This article is obsolete and no longer maintained.

During the past few months, after I decided to become an affiliate of the EAs I review, I started to receive quite a few invitations to write articles about automated Forex systems. As you can probably guess, I’ve had to turn down most of them, but here we are now, looking at one that I believe to be profitable even though it isn’t widely renowned. I’ve actually wanted to review it since before Christmas but I’ve been away for the holidays and I’ve had an extremely busy time period after the New Year.

Later edit: EURClimber was renamed to EuroRise so the article has been edited to reflect the name change.

EuroRise, just like KangarooEA, provides backtests using the methods described on my tick data page, but goes a step further: it even uses the real spread! Despite the fact that I wrote the code for real spread testing over half an year ago, I never actually used it in a review so the fact that an EA author was one step ahead of me with it prompted me to write the 2GB patch and to also use real spread data in this review on top of which I decided to add a commission for added realism, but more about that below.

So, by now you must be wondering what exactly is this EuroRise and I’ll try to answer this question to the best of my ability: in a nutshell, it’s an Asian session scalper with quite a few twists. First of all, it has a really tight stoploss of 11 pips (plus spread) and it usually takes profit somewhere between 3-10 pips, leading to an absolutely awesome risk:reward ratio. Second, it has a very nice system that will determine your broker’s suitability – it records the spread, slippage and commission over a number of trades (minimum 15) and it spits out a “broker suitability” figure. In other words, it tells you whether your broker is any good for the EA or not.

Last but not least, it has a very interesting system called “Equity Curve Account Protection System” – this keeps track of the trades the EA takes on your account and it calculates a moving average with a period of 15; if the MA starts heading down, the system kicks in and starts paper trading until the MA changes its slope. I must admit that I thought this system to be just a marketing gimmick, but upon close inspection of the EA, I found it all in there, including saving the trades when paper trading. If you’re wondering what I mean by “paper trading”, I’m referring to trading by writing down the proposed entry and exit points, very much like demo trading – it doesn’t actually place any orders, yet the trades still get stored in its files.

Strategy

Although the manual doesn’t go into a lot of details about this, at least it does explain the basics behind the system, unlike most “black box” EAs there. The EA runs on the M15 timeframe and trades EURCHF and EURGBP, two of the least fidgety pairs, new positions being taken between 10 and 12 PM GMT. As mentioned above, it has a stoploss of 11 pips plus spread (so if your spread is 3 pips, your SL will be 14) with profit being taken between 3 and 10 pips, leading to an extremely good average risk:reward ratio. Most of the positions stay open for less than an hour, but sometimes (about 10% of the time) they can extend for over 2 hours. What the manual has to say about it is that the EA considers the underlying trend, calculates a support and resistance and if the trend is bullish, it trades when support is hit, while if the trend is bearish, it trades when resistance is hit, so it basically tries to catch a retracement move. Supposedly, as a side benefit this can occasionally generate positive slippage, but I guess that will only happen on exceedingly honest brokers. The main idea is that it never trades against the trend and it uses the small “bounces” as entry points, only trading during the most quiet time of the day. It’s worth mentioning that on its first trading night, my live account had two EURCHF trades in opposite directions, suggesting channel trading; I don’t know if it’s just an exception from the trade-with-the-trend rule or just a bug or simply a misleading description or perhaps just intended behavior.

EuroRise trades quite often, averaging almost 1 trade per day. Sure, there will be days when there are two or more trades as well as periods of 2-3 days without a trade, but it can easily be described as an active system. It never opens more than a position at once on each currency, so it’s totally safe when it comes to the stupid NFA FIFO & hedging rules.

Website

The home of the EA is eurorise.com. The main page is actually a pleasant lecture, featuring some pertinent and interesting information and a forward tests which I am going to take the liberty to link here.

Several backtests using tick data with the Dukascopy real spread are also there; they were performed before I wrote the 2GB limitation removal patch, so the results are nicely merged in some PDF files. The actual backtest result files are also available on a different page and finally the FAQ page is also worth reading.

