This article is obsolete and no longer maintained.

Trading style: attempts to capture large market moves based on several chart patterns; uses a trailing stop.

Currency pairs: EURUSD, GBPUSD, USDCHF

Timeframe: H1

EA price: $350

License: 2 live accounts, 2 demo accounts

NFA compliance: yes

Refund policy: none

Read more at the PhiBase Synergy website

Buy PhiBase Synergy

Note: the EA changed its name from PhiBase Pro to PhiBase Synergy when v3.2 was released during the 2nd half of July 2012.

Birt’s forward test

Settings: default (Max_Allocation_Per_Trade 10.0, Geometrical_MM true)

Started: 15.02.2012

Broker: PrivateFx

Account type: live, micro

Starting balance: $300

Currency pairs: EURUSD

Current version: 4.03

Official accounts

Settings: default

Started: 13.06.2012

Broker: FxPro

Account type: live

Starting balance: $3000

Currency pairs: EURUSD, USDCHF

Backtests

All backtests were performed with v1.23. Newer versions might display better performance.

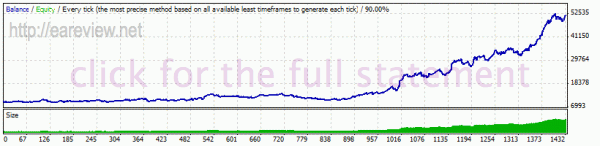

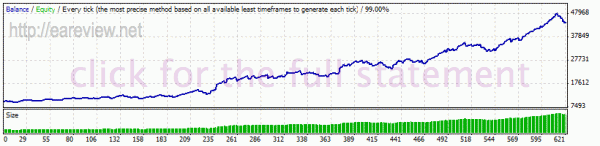

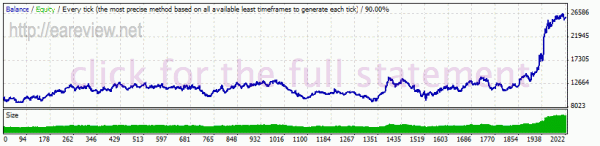

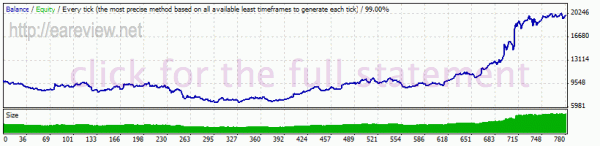

EURUSD

History center data, spread 1.5

Tick data, real spread

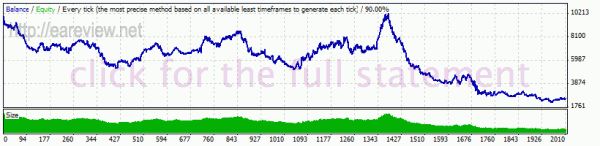

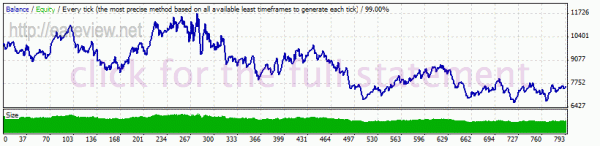

The EURUSD backtest is very good as you can see in the charts above, but the other two pairs aren’t keeping up the same pace. The vendor mentioned that the standalone strategies for GBPUSD and USDCHF will not be profitable when the parameters aren’t updated based on the price action, which I understand will happen 3-4 times per year. Quote from the vendor regarding the two additional pairs (GBPUSD & USDCHF):

It is optional for the users to choose running these additional pairs. We do not recommend running these pairs for stand-alone trading using the recommended parameters.

GBPUSD

History center data, spread 2.0

Tick data, real spread

USDCHF

History center data, spread 2.0

Tick data, real spread

Comments are closed.