This article is obsolete and no longer maintained.

I figure the name is related to the author being in relatively close proximity to the shore of the Caspian sea, which also explains the Arabic language featured everywhere on the site.

The EA is a scalper and it’s actually two EAs, one for EURGBP and the other for EURCHF. Some investigation quickly reveals that the EURCHF is an almost exact copy of Dragonpips (which is rumored to be a copy of Thunder4WD, a free EA, but I haven’t personally verified that). I’m not sure if the external parameters were modified since an older version of Dragonpips was used, but the functions are almost the same as the ones in the new version. A quick glance on the EURGBP version reveals it to be a copy of an older version of VS EuroCross, a good free EA available from The Volatility Scalp Blog, with some parameters changed.

Despite being an obvious scam, I’m continuing the review because it’s a frequent conversation topic on many forex forums and some people don’t really care whether an EA is a copy or not; even if it’s a slightly modified copy of a free EA, profitability does play a very big role into the decision of buying it or not.

The EA has no real protection to speak of. It’s using the DLL from VS EuroCross (renamed to Caspian) and since Dragonpips had no DLL, the scammer (after careful thinking I decided not to call him “author”) decided to copy the VS EuroCross DLL again with a different name. Of course, they are identical and the EURCHF EA doesn’t use that DLL. The idea was probably to scare the normal customer into thinking that the EA is protected. It’s funny how he used an editor to change the copyright strings in the DLL.

Strategy

Not much to tell here, other than the fact that it opens scalping trades in the Asian session. Naturally, since it’s copied from two different EAs, they behave in slightly different ways. The EURCHF EA seems to have a 50 pips stop loss and the EURGBP seems to use various values for its SL or no SL at all; while the EURGBP EA is taking profit at each 4 pips, the EURCHF one seems to take more advantage of what the market is offering and take profits that are often in excess of 10 pips. Since they’re essentially different EAs, I will backtest them somewhat separately.

Website

As mentioned in the introductory part, over 90% of the Caspian EA website is in Arabic. Either the google translator either sucks at Arabic or the website texts are written by an illiterate or perhaps it’s not even Arabic, it’s very hard to tell. For me, all the languages that are written from the right to the left look identical. Bottom line is, I haven’t been able to gather much from the website besides the fact that there are a bunch of backtests and two live statements: one for Caspian EURCHF and one for Caspian EURGBP. At the time of this writing, I suppose mt4stats.com is having a problem (that or the statements have been taken offline), but I also checked them two days ago and they were both profitable.

Other than that, I can tell the scammer hasn’t really paid a lot of attention to the website design, seeing that the page title for all the pages is… “Page Title”. He was probably in a rush to get the scam going faster.

Parameters

EURCHF

By default, EURCHF comes with 50% risk and maximum 3 trades, probably amounting to a ~16% risk per trade. Other than that, one has to configure the number of lot digits and the operating hours, which are 20-00 GMT. There’s no way to enter the GMT offset so you have to recalculate those manually.

EURGBP

This one comes with a slightly more sensible default risk setting, 10. Just like for the EURGBP, the lot digits have to be configured and the operating hours, which in this case are 19-21 GMT.

Backtesting

For backtesting, risk was set to 5 in both EAs. Unless otherwise specified, the spread used was 3.0 pips for EURCHF and 2.0 pips for EURGBP.

Caspian EA.EURGBP

The EURGBP test is bound to be somewhat unreliable due to the very small profit setting at 4 pips. Besides that and the trade hours which were set to 19-21, I tried to use the default settings.