Parameters

The EA doesn’t require you to configure a large number of settings. In fact, you could just toss each EA (there are two different ex4 files, one for EURCHF and one for EURGBP) on a chart without changing anything and come back to check the broker suitability index after a few days. You should however configure the risk: it’s nicely expressed in percents of your balance per trade, so if you type 1 in there and a trade hits SL, you will lose 1% of the balance.

You can also choose to trade the EA with a fixed lot and I strongly recommend trading it with the minimum lot size available on your broker until you determine your broker suitability. The MaxSpread is set by default to 2.5 for EURGBP and 3.5 for EURCHF and you shouldn’t change these values.

There’s a bunch of settings for backtests that include the GMT offset and the option to enable DST, which doesn’t really have any hardcoded start/end dates but rather simply activates DST in April and ends it at the start of November. A backtest setting that I didn’t fully understand is the RiskCoeff, a parameter used to adjust the backtest lot amounts, apparently calculated based on the USDCHF and GBPUSD pairs.

A last section includes some fine tuning parameters: here you can configure the max spread for opening and for closing trades individually, the max leverage and a special “StartWith” parameter that lets EuroRise work with only a part of your account balance and use that (plus its profit) when determining lot size. It’s also possible to fragment your order into several smaller ones, but I don’t see why you’d need this unless you’re trading a large account without partial fills. Finally, there’s also a stealth SL setting which adds a bogus stoploss setting of your choice to each order.

When the EA is added to the chart, a lot of info is displayed in the comments and you should pay extra attention to the broker suitability details section, which includes the average trade spread, the average slippage, the commission, the real average spread (a sum of the first three) and the overall broker suitability index. Note that these are different on each currency pair so you should keep an eye on both symbols.

Backtesting

I’ve used an FxPro terminal in all my backtests, manually configuring the minimum lot size and lot step to 0.01 to allow more meaningful money management without using large sums.

All the settings were configured using their default values, with the notable exception of the risk in some cases.

Even though I’m aware that backtesting on Metaquotes history data is going to be as good as useless due to the very low SL & TP targets, that was the first thing I did, just as a preliminary test to determine whether EuroRise is a potential review candidate or not. So, I’m going to share the results with you here, even though they’re quite irrelevant.

Metaquotes history data backtests

In order to have a balance curve that makes sense instead of shooting up into the hundreds of millions, I had to dramatically reduce the risk parameter when backtesting from 1999 to 2011. I chose 0.3 for EURCHF and 0.5 for EURGBP – I had to use different values for each pair to get them to have almost the same starting lotsize and I assume that’s because of the RiskCoeff setting that I mentioned earlier and that I didn’t change.

So, I began by assuming that the average user would choose a decent broker and I made a rough average of the spreads from brokers offering good spreads during the hours that the EA trades. That may sound slightly confusing, but I eventually landed on 2.3 pips for EURGBP and 3.0 pips for EURCHF by using the Asian session average spreads from some 15 brokers, values that seem quite reasonable to me.

I’m pretty sure that FxPro uses DST, but the manual mentions that one should try backtesting both with DST on and with it off, so I complied and did a double set of tests.

Sure, the EURCHF result looks very good, but like I said, this is a very poor quality test so for now let’s ignore the fact that its balance graph looks awesome and try to memorize some figures, just to compare them with those obtained in the better quality backtests: profit factor 5.04, profit trades 91.50%. We can ignore the drawdown of only 2.58% because the risk used was very low; had I used a risk of 3, the relative drawdown would’ve probably been around 15%, but the profits would then number in the hundreds of millions. The average win:loss report is an impressive 1:2.13.

The results for EURGBP are even better than those for EURCHF. With a profit factor of 6.67 and 95.76% trades won, the EA turned the starting 10k balance into a virtual 4.5 million by the end. Again, we have a meaningless but very low relative drawdown of 2%, although this time the average win:loss report is slightly worse, 1:3.38 and the EURGBP EA is able to reach a higher end balance than the EURCHF EA just because it has a higher win percentage and a much higher number of trades.

