This article is obsolete and no longer maintained.

Many of you will have heard of this EA already. I’ve been asked to review it numerous times and taking a look at its homepage and stats surely got my attention. So, I’ve mailed the author and promptly received a reply with a review copy attached, but I’m a bit ashamed to say that writing this article has been on my TODO list for over 10 days now.

But enough about that, let’s get on the case: a trend EA by definition, Forex Growth Bot takes the trader expression “cut your losses short, let your profits run” really serious. Since it runs only on EURUSD M15 and it’s not what I would call a feature rich software, this review will likely end up quite a bit shorter than my other reviews.

Strategy

There’s no description of the strategy so this merely guesswork: the entry is based on a volatility indicator running with two different periods – when the volatility is changing, a trend is considered to have started and the EA will open a position. From here, all the mojo lays in position management: if the market goes against it, the position will be promptly closed (at an average loss of 30 pips) and the EA will wait for other fish to fry. If, however, the market moves in the correct direction, it starts adding to the existing position until it reaches up to 5 times its original size. Sure, sometimes the market will retrace and the positions will not always run their course, but when they flow, they do so nicely.

During the course of such a basket of positions, the EA will occasionally close some of them and open others and frankly I have no clue how this mechanism works – Forex Growth Bot is a bit of a black box, but it works quite nicely both in backtesting and in forward testing and that’s enough for me.

Overall, the win ratio is only about 40%, but this is more than compensated by the fact that the average profit trade is more than twice bigger than the average loss trade. It’s the very definition of a trend-following robot and I’ve been looking for something like this for like two years without much success until now.

The website states that between 3 and 10 trades are open per week, but my analysis seems to suggest an average of more than 1.5 trades per day. Of course, there will be periods of several days without a trade as well as days with 5-6 trades, but on average it trades more than once per day. Even though the author says this is not frequent trading, I beg to differ: at least when compared to other EAs I’ve looked at lately, this is a shower of trades. As for the duration, over 80% of the trades will be closed within a day (the average being around 12 hours), but it’s not uncommon to see trades lasting 2-3 days. As is the case with most trend EAs, opening positions is not restricted to any trading session and trades are just opened around the clock when its signal conditions are met.

It’s notable that the bot opens and closes its positions only at the start of each bar and that it does not send a stoploss & takeprofit target with each order. The latter can be a minor advantage if your broker’s out to get you, but it can also be a hindrance if your internet connection goes down or if your VPS crashes.

As far as I can tell, Forex Growth Bot complies with the no-hedging rules, but does not comply with the FIFO rules because some of its positions get closed before those opened prior to them and still open at the time.

Edit 20.02.2010: should have mentioned this earlier, but I totally forgot. The expert advisor now features a parameter that lets you enable FIFO compliance.

Website

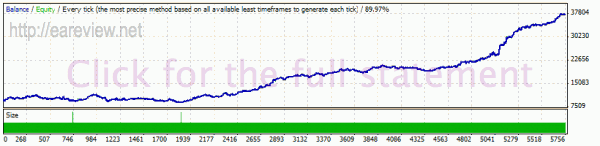

The product home page is located at www.forexgrowthbot.com. It does not throw a lot of marketing dust into the visitors’ eyes and it features a live forward test complete with the investor password plus a few backtests. There’s really not much to it other than that. The forward test was started with a large lot size which was later decreased, so the balance curve looks rather weird:

Parameters

When it comes to configuration, it can easily be called lackluster. It lacks all the bells and whistles that other EAs shower you with. All the money management in the basic version consists in a parameter that lets you set the lot size manually. There are also 3 parameters for controlling the volatility settings but you shouldn’t touch those unless you want to optimize it for a different pair and timeframe.

Speaking of which, the author recommends only running it on EURUSD M15, but it can be run on other pairs as well so feel free to experiment. The only such endeavor that I had the time for was actually a mistake: I prepared an EURUSD M5 FXT and ran it on that one by accident; as luck would have it, it was profitable with the default settings even on that timeframe. By the way, if you do try to optimize it on other pairs, feel free to use the “open prices only” method, it’ll do just fine given the fact that the EA only trades and closes on bar start.

There is also an advanced version (purchased separately) that gives you access to more settings such as an interesting Wave Trailing (kind of a trailing stop) and more volatility settings that the manual briefly describes without giving any indication of the range you should use for them or what will they actually do when changed. It’s notable that the advanced version has a reinvest capital option, which is some kind of “advanced” money management – the lot size will be increased by 0.1 for each $4500 profit.

