This article is obsolete and no longer maintained.

An EURCHF M5 martingale scalper EA that trades 24/5… A somewhat original concept compared to the others out there. Normally, most EAs (if not all) that use martingale will make your account vanish sooner or later, but before I make any assumption let’s see if that holds true with FX Equity Builder.

It’s protected with a commercial protection, ForexCIO but that doesn’t really mean much, other than the fact that they care about it enough not to let the next random user with a decompiler inspect their code. I have to say that the programmers are not the most imaginative I’ve seen and despite paying several hundred dollars for the protection, they didn’t go the full length and made a very poor overall implementation. The EA comes with a manual, a DLL locked to your account with a built-in expiration date and with a useless file that was used for the protection and that shouldn’t be distributed with the EA.

Strategy

It works just like any other Martingale EA: it opens a position based on some internal voodoo signal and starts praying hard. If the market goes against it, it opens another position with an increased number of lots. If the market keeps going against it, it starts cursing at the non-working prayer and opens even more positions with even more lots until it hits the trade limit you configured, at which point it waits until the market comes back and it can close the trades at a profit.

Website

The home of the EA really stands out from the typical bullshit marketing page. It’s not assaulting me with colored graphics, bullshit statements and testimonials and other marketing crap. In fact, it’s almost pleasant to look at, which is a complement coming from me. I guess they’re trying to sell it via the honest approach and with this occasion filter out the software challenged users who have no idea what MT4 is or how to install an EA, saving themselves the support nightmare that managing a popular EA must be. Still, despite their honest-wannabe website, not a single mention of the word martingale is on the first page, but instead I can spot a “turn 10k into over 1mil” hook.

Their performance page is sporting some backtests designed to make it look all nice and shiny, yet if you look closely at the strategy reports they have relative drawdowns of ~90%, ~50% and ~30%, directly proportional to the profit. It might fool the average customer, though. They also have a live forward test and I can’t help but wonder how long’s it gonna be until the account goes boom.

One thing worth noting is that FX Equity Builder is rather cheap at a 99$ compared to the other EAs out there and on top of that they do have a 60 day money back offer, even though I suppose you’d have to provide a live statement of an account on which the EA has been unprofitable…

Parameters

The EA is equipped with quite a few parameters that allow the user to control its behavior.

Some of the parameters are useless (for example Account Type and Lots, which should be determined using MQL) and some things are missing, such as the option to place the trades in a way that’s compatible with an ECN/STP broker. The lack of the latter option basically renders the EA unusable on many good brokers (ATC brokers for example). However, they do have a list of brokers on their site. The fact that they’re at version 1.5 and they haven’t been able to fix this issues denotes poor programming, confirming my “feel” mentioned above.

The other parameters are described in detail in the manual. The disturbing fact is that there’s some kind of a formula that the user can use to calculate how many floating negative pips his account balance can take. That scares me and I haven’t even begun testing it yet.

I can configure the max number of trades, which by default is set at 8 and which I’m not going to touch; I can also configure the risk, min and max lot, which affect the way martingale is used and obviously the risk the EA is taking and accordingly the reward.

Further down the manual I read this:

As stated above we suggest you use you initiative to exit trades as shown below. If you are not comfortable with this then we suggest you set an equity percentage setting of 50%. This may seem quite high.

This has not happened this year on the “Risk = 2 or 4“ with a 5k starting bank. As this EA currently produces approximately 40% per month, within one month you will have almost made this profit back.

Seriously, where did they learn math? If you lose 50% of your balance (shudder) then in the next month you make 40% profit, you would’ve made 40% of those 50%, which is, gasp, 20% of the balance you had when the drawdown occured, bringing your balance at the end of the month to 70% of the original, which is pretty f’ing far from where you started and nowhere near “almost making this profit back”.

Right below that they state:

We also recommend you wait until your initial balance is doubled, withdraw your initial balance and continue with the accumulated profit. The result is that in the worst case scenario you will still be above break even.

Now, gotta give it to them, that’s some smart advice. It’s probably unlikely that it will happen, but still…

Even further down:

We strongly advise that you only trade with capital you are comfortably able to lose.

If you trade it on your real account for a while, you’ll probably wish that was written on their website instead of the manual.