Either way, although not entirely unexpected, the results fall into the domain of science fiction due to the poor data quality. Before we proceed to tick data backtesting, let’s check out the same backtests with DST disabled:

Looks like I was right and FxPro does indeed use DST. Both backtests ended up with lower final balances than their counterparts with the DST parameter enabled, even though on EURGBP we can witness a higher profit factor – 8.30 – and a slightly lower relative drawdown.

Tick data backtests, fixed spread

I proceeded to use the Dukascopy tick data with the same spreads mentioned above: 2.3 for EURGBP and 3.0 for EURCHF. As you probably know, tick data is only available starting from 2007, so I increased the risk to the default of 3. Naturally, I also had to change the GMT setting to 0 while DST was set to false, its default value.

Initially, I had to split the data for each pair into 3 files: one for 2007, one for 2008 and one for 2009-2010, but I forgot to set the lot sizes properly and I got so annoyed with having to manage so many files that I ended up writing the 2GB limitation removal patch so finally the backtests are now contiguous and we don’t have to stretch our imagination placing the resulted graphics at the end of each other. While at it, I revised the actual spread patch and made it work with all MT4 builds between 225-229 (and possibly earlier and later builds as well) and I also added a few other features.

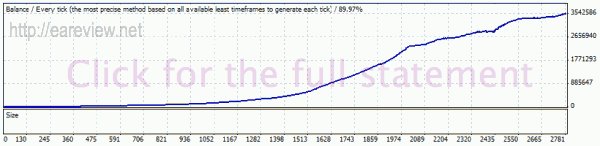

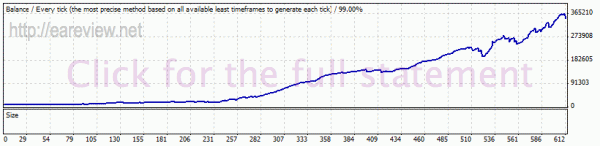

Now’s the time to compare against the numbers we got in the history center data backtests. The profit factor on tick data is 2.27 and the profitable trades are now 82%. On the bright side, the average trade profit/loss ratio increased to 1:2.02, but we can also see a maximal relative drawdown of 24%, which can be more than most people can stomach. In light of this, even though it’s only a one-time occurrence and I decided to use risk 3 on my forward test, I recommend setting your risk to 2-2.5%. It’s also noticeable that 2007-2008 were not nearly as profitable as 2009-2010, the balance appearing almost flat compared to the rest in spite of the 100% balance increase during that part of the test.

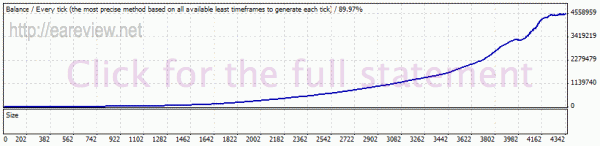

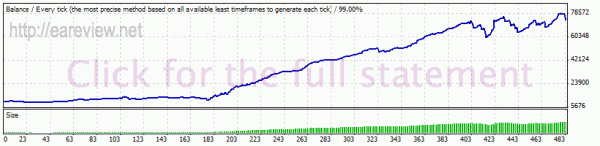

The balance curve exhibited by the EURGBP version of EuroRise on tick data with fixed spread seems a bit more consistent throughout the chart. The profits for the 2007-2008 part of the test don’t exceed those obtained on EURCHF during the same period of time; however, the end balance is quite a bit lower, resulting in an overall smoother curve. The profit factor is 2.94 and the winning rate 86%, both lower than they were in the history center data backtest, but we also have a much better average trade profit/loss ratio here: 1:2.14.

Overall, very nice results for a scalper, but I’ll take you through the real spread backtests before drawing a conclusion.

Tick data backtests, real spread

Like I said above, the author backtests are using real spread data which prompted me to do the same. I can’t really figure out why I failed to use it in my previous articles, it’s tremendously useful for scalpers. To enhance the realism of the backtest, I also added a round-trip commission of 0.8 pips. For those not familiar with commissions, this means that you’d pay 0.4 pips for opening a position and another 0.4 pips for closing it. The backtest parameters were identical to those used for the fixed spread tick data backtests.

