This article is obsolete and no longer maintained.

Trading style: opens positions both long and short in a grid style, using martingale and creating a trade basket for each pair; the basket is closed when a target profit is reached.

Currency pairs: EURUSD, GBPUSD, EURJPY, EURGBP, USDCAD, AUDUSD, NZDUSD, USDJPY, AUDNZD

Timeframe: M30

Price: $379 + $39 quarterly

License: 3 live, 3 demo accounts

NFA compliance: no

Refund policy: 30 days, 110% of the price is refunded conditioned upon the EA failing to bring profits on a real or demo account

Read more at the Forex Envy website

Buy Forex Envy

Note: this expert advisor uses martingale money management and is inherently risky. There is a chance to completely wipe out an account which is greatly increased in case of improper use. It is strongly recommended to only use Forex Envy as recommended by the vendor. Furthermore, it is a good idea to aim to make withdrawals that amount to the sum of the deposit prior to any attempt to increase the account size. When using any martingale EA (except the strictly limited ones), it is also a good idea to withdraw regularly even after you recovered your initial deposit. Under no circumstances should one attempt to trade this EA with funding that doesn’t match the minimum recommended by the vendor for the selected brokerage. To illustrate the minimum starting balances with a leverage of 1:500 in some cases (more info on choosing a broker can be found in the members area on the Forex Envy website):

| Account type | Contract (lot) size | Minimum lot & lot increment | Minimum starting balance | Broker examples |

|---|---|---|---|---|

| cent | 100000 | 0.01 | $360 (¢36000) | Instaforex (0.1 min lot) |

| regular | 1000 | 0.01 | $360 | Trading Point |

| regular | 10000 | 0.01 | $3600 | LiteForex floating spread accounts, the old GO Markets L-Plate accounts |

| regular | 100000 | 0.01 | $36000 | Most brokers nowadays |

| regular | 100000 | 0.1 | $360000 | Some ECN brokers |

Birt’s forward test

Settings: as provided by the vendor, long cycle only

Started: 12.03.2012

Stopped: 08.01.2013 (account wiped out)

Broker: PrivateFx

Account type: live, cent

Starting balance: $400 (¢40000)

Official accounts

Settings: long & short cycle

Started: 11.04.2011

Broker: Instaforex

Account type: live, cent

Starting balance: ¢82842

Settings: long cycle only

Started: 11.07.2011

Broker: Instaforex

Account type: live, cent

Starting balance: ¢178751

Settings: long cycle only

Started: 11.07.2011

Broker: Trading Point

Account type: live

Starting balance: $90

Settings: power edition

Started: 26.03.2012

Broker: TradeFort

Account type: live

Starting balance: $5000

Note: this account is using Forex Envy Power Edition.

Backtests

One thing that sets Forex Envy apart from other martingale EAs is that the vendor acknowledges the risk and works together with each customer to create setting files tailored for their account, so all my backtests use the same starting balance and trading conditions as my live account and all the settings used below were those provided by the vendor in .set files unless otherwise mentioned. Due to the vendor’s concerns about piracy, the parameters were removed from the backtest reports. Version 2.1 was used in all backtests.

As you will see below, some of the backtests resulted in an account wipe. While that is a rare occurrence, the possibility of such an event is certainly not excluded. I’ll stress this once more: if you use Forex Envy, withdraw often.

When evaluating the results here, since the same starting lot was used throughout the backtests regardless of the increased balance, a realistic calculation of the drawdown should be performed by reporting the maximal drawdown figure to the initial balance of 40000.

Before we delve into the backtests, I would advise against opening the detailed statements in your browser due to their large size (some of them exceed 50 MB which can give your browser a major headache).

History center data

Just like my account, all history center data backtests have a commission of ¢5 per lot round-trip, which is why the spreads were configured a bit lower than I usually set them. I’ve tried to perform backtests on all currency pairs supported by the long cycle, but the history center data for NZDUSD was badly lacking (starting late and ending early) so I ended up skipping that currency pair. Speaking of which, backtesting currency pairs with a suffix using history center data can be quite a pain in the behind because one has to rename each HST file and edit the currency name in all of them.

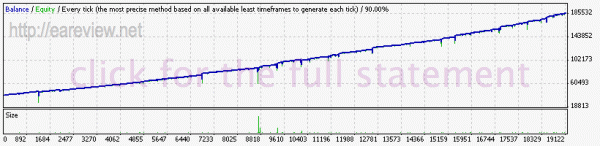

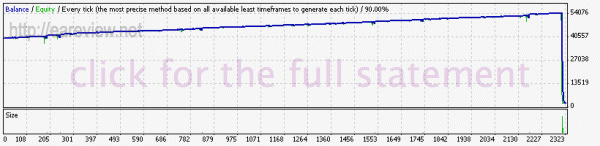

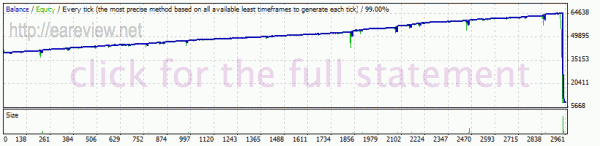

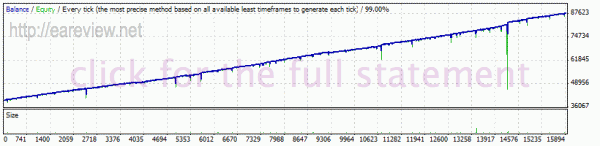

EURUSD history center data

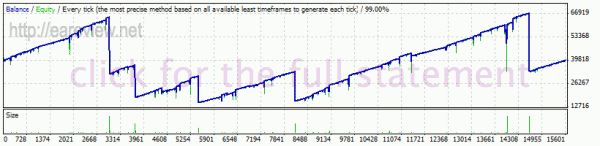

EURJPY history center data

Several drops throughout this one:

