This article is obsolete and no longer maintained.

What a lame name for an EA. As if there was anything to hack about the forex market. To me, it’s pretty much screaming “bullshit”.

It’s using a “call home” protection scheme, by which the server authenticates the user and the account that must be associated with the customer’s user in the client interface. No extra protection is employed, although the EA authors are supposedly valiantly hunting pirated copies all over the internet.

It’s supposed to run on H1 on GBPUSD, NZDUSD, EURUSD or EURCHF chart, but the manual recommends running it only on GBPUSD.

Strategy

One word: Martingale. It opens trades according to some really simple indicators and if the trades aren’t profitable, it just opens more trades with an increased lot size. This approach typically leads to accounts being lost at some point, normally sooner rather than later. The take profit targets are big enough to warrant backtesting on history center data instead of tick data.

Website

Forex Hacked is featuring a bunch of marketing crap on the first page, although it doesn’t hurt my eye like the typical EA homepage does. Besides some bullshit about how their EA is the best ever, it’s featuring a live statement that looks particularly good. However, next to this there’s a link to “more results” and among those I find their flagship test account.

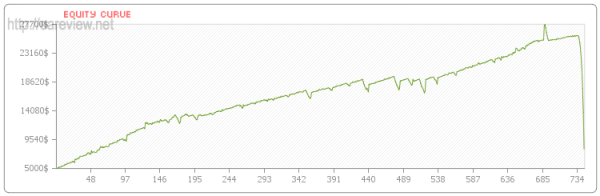

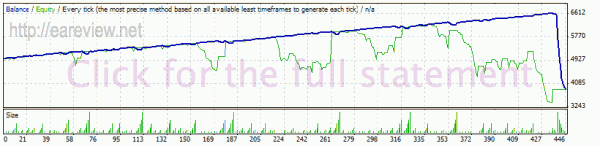

At the time of this writing, the account has a balance of over 25000 (having started from 5000) but a floating negative of almost 18000. That’s a ~70% drawdown. 15 minutes before I took the screenshot it was a 20k drawdown. That account is probably going bye-bye soon if GBPUSD keeps going up, that is unless they stop it and remove it from their webpage and mt4stats before that. Just in case they do that, here’s a graph of the equity:

Although I should stop here because obviously the EA is an account crasher, I’m going to give it a chance in backtesting anyway.

I can’t help but notice their testimonial section while browsing around. There’s a bunch of happy-sounding quotes, some of which include links to account statements. It’s notable that none of the account statements are real accounts, even though the quotes imply that’s live cash. I suspect the accounts are just demos set up by the authors at different points in time.

There’s a complete lack of a real live account statement, which is pretty natural since the EA authors are probably not dumb enough to run it on an account with real money in it. There are also no backtesting results and their excuse for that is an explanation of how backtesting results can’t be trusted, while the real excuse is probably the fact that when backtested, their EA is a very proficient account crasher.

Parameters

The manual describes all the parameters in detail, but the only ones worth noting are the Lots, which default to 0.1 and which is used as the smallest unit to open position with and the Booster, which is a factor used for martingale sizing of the positions.

Backtesting

I used history center data since, as previously mentioned, the take profit setting is a high number of pips (45). All the settings have been left at default and the starting account size was 5000, since that’s what they used for their forward tests, too.

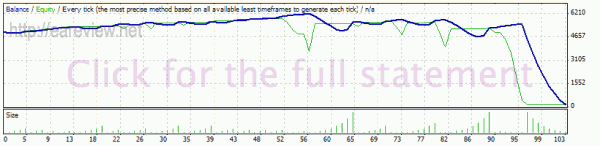

GBPUSD 01.01.2009-20.10.2009 defaults… errr, make that 01.01.2009-01.06.2009

As can be seen above, the default settings (Lots 0.1, Booster 1.4) managed to crash a 5k account in only 6 days.

Let’s try that instead with Lots set to 0.01.

GBPUSD 01.01.2009-20.10.2009 Lots 0.01, Booster 1.4

First try, failure: the EA is trying to multiply 0.01 by 1.4, rounds it to 2 decimals and comes up with 0.01 again, failing to increase the lots.

I figure I’ll use a 1.5 Booster to help the EA (0.01 times 1.5 rounds to 0.2).

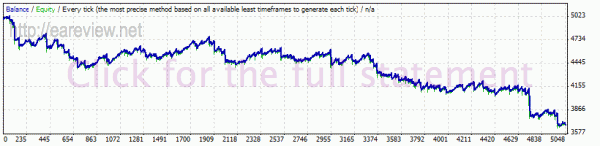

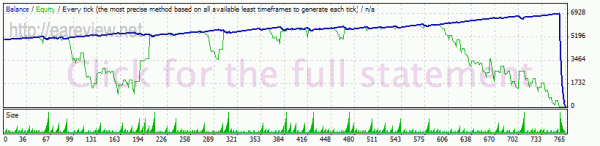

GBPUSD 01.01.2009-20.10.2009 Lots 0.01, Booster 1.5

Wow, this time it managed to run for the whole period and even bring a profit. But even considering the 0.01 starting lots, it had an almost 80% maximal relative drawdown and most of the time the equity was way below the account balance, as can be seen from the floating green curve. Note the ugly test finale.

I’m going to try the same starting in 2008.

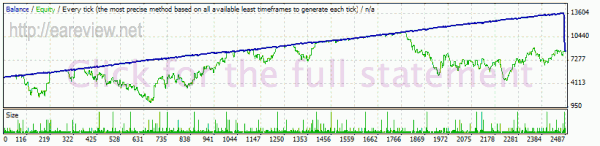

GBPUSD 01.01.2008-20.10.2009 Lots 0.01, Booster 1.5

Boom, margin call. I didn’t even try choosing a start date for it.

One last test, using the recommended 1.4 Booster with a Lots value that the EA can comprehend.

GBPUSD 01.01.2009-20.10.2009 Lots 0.02, Booster 1.4

I think you could see this coming as well as I could.

Conclusion

d00d, j00 h4xx3d f0ur-X wR0ngL33!!!111oneeleven

There, message to the author.

To the potential customer: stay away from this EA unless you have an overwhelming desire to crash your forex account.

It is, however, a somewhat cheap EA, at its “reduced” price of $169.99 and the refund policy is 30 days no question asked – I suggest taking that exit if you’re in a position to.

Details

Version tested: 1.0

Forward test: official

Pairs and timeframes:

- GBPUSD H1

- NZDUSD H1

- EURUSD H1

- EURCHF H1

Comments are closed.