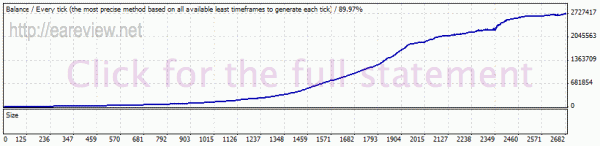

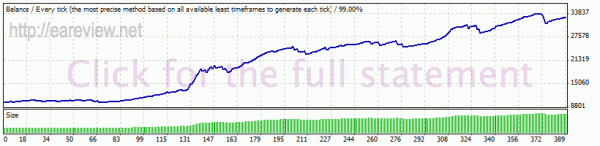

The 2007-2008 flatness is still present here and the balance chart looks about the same as it does for the fixed tick data backtest. We have a lower profit factor of 1.82 but the resulted relative drawdown is better. This time, the drawdown of 21% can’t be ignored at all because this backtest is as close as it gets to the real thing. I’m repeating this, but I feel the need to stress this point: just because it seems to be only a one-time occurrence it doesn’t mean that it will never happen again. Either way, overall it was able to pull off a nice profit, albeit lower than in any of the previous tests.

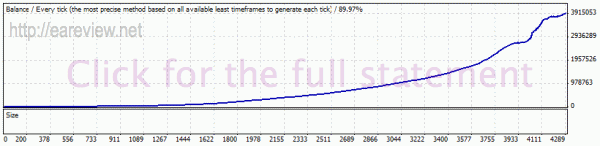

The same holds true for the EURGBP backtest: it was able to end the backtest with a nice profit, even though not as high as in the optimistic backtests before. The profit factor was 2.06 and the relative drawdown 11.30%, much lower than the one exhibited on EURCHF.

The author mentions this on the website and I tend to agree with him: Dukascopy truly had rather horrendous spreads during the Asian session a few years ago, so the real spread backtests are a bit of a worst-case scenario. The EA has the very nice habit of printing the spread and slippage in the log for each trade it takes both at opening and at closing and I’ve seen trades closed on spread as high as 8 pips. Lots and lots of trades were not taken due to the wide spread; as you can see above, backtests done on fixed spread data had almost 30% more trades for EURGBP and over 45% more for EURCHF – not only does that show that the realism factor is undeniable, but it also points out that the spread conditions in these backtests are likely worse than you will face online nowadays. Sure, online there’s also the unknown factor of slippage, yet simulating that in backtests might prove rather hard.

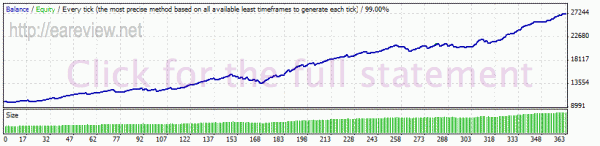

To analyze the results a bit more, I proceeded to merge the reports from the real spread data backtests and this is what the resulting chart looks like before standardizing the lot size:

By fixing the lot size to 2.0 in the EURCHF results and to 1.4 in the EURGBP results (the starting values you will get with a balance of 10k if you’re using risk 3), I was able to obtain a monthly return figure of 729, which translates in returns of 7.2% per month. Based on the same dataset, I also ran a Monte Carlo simulation:

Of the other several analysis that I ran, you’ll be interested to know that almost 70% of the trades are closed in less than 1 hour and that the average number of positions per trading day is 0.89. Also, given a starting balance of 10k and a risk of 3, the best month in the backtest had returns of 3.7k while the worst month resulted in -1k, but perhaps the most interesting fact is that its overall risk:reward ratio is 1.4:1.

Version 5.0

There were a lot of updates since I wrote the review and the EA has undergone a lot of changes, starting from the widening of its stop loss and going all the way to the addition of the USDCHF pair, but also passing through a lot of other minor stuff on the way. I was going to update the article with some backtests for v4.2 but I ran into some problems and had to wait for the next version which, as it turns out, brings another major update: EURCHF was removed in the new v5.0, released on April 10th 2011.