Backtests

I used EURCHF tickdata spanning 01.06.2008 up to 01.10.2008. I strongly doubt using history center data will make any difference so I guess I could’ve used that, too. I tested with the Alpari client instead of my normal JadeFX because of the min lot size/lot increment issue (0.1 on Jade vs. 0.01 on Alpari would mean that I have to use 100k starting balance on Jade for any relevance and I wanted to stick to the manual recommendations).

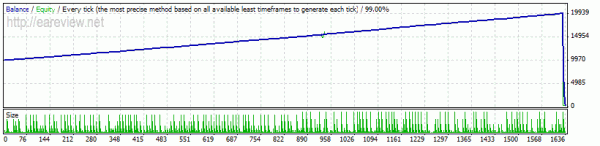

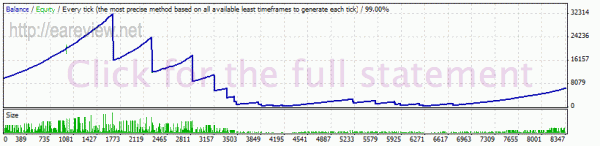

First backtest, default settings

Disaster. Just confirms what I knew about martingale EAs: they will eventually crash your account.

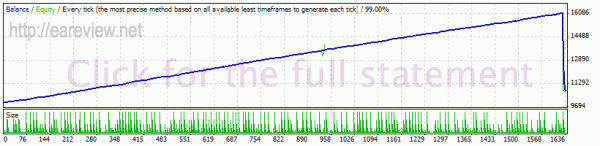

Second backtest, risk 1

Instead of a margin call and a vanished account, we now have some trades that are open for over an year. I don’t even wanna think of the swap paid in such cases. Note that the relative drawdown is almost 80%.

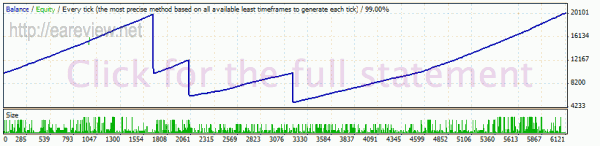

Third backtest, back to the default risk 2, with equity protection set to 50

Just like they recommend in the manual, I set the equity protection to 50%, even though I wouldn’t be able to sleep at night knowing that tomorrow half of my account might be gone. As it turns out, quite a bit more than half might actually be gone, but not really over night. That wouldn’t comfort me much, though.

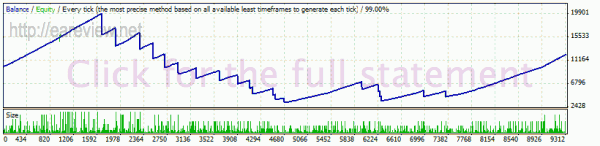

Fourth backtest, equity protection 80

I figure that the EA makes like 10-20% per month with the default settings and a 10k starting balance, so let’s try to set the equity protection level to 20%. Boom! Not a very bright idea apparently.

Fifth backtest, risk 4, equity protection 50

Soo… I’m thinking one last attempt at glory, higher risk, higher reward. Disappoint result. I actually saw this coming after the first 4 tests.

By the look of the balance graphs, I’m starting to smell the EA was curve fit for 2009.

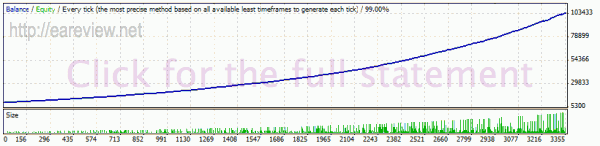

Last backtest, default settings, risk 4, 2009 only

And if I’m not mistaken, it was indeed curve fit to look nice in the 2009 backtests. Don’t let it fool you, though: there’s a 50% relative drawdown…

Conclusion

A martingale EA remains martingale. It will eventually crash your account sooner or later, but most probably rather sooner than later. If you’ve run it and made some profit, I suggest stopping while you’re ahead. If you plan to run it, I’d advise against it.

They do recommend that you should close floating negative trades manually, but unless you’re extremely lucky or you can see into the future, you’re probably not going to get any better performance than closing them automatically when the equity reaches a given balance percent.

Overall, even though it will chop-chop your account to pieces eventually, it doesn’t leave a bad impression. Fair warning is given to the customer and the authors don’t abuse marketing gimmicks like most others do, but still, that’s no reason to waste your money buying it.

Details

Version tested: 1.5

Homepage: http://www.fxequitybuilder.com/

Forward test: http://fxequitybuilder.mt4stats.com/

Pair & timeframe: EURCHF M5

Comments are closed.