This brings me to position sizing. Like I said, you can input the number of lots manually and the manual states that you should use 0.01 lots for balances lower than $250 and 0.1 lots for balances above $2000. However, my recommendation is to use no more than 0.1 for each $5000 in your account (this translates to 0.02 lots per $1k), perhaps going as low as 0.01 lots per $1000 balance, depending on your drawdown tolerance, but I will go more into this in the backtesting section. Overall, the money management that adds 0.1 for each $4500 profit seems quite reasonable.

Given the chart decorations that I’ve seen in some EAs lately, I would’ve also expected to see a bunch of comments on my screen from Forex Growth Bot, but surprisingly it’s totally silent, not only on the chart but in the experts log as well.

Backtesting

As usual, I ran the backtest on an FxPro terminal. Since we’re talking about EURUSD, I set the spread to 2.0 and even that’s a bit on the high side nowadays. I’ve left all the 4 parameters on their default settings, including the lotsize default of 0.1, a bit low but suitable for a starting balance of $10000.

For a trend EA, this is just awesome. I ran it in visual mode to watch its entries and exits and it’s quite a show – if you buy it, run a visual backtest yourself, just to see how it captures the trend as it progresses.

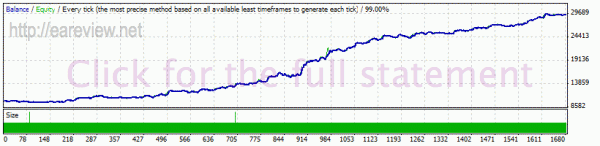

Despite the rough time it had in 2002, its balance curve looks very good. The average win is around 55 pips while the average loss is around 27 pips, resulting in a risk:reward ratio of over 1:2. Just like it is to be expected from a trend EA, its profitable trades add up to less than half of the total, 38% to be precise. The 24% max drawdown might be considered quite large, but such low levels are only hit in 2002, which was a rather bad year for Forex Growth Bot – before and after this particular year, the EA had a very nice behavior, but there’s no guarantee that there will be no such “ugly” time periods for it in the future.

It’s visible that the lot size is sometimes doubled, albeit very rarely. According to the author, this only happens in trade setups with a high profit probability. I haven’t seen it use more than double the lotsize so it’s nothing that we should be worried about.

In the end, what matters is the balance curve. We can gather from the backtest that the bot will have periods of “flatness” or perhaps even slight drawdown, followed by periods of large gains.

Since the EA deals in the hundreds of pips most of the time, it’s quite pointless to backtest it on tick data, but I did it anyway, just to keep in line with my other reviews. I also used the real spread data and here are the results:

It’s safe to say that spread doesn’t really matter for Forex Growth Bot. Anyway, if you have a broker that has an average EURUSD spread higher than 2 (if there are still any that do), you should consider finding another.

This backtest is not much different from the previous. The average profit is now 70 pips while the average loss is 30 pips, resulting in a risk:reward ratio of 1:2.3, even better than in the 1999-2011 backtest. The percent of profitable trades also increased now to a tiny bit above 42%.

What’s very notable is the drawdown: the value displayed in this backtest is only 7.76%. However, there’s not much point to a max relative drawdown if the lot size is constant during the backtest so let’s calculate it on our own. The easiest way to do it (well, the only one I can think of) is to take the maximal drawdown in account currency resulted in the test – 1283 in our case – and report it to the initial balance, which yields a result of 12.83% relative drawdown; quite acceptable but keep in mind that the lotsize used was 0.1 for a starting balance of 10k – if you use 0.1 lots for 5k, the income potential doubles but the drawdown potential also doubles with it.

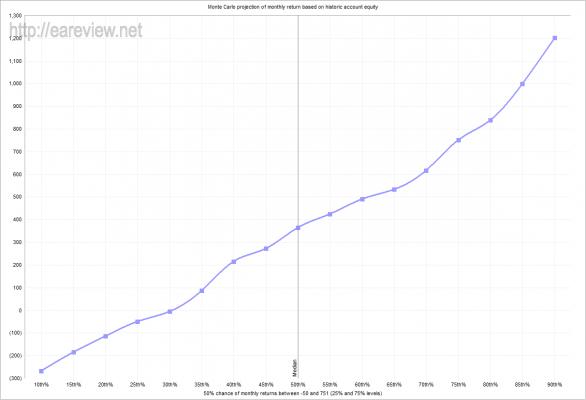

I also ran the 2007-2010 backtest through the MT Intelligence offline analyzer tool to get the average monthly return for a 0.1 lot size and the result was $423. While at it, I also exported the Monte Carlo projection:

Power Source Edition

So, I also received the extras package from the author yesterday (this section was added on 21.01.2010, roughly two days after the review). This version has a bunch of extra parameters, some of which I am going to mention here:

- FIFO – This will make the EA work with your broker if you’re using an US broker that implements this particular rule in the client (well, most of them do).

