This article is obsolete and no longer maintained.

Trading style: opens a basket of up to 4 positions based on volatility; takes profit at 20 pips and has a hard SL of 380 pips for GBPUSD (9/300 for EURUSD), but closes way before that most of the time.

Currency pairs: GBPUSD, EURUSD

Timeframe: M15

Price: $299 (EURUSD is a separate premium license charged $14.90 per month)

License: 1 live account, unlimited demo accounts

NFA compliance: yes

Refund policy: 60 days unconditional

Read more at the Volatility Factor website

Buy Volatility Factor

Note: as specified in the manual, one should carefully choose their risk when using this EA. It can have drawdowns in excess of 1500 pips. Hitting a full SL for all 4 trades would mean a drawdown of 380 * 4 = 1520 pips. My live account used an AutoMM of 0.5 in an attempt to keep the relative drawdown below 20-25%. The manual offers quite a few details and recommendations on account sizes vs lot sizes.

Birt’s forward test

Settings: GBPUSD_settings_3.set, AutoMM 3, AvoidNews enabled

Started: 13.07.2015

Broker: FXOpen (why?)

Current version: 6.0

Currency pairs: only GBPUSD, as recommended by the vendor

Birt’s live forward test

Settings: default, AutoMM 0.5, AvoidNews enabled

Started: 27.03.2012

Stopped: 12.06.2015

Broker: PrivateFx

Account type: live, micro

Starting balance: $300

Current EA version: 6.0

Currency pairs: EURUSD, GBPUSD

Official accounts

Settings: unspecified

Started: 06.01.2012

Broker: Alpari NZ

Account type: demo

Currency pairs: GBPUSD

Settings: unspecified

Started: 06.01.2012

Broker: FxPro

Account type: demo

Currency pairs: GBPUSD

Backtests

Note: the EA does not open any positions prior to 2008 in backtests. This seems to be a hardcoded limitation. My best guess is that its optimized for the past 3-4 years.

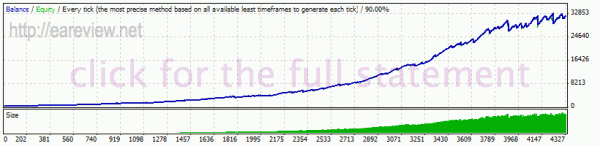

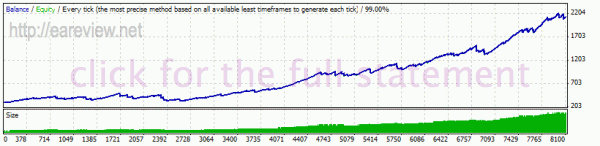

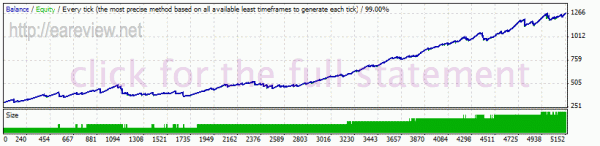

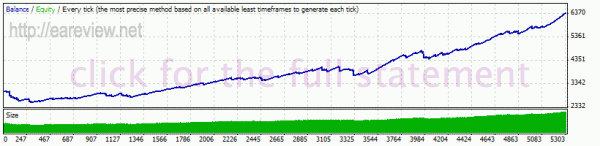

History center data

Tick data

I decided the drawdowns in the tick data backtests (albeit mostly floating) are a bit too much for my taste so I also ran some more backtests with AutoMM 0.5, which is the setting that I ended up running with on my live account. The drawdown was – naturally – much lower.

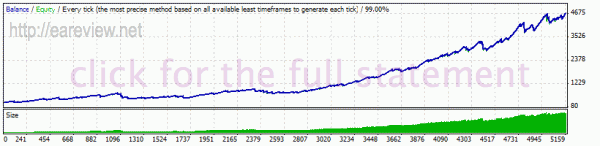

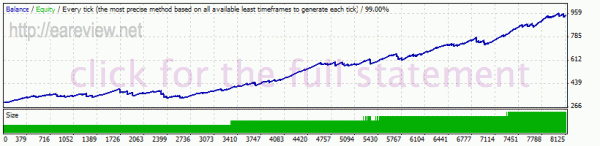

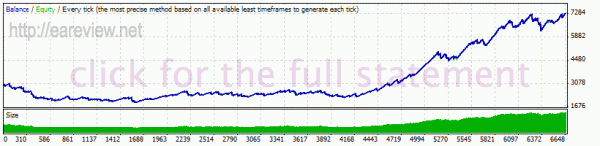

Oanda tick data, timeshifted 28 years in the future

Since the EA has a hardcoded limitation and it only starts trading in backtests when 2008 is reached, there were a few requests to run some backtests with the data shifted in the future. The only “good” shift that makes the days of the month land on the same day of the week is 28 years; the problem is that MT4 has a limitation and is unable to run backtests past January 2038 so it follows that it’s impossible to test past 2010 using this method. Even knowing this, creating the files up to 2010 (shifted to 2038) is a royal pain in the ass and I don’t recommend trying this at home. I chose the Oanda tick data because it spans a larger interval (2004-2012 vs 2007-2012 for Dukascopy) and consequently yields a longer backtest period. Both backtests are using real spread.

Comments are closed.