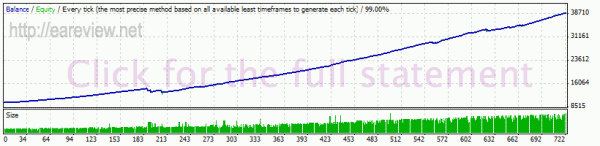

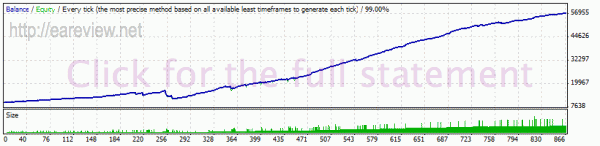

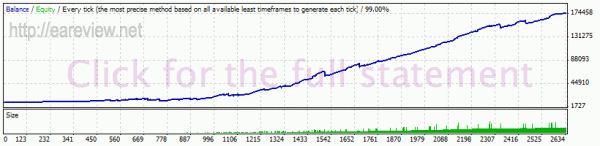

Caspian EA.EURGBP M15 01.06.2008-21.10.2008 spread 2, defaults

Looks pretty good, but the hiccup around trade 200 is actually an almost 20% drawdown, even with the risk set to 5%. I stress this again: the take profit target for EURGBP is set at 4, so these results aren’t extremely reliable.

Let’s try to increase the spread to see how it performs under adverse conditions. In the following test, the spread is set to 4, which is as much as its profit target.

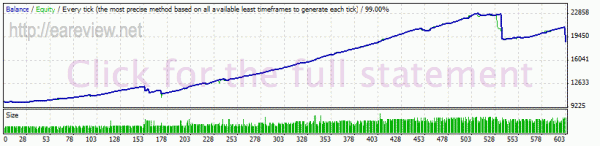

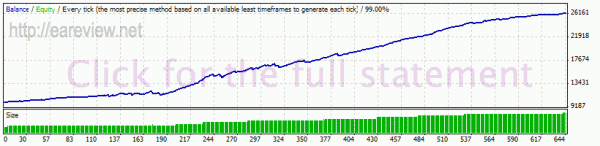

Caspian EA.EURGBP M15 01.06.2008-21.10.2008 spread 4, defaults

That visible ~25% drawdown is scary. That trade was closed at a loss of over 160 pips. I guess that means that the exit strategy is not really solid and if you happen to get some slippage or widened spreads, you might end up with a trade just like that. It’s quite foreseeable, seeing that it often runs without a stop loss.

I tried to test it with MaxTrades set to 1, but that results in a division by zero error and I didn’t want to waste time fixing their code so I proceeded to test with MaxTrades 2.

Caspian EA.EURGBP M15 01.06.2008-21.10.2008 spread 2, MaxTrades 2

It looks just like the one with MaxTrades 5, but with a slightly lower drawdown and also lower profit. Seems to be pretty much the same, but with a lower risk. Running it with MaxTrades 5 seems to produce better results.

Before concluding the EURGBP test, let’s also see a sample of some previous years.

Caspian EA.EURGBP M15 01.06.2007-01.06.2008 spread 2, defaults

Again, we can spot a large drawdown similar to the one that happened when running it with spread 4. In this case, however, it’s not generated by a single trade – it’s generated by 5 trades being closed at a loss. So, I guess less trades might in the end be a bit safer. If we ignore the drawdown, it looks decent.

Caspian EA.EURCHF

Due to the average number of pips in the winning trades of this EA, the test will be more reliable than the EURGBP one. The only settings changed from the defaults in all tests were risk, which was set to 5 and the trade hours which were set to 20-00.

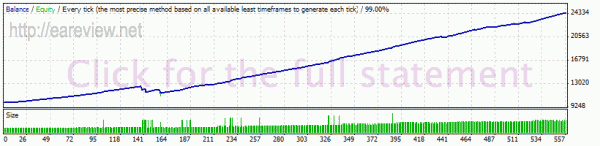

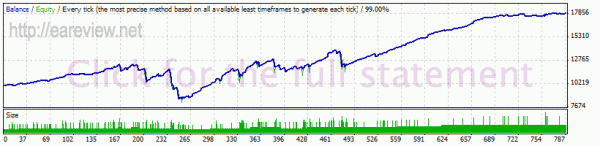

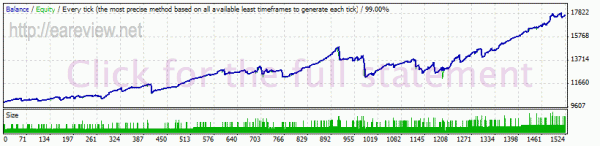

Caspian EA.EURCHF M15 01.06.2008-21.10.2009 spread 3, defaults

Although the results look impressive, the maximum drawdown is almost 30%. Ask yourself, if you had a live 10k account, would you enjoy seeing it go to 7k? I certainly wouldn’t like anything like that to happen to me. I suspect the MaxTrades setting actually multiplies the risk I configured, so I’m going to try testing it with MaxTrades set to 1 to see if we can get a better result when it comes to the drawdown and a more realistic profit figure.

