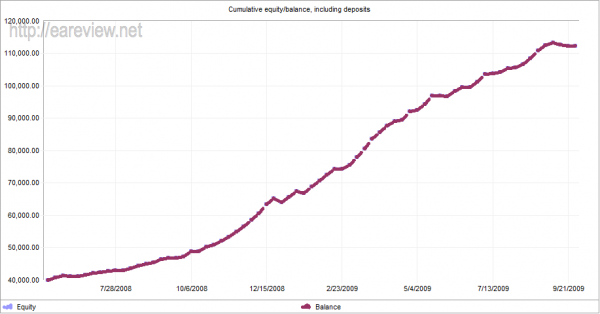

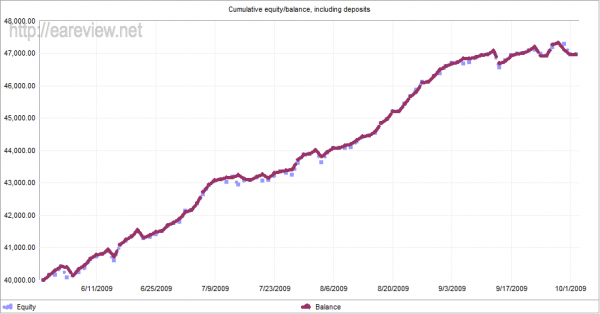

They’re even brave enough to link a real account statement that actually does look rather real. They advertise that the account listed started at 5k and is now at 42k… However, a quick inspection by pasting the data into an XLS and generating a graph (see picture) reveals that the account already reached ~31k between 06.11.2008 and 31.12.2008 and after that, it barely manages to scrape some more profit, around 3k until march and then it just lolls around, until a 7k deposit is made on 27.05.2009. Funny enough, at 27.05.2009 the account balance was at 42511; at the time of this post it’s at 42482, which means it only managed to *almost* break even during the past ~5 months. A quick inspection reveals that you can easily browse their account statements directory, which is quite typical for EA marketers that have no clue how to set up a web site. A cursory glance through these accounts manages to make me sad: one of them is as old as 2005 and has even been crashed once, although that particular incident doesn’t seem to be FAP Turbo related. All of the others mysteriously end either when FAP Turbo stopped being very profitable or when it started losing rather heavily.

Random thoughts

I can’t help but wonder: did it gradually stop being profitable as more and more people started using it? It has an extremely nice profit curve from the launch until the end of 2008 and since that date the profit curve angle has been steadily declining. The forex market might be big, but the liquidity during the Asian session is lower than normal to begin with… Add to that the fact that we’re in a crisis leading to an even lower volume being traded and if you calculate, say, 10000 users using the EA and each of them opening a mere 0.1 lots, you end up with 1000 lots worth of positions being opened almost at once. Not only will this generate slippage for most of the users, but it will most likely manage to move the price against the positions that have just been opened. Assuming there were 40k copies sold, this is quite an optimistic scenario.

Facts

Enough rant. For those of you who aren’t familiar with the EA, its main strategy is scalping during the Asian session on 4 different pairs. It also has a different strategy that is only applied to EURUSD on the M1 timeframe and that is called a “long term strategy”. It comes up with a really extensive manual that attempts to explain everything from the forex market up to VPS solutions, going through history data, backtesting and slightly surprising me by failing to clarify the origin of the universe among the various things listed in it. It consists of an ex4 and a DLL and it sports a ton of parameters which are more or less explained in the manual, along with the following mention:

Other settings can be left as defaults. All other settings can be left as they are, and you can be confident in the knowledge that we have worked hard to optimise the default settings to ensure you achieve good results.

It begs the question: why put the parameters there in the first place if it’s supposed to work without changing them? Oh well… I guess the authors have to think about the curious Joe who wants to backtest and run optimizations to curve fit his newly bought toy. The only option that the average user is supposed to change seems to be the GMT offset. Accordingly, I ran all the backtests changing only the GMT offset. I suppose one would also want to change the money management risk; the scalper default was 5 which suits my backtests just fine but I had to manually set the “long term strategy” to automatic, with a lot factor of 1, which seemed a decent risk setting for the number of pips involved in each trade.

Backtesting

As mentioned above, mostly the default settings were used for each test, except the GMT offset which has been set to manual, 0 and of course the log settings which were set to false to speed up the testing.

Backtesting seems to disagree with the results they have in their forward test:

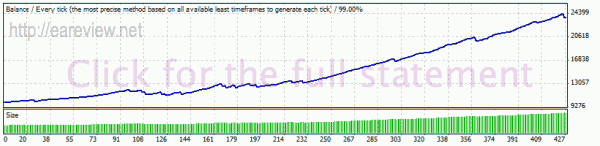

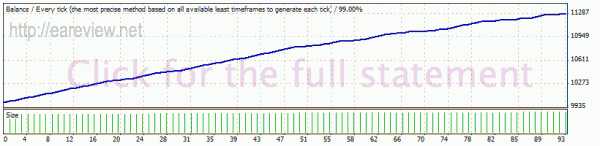

2008.06-2009.10

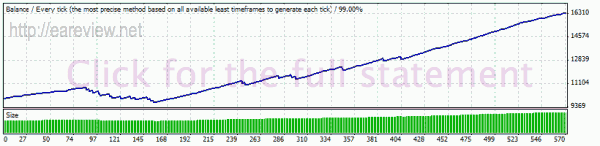

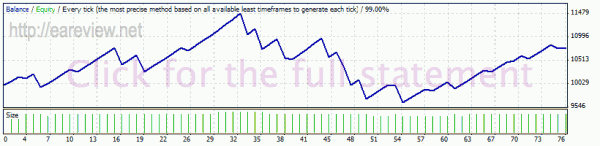

The “long term strategy”