- ClosePreviousSessionOrders – Will naturally close the orders from a previous session which will otherwise remain open. I’ve had a personal encounter with this issue as you will be able to read below in the forward test section.

- Wave Trailing – complex trailing stop system, available only in the Power Edition (it’s not in Advanced and Basic)

- Re-Invest capital – as explained above, it adds 0.1 lots for each $4500 profit (again only available in the Power Edition)

- Assign SL & TP – Enabling this parameter will send a SL & TP with each order, but will disable Wave Trailing and Re-Invest capital.

- BotComment – Allows changing the comment sent with each order.

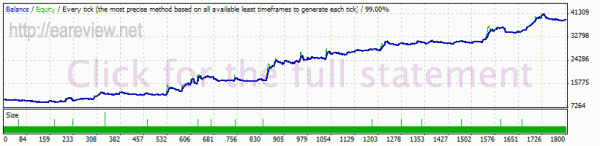

It seems to me that the most interesting parameter is Wave Trailing, so I decided to enable that and run a backtest. Since I already had the 2007-2011 tick data in the terminal, I used that FXT file. To have a comparison term in the 2007-2010 backtest of the default version, I didn’t enable the money management parameter. Actually, all the parameters were set to their default values except WaveTrailing and here’s what resulted from that:

The first noticeable thing is that it made quite a lot more profit than the basic edition. Also, the balance graph has a look that resembles a staircase, meaning that some trades brought a lot of profit, so they are likely allowed to run longer and capture more profits when Wave Trailing is enabled. However, the relative drawdown recorded was 20%, significantly higher than the one in the basic edition test. Overall, Wave Trailing looks like an interesting option if you’re willing to take the higher drawdown risk.

My live forward test will still run the basic version, but that’s mostly because that’s the version it was started with and because most readers will be interested to see the evolution of that particular edition.

Conclusion

Despite its lack of user friendly features, Forex Growth Bot is a really solid trend EA. It should only be in your portfolio if you can stomach periods of balance curve flatness that sometimes extend for several months and if you can also accept the fact that it’s going to be profitable even though a slightly larger part of the trades is going to be closed in the negative. I’d dare say it’s an EA for the connoisseur, in contrast with its rather low price of $129.

At the time the review was written, the EA used to allow unlimited accounts but nowadays the basic license is limited to a single account.

Like I mentioned earlier, there is also an Advanced Edition available for $89, opening additional configuration settings and a Power Source Edition for $99 that will let you access a part of its source code. Finally, there’s a monthly subscription of $49 entitled Advanced Support & Optimization which will give you access to support via Skype & remote assistance, the opportunity to request additional features and as time goes, it will open access to additional pairs. The author states that the basic version is “built to last” and all the other additional purchases are not mandatory for the robot to properly function, which I judge to be true given my backtests, live forward test and the opinion of the other buyers that I’ve been able to find.

Forward test

I started this live test account a week ago, on 12.01.2010 using an account opened at LiteForex. It had a few small losses, but to my surprise, it almost immediately caught a large bullish movement and I’ve seen floating profit of as much as 1.6k which is huge given the 5k starting balance. I would’ve probably closed the trades manually if it weren’t a live test account. The reason it is having such a large floating profit is that I started the test with a lot size of 0.1 because I did it before thoroughly analyzing the backtest. I will keep the live test with this lot size for consistency’s sake, but if I had to start it again, I would do it with 0.05 lots for the starting 5k balance. All the parameters were set to default (even the lot size actually).

Edit right after posting: the author informs me that if the EA is restarted, it loses control of its trades. Since that was the case with the trades that I mentioned above (the 1.6k floating) due to the crash issues I’ve had recently and that I mentioned on the forward page a couple days ago, I am now closing them all manually. If you buy it, you should make sure you don’t run it into such problems by using it on a VPS from the start. Personally, I’m using SWVPS but I can also recommend Forex VPS if you’re looking for a provider.

Edit 26.01.2011: I’ve been informed by the author that a signal service based on the EA is in development and will soon become available as an alternative. Also, the new version of the EA no longer has the problem I described above.

Edit 04.03.2011: For about a week now, my live forward test account kept trading opposite to all other accounts. I ended up emailing the author yesterday and after his reply decided to restart the terminal manually, which resulted in the short trades being closed with a rather large drawdown on the account. The logs have been sent to the author for further investigation and I’ll post an update if I have any news as to what might have gone wrong.

Details and links

Version used in backtesting: the “regular” edition; there’s no version tag on the ex4, but the DLL has its file version set to 2.0.2.15 and the product version set to 2.0, while the installer is dated 17.12.2010.

Version used on the forward test real account at the time of this writing: same as above

Currency pairs & timeframes: EURUSD M15

Buy Forex Growth Bot

Comments are closed.