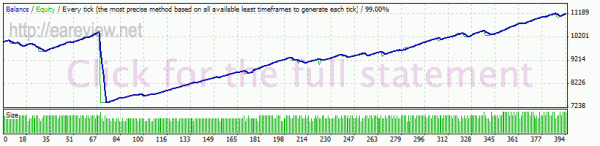

Caspian EA.EURCHF M15 01.06.2008-21.10.2009 spread 3, MaxTrades 1

Much better: the drawdown is now only ~6% and the profit I end up with is a more down-to-earth figure. It looks like with these settings it might be run live even by the most conservative traders.

But let’s see how it performs with widened spread.

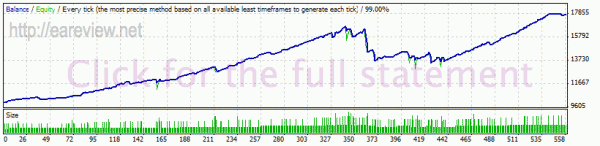

Caspian EA.EURCHF M15 01.06.2008-21.10.2009 spread 5, defaults

Now, this looks scary. This is exactly what you should expect in case your broker typically gives you widened spread, slippage and requotes during the Asian session. It’s not hard to conclude that this EA is extremely sensitive to broker spreads and execution.

Just like I did for the EURGBP version, I’ll continue with a test of the 2007-2008 period.

Caspian EA.EURCHF M15 01.06.2007-01.06.2009 spread 3, defaults

While it seems to work ok even on that period, it’s worth noting that it has an extended drawdown period, which is probably exactly what should be expected in the future if the market conditions change. However, it manages to get out of it in the end and to come up with a profit.

Some people mention running this EA on M5, so I’m going to try that as well. I’m going to use exactly the same settings as for M15 and compare the results.

Caspian EA.EURCHF M5 01.06.2008-21.10.2009 spread 3, defaults

This looks pretty good but it has over 25% maximal drawdown. Reducing the number of trades would probably reduce that, just like it did for M15. Comparing the results of the two tests trade by trade, it’s very obvious they are 100% different, so probably running this on M5 in addition to M15 (with a different magic, of course) would increase the profit curve without increasing the risk too much. Sometimes they even hedge each other, thereby reducing the risk.

I’ll also try the M5 timeframe on 2007-2008.

Caspian EA.EURCHF M5 01.06.2007-01.06.2008 spread 3, defaults

This looks very much like the M15 test on the same time period. Not much to say besides the fact that you should be prepared to have a balance curve like this if running this on a live account. Even though it looks to be performing very well now, you never know when that changes.

Conclusion

Despite being profitable, it’s definitely not worth spending the $550 to buy it. You can get Dragonpips for the same price and VS EuroCross for free. Not to mention that, seeing the scammer is not the author and he doesn’t seem to be very proficient with MQL, you will most likely receive zero support and given the language of all page content, it’s very probable that you won’t even talk to someone who speaks English.

It appears to be a scam targeted exclusively on the people who understand Arabic and even though the author might have made some modifications to Dragonpips and VS EuroCross, I’m pretty sure that those two EAs are not performing much worse than this one.

If you do run it, I recommend using a risk as low as possible on the EURGBP EA or simply not using it at all. It’s not using a stop loss and those large drawdowns can happen to you, too.

Forward test

The Caspian EA forward test is running on JadeFX since 01.10.2009 with the default settings and Risk set to 5, on the following currency pairs and timeframes:

- EURGBP M15

- EURCHF M15

- EURCHF M5

Edit 04.11.2009: removed EURCHF M5 due to poor overall EURCHF results.

Edit 06.01.2010: the first demo account was closed by the broker on 11.12.2009. A new forward test was started on the same day, using the same parameters. The old one is still available for inspection.

Details

Version tested: the one and only

Forward test: Jade FX Caspian EA forward test

Pairs and timeframes:

- EURGBP M15

- EURCHF M15

- EURCHF M5

Comments are closed.