This article is obsolete and no longer maintained.

Trading style: Ray Scalper is a strategy that uses an algorithm named “backward ray tracing” for determining its entry and take profit target; the stop loss, take profit and trailing stop are dynamically calculated based on the average true range. Even though its name says “scalper”, the average profitable trade is in excess of 30 pips and the average trade length exceeds 10 hours.

Currency pairs: EURUSD

Timeframe: M15

Price: $350

License: 2 live accounts, 2 demo accounts

NFA compliance: yes (one trade at a time)

Refund policy: no refunds

Read more at the PhiBase Ray Scalper website

Buy Ray Scalper

Birt’s forward test

Settings: default, risk 6

Started: 28.01.2013

Broker: PrivateFx

Account type: live, micro

Starting balance: $300

Current EA version: 1.9

Official accounts

Settings: recommended – 4411

Started: 29.08.2012

Broker: FxOpen

Account type: live, ECN

Deposits: $2920

Note: the account was running with a higher risk and conservative settings (1411) until 08.01.2013.

Settings: recommended – 4411

Started: 17.01.2013

Broker: AGEA

Account type: live

Deposits: $3000

Backtests

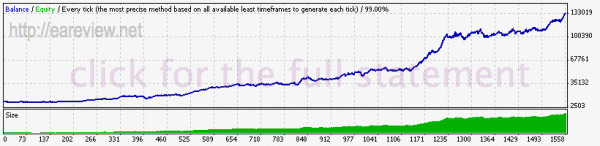

This backtest was performed using v1.9 with Dukascopy tick data and real spread, using the recommended settings (so called “4411”).

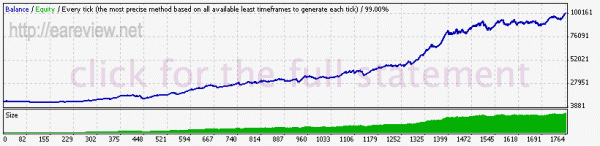

I also ran another backtest with the same tick data set using the conservative settings (1411).

Comments are closed.