The balance curve for this looks plain ugly. It was probably optimized to run on the period predating the EA launch and it simply failed after that. Not even their forward live account is using it in 2009. Basically, it sucks, but I figured I should test a higher range before making that affirmation, due to the low number of trades per unit of time:

Since this strategy is using very large tp/sl targets, it’s no longer necessary to use tick data for testing, so in the test above I used history center data. You can see how it took almost identical trades, with small differences here and there. Bottom line, it’s still a rather bad strategy, even though it doesn’t seem like it’s going to burn through any account if not over leveraged. I guess we can safely ignore this, just like the authors did.

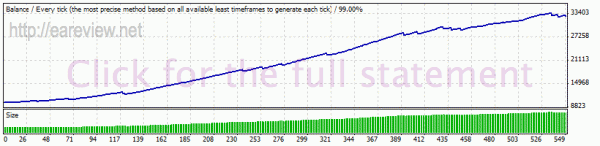

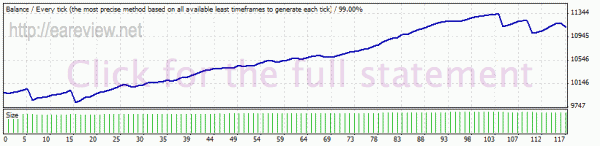

Scalping strategy

Moving on, I notice that all the scalper pairs are profitable even when the live account stops being profitable, here’s what happens when the graphs are merged:

Now, this is very puzzling and it prompts a round of tests for the period where the real account is clearly not very profitable, which can be established as starting around 06.01.2009.

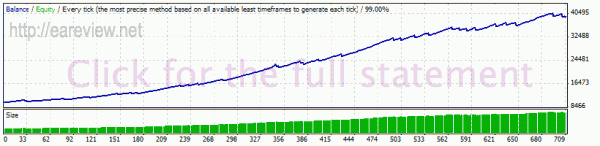

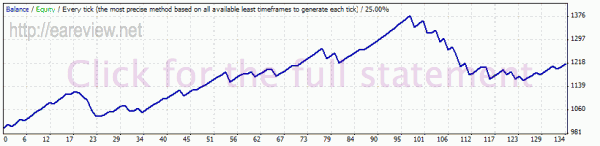

2009.06.01-2009.10.01

So, going through it again, we get this:

Scalper result

Despite having a rather bad september, the EA should have been very profitable, yet it’s clear from their forward test that it actually was breaking even.

How come?

Remember how I mentioned earlier that due to the sheer number of users using it, the market might be adversely affected? Let’s verify that theory, taking EURCHF as example and starting from today, going backwards and displaying the real trade on top of the backtest trade:

2009.09.30 18:42 buy 1.51711 close 2009.10.01 06:30 1.51734

2009.09.30 21:42 buy 1.51625 close 2009.09.30 22:57 1.51670

Obviously, the GMT offset difference is -3. Also, trades are closed faster in backtesting due to needing less pips to get to the profit target.

Slippage: 8.6 pips

2009.09.28 18:14 sell 1.50893 close 2009.09.30 10:57 1.50874

2009.09.28 21:16 sell 1.50940 close 2009.09.29 01:10 1.50945

Slippage: 4.7 pips

Let’s try August. I’m having a hard time finding matching trades on EURCHF, probably because the version being used back then was v47 and also the spread in my tests might be lower than on their server. I find a matching trade in July:

2009.07.30 19:16 sell 1.53120 close 2009.07.30 23:16 1.53250

2009.07.30 23:15 sell 1.53140 close 2009.07.31 00:52 1.53110

Slippage: 2 pips

However, those 2 pips made the difference: in backtesting, the position was closed at a profit, while on the real account it was closed at a loss.

I leave it as an exercise to the reader to find more such cases, but by now I’m pretty certain that I was right and that FAPTurbo is killing itself by slippage and probably widened spreads. Unfortunately, I have no relevant data to prove that the market is also being moved against the FAPTurbo positions, by the sheer number of the users entering the market in the same direction.

Conclusion

If I had a time machine, I’d go back to 2008 and buy it at launch. It was well worth the money at the time. Yet running it on a live account now would probably be a bad idea.

Did it work in the past? Yes, for a while, but not in the past few months, though. Will it work in the future? Possibly yes, probably not, but to tell the truth I have no idea and my forex crystal ball is broken. Who knows, if people stop using it, it might start working again. If I had to classify it, I’d say it’s a decent effort, originally well meant, but now only existing to fish any inexperienced customers unaware that it’s obsolete. In my opinion, running it in a forward test would be a waste of CPU resources.

Details

Version tested: v48, using MT4 build 225

Homepage

Pairs & timeframes:

- EURCHF M15

- EURGBP M15

- GBPCHF M15

- USDCAD M15

- EURUSD M1

Comments are closed.