So, the current state of things is that EuroRise runs on EURGBP (with a SL of 25 pips) and on USDCHF (with a SL of 35 pips).

Because the changes are quite major, I decided to run some new backtests. As before, I did it using tick data with the real Dukascopy spread and a commission of 0.8 pips. The EA was configured with its default settings, with the exception of the UseLimitOrders parameter which was set to false to avoid huge resulting statements. The risk was set to its default of 3.

The resulting balance charts are much smoother and the profit factor was improved over the version I originally tested. In addition, the maximal relative drawdown is now a lot better, sitting at a 9.11% for EURGBP and 13.14% for USDCHF. Thing is, the EA went into a mild drawdown almost as soon as it was launched, but it already started to dig its way out, so the question that comes naturally is: will 5.0 help set it on the right track? Personally, I believe it will. The backtests are looking better and after v4.0 my live account started to increase its balance, but what happens from now on remains to be seen.

Running some stats on the above backtests, I ended up with a monthly return of about 4.5%, calculated with a fixed lot of 0.75 on both pairs and assuming a starting balance of 10k. Sure, it’s lower than it was in v2.0, but the reduced drawdown means you can use a higher risk setting, perhaps go as high as 5 and maintain the same risk as a percent of your account as it was in 2.0 with a risk setting of 3. I also ran a quick Monte Carlo simulation for those interested.

Since v4, EuroRise also allows entering the market by using a limit order (the UseLimitOrders parameter mentioned above) instead of a market order to avoid excessive slippage. In theory, this is a good thing so I figured I would also try to backtest with this setting enabled. The trades taken in the backtests are identical as far as I checked, so I would highly recommend keeping it enabled on live accounts.

Conclusion

I have a few online buddies who despise Asian session scalpers by principle but I disagree with them. The early hours of the Asian session are still the most quiet period of the market so it makes a lot of sense to restrict your trading activity to the least risky period. Whatever I say, I’m sure they won’t even consider EuroRise, but if you’re not a member of the hater crowd, it might be a very good addition to your EA portfolio. The amazing risk:reward factor combined with the very tight SL make it a very predictable tool in your arsenal, but beware of the broker – if you spot excessive slippage or exceedingly wide spreads while running it, I’d suggest changing your broker if you want to run this. All in all, EuroRise is extremely dependent to your trading conditions, so the results are bound to vary from one broker to another. The author recommends running it on ECN brokers so it’s probably wise to restrict your trading to such accounts.

EuroRise is currently only available as a monthly subscription, with a price of $39 per month. There’s even a 30 day refund policy on that. After subscribing for 4 months, customers become eligible to purchase the lifetime license for an extra $394, leading to a total price of $550. I think this is a very fair deal to the customer, basically forcing everyone to test the EA thoroughly before paying the full price. In addition, each license can be used on up to 5 accounts, as long as all of them belong to the license owner and are originating from the same IP address.

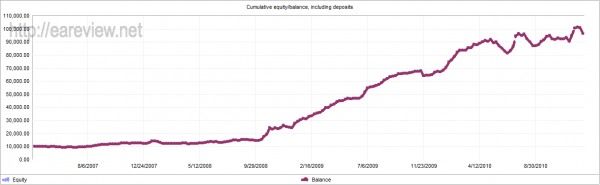

Forward test

Despite the author’s recommendation that the EA should be run on an ECN broker, I believe it can do well on good brokers with fixed spread, which is why I’m running it on such an account opened with FXOpen, with a spread of 3 pips for both EURCHF and EURGBP. The EA is running on the account since 13.01.2011 with default settings, the only exception being the max spread for EURGBP which was increased to accommodate the fixed 3 pip spread.

Details and links

Version used in backtesting: 2.0

Version used on the forward test real account at the time of this writing: 2.0

Currency pairs & timeframes: EURCHF M15, EURGBP M15

eurorise.com

Buy EuroRise

Comments are closed.