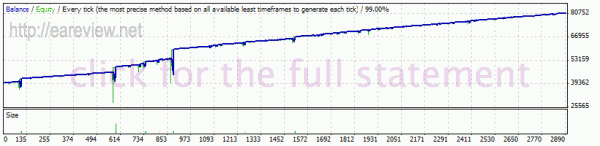

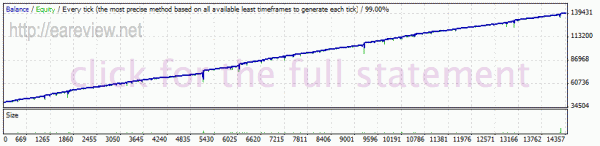

EURGBP history center data

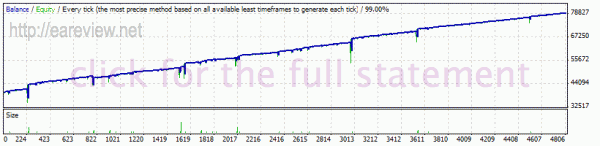

USDCAD history center data

AUDUSD history center data

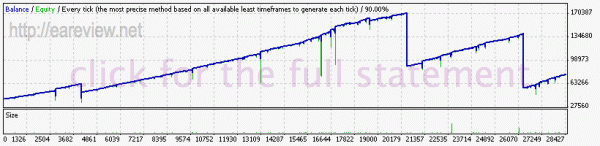

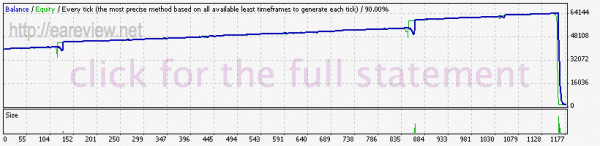

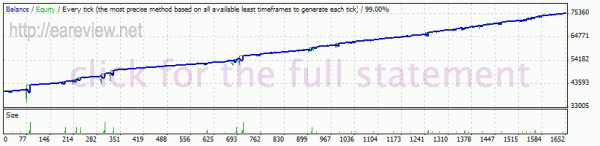

GBPUSD history center data

This is where I hit the first bump in the road. The EA is definitely not infallible but these “oops” moments seem to be very rare when running with the recommended settings.

USDJPY history center data

Second road bump.

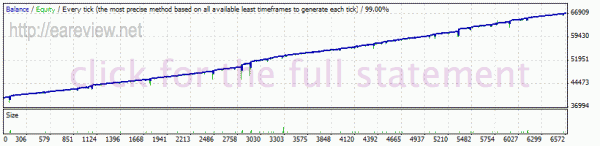

AUDNZD history center data

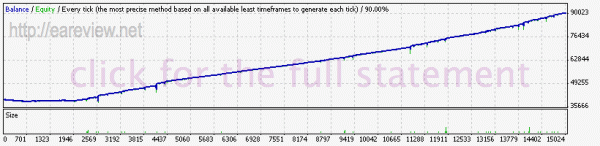

Tick data

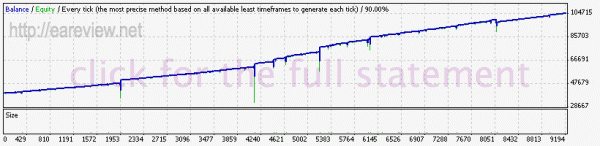

EURUSD tick data

This one had a hiccup in the middle:

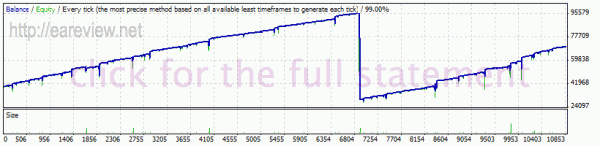

EURJPY tick data

Since this one crashed, I figured I would test the BailOutPercent parameter and set it to 50 and here’s the result:

EURGBP tick data

USDCAD tick data

AUDUSD tick data

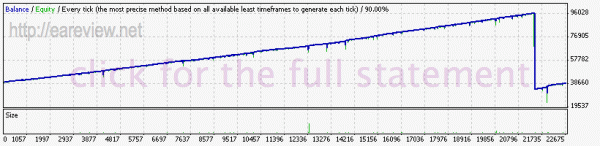

GBPUSD tick data

NZDUSD tick data

USDJPY tick data

AUDNZD tick data

Conclusion

Will Forex Envy end up crashing the account? Not excluded. However, I don’t think that will happen anytime soon as long as I’m following the vendor’s recommendations. I plan to withdraw regularly from my live forward test account, at least until matching the deposit size.

Comments are closed.