This article is obsolete and no longer maintained.

Hey, that’s a rather cool name for an EA… This is an advisor used in a very closed community called by its owner a “room” (which used to be of 25 people but which number I suspect may have decreased as of the date of this writing), so this review is dedicated to a very limited audience. I hope they already know at least part of the stuff I’m going to mention here. The EA strategy is created by FXiGoR (possibly prefixed FX to avoid any possible confusion with Terry Pratchett’s Igor, miscellaneous other Igors or even the character in Igor the movie; I suspect the upper case letters serve the same purpose or perhaps they’re there just for extra coolness), a somewhat renowned individual on the Forex TSD forums. Despite past affirmations that EA trading isn’t working, it appears that he had a sudden change of heart and went ahead with the creation of this piece of work. It is unclear if he’s also the programmer or just the brains behind the brawn, but I suspect the latter.

Edit 22.10.2009: it appears that my prediction was wrong and that at the time of this edit there are no less than 36 members of the room. I guess some opportunities couldn’t be passed and the number of maximum members had to be increased.

The EA is a scalper that trades during the Asian session, meant to be run on EURUSD, GBPUSD, USDCHF, USDCAD and USDJPY on the M5 timeframe. The first thing that strikes me is that it comes with a DLL enveloped in a virtual protection fortress, namely Oreans’ Themida, which is one of the strongest protection techniques available, although obviously not untouchable. Saying that this is extremely fancy for an EA would be an understatement. The EA usage is controlled with account-locked keys that are updated every week or month. Surely shows a lot of care about who runs the EA and for how long. Backtesting is disabled in both the ex4 part of the expert and the DLL and it actually almost gave me a headache activating it. FXiGoR can however rest assured that I will not publish the details of performing the above feat or its results.

Strategy

As previously mentioned, the EA opens trades in the Asian session. Versions earlier than 5 (latest at the time of this writing) would split the Asian session in two: an early part of 2-3 hours used for opening trades and a second part, called an averaging session, that ran for another ~5 hours, used to open additional trades that would balance any potential losing trades opened in the first session. If no open positions would be open at the start of the averaging session, no further trades would be opened. Despite FXiGoR mentioning in the past that the Forex market is unpredictable, a statement I totally agree with, the EA calculates a price range based on the previous 5 minute bars and the previous daily bars and attempts to predict a range for the following price movement, opening short positions at the top of it and long positions at the bottom.

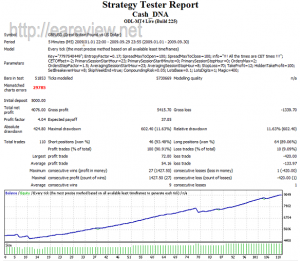

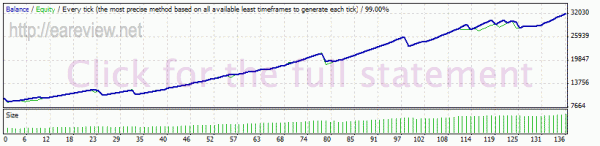

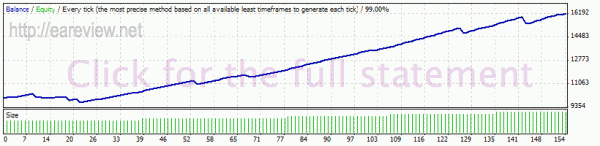

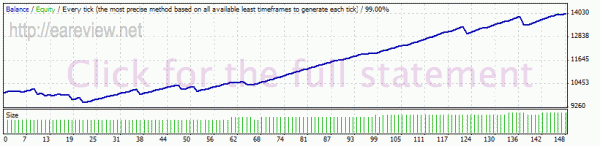

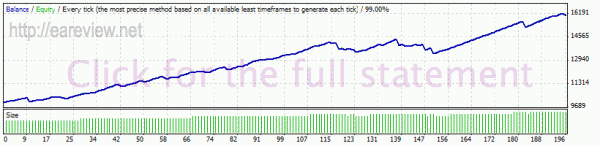

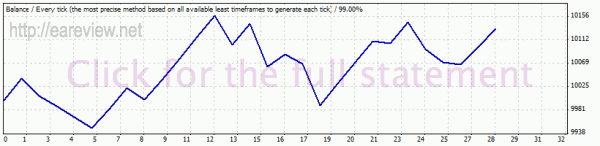

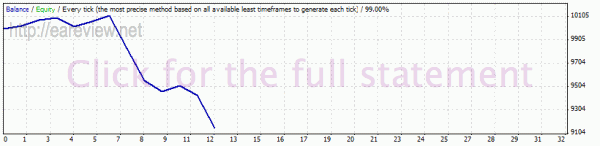

The averaging session behavior was practically removed in v5, the EA being limited to a single trade per currency pair. This was caused by heavy losses taken by v3 at some point, which were justified to the room members by nonexistant bugs in v3. FXiGoR claimed that bugs in v3 caused unnatural behavior and brought two backtests as evidence of the difference between CashDNA v1 and CashDNA v3:

Anyone actually paying a little bit of attention will notice the differences:

- v1 was tested on 2009.01.01-2009.09.29, while v3 was tested on 2008.01.02-2009.09.29

- the session stop hour is 1 for v3; in the default GBPUSD settings it is 0, as well as in the v1 test

- even though the provided default settings for v3 specified MaxOrders 2 and OrdersStepFactor 1.5, just like the v1 parameters were set, for the v3 test these were set to 1 respectively 50, effectively preventing the EA from acting in the averaging session

- although the differences above are not to be ignored, the most blatant one is the StopLoss: while it is correctly set to 70 for v1, it is set to 700 for v3, resulting in the huge drawdowns you’re seeing

- not that it makes much of a difference, but compounding was also disabled for v3

- don’t be quick to judge the difference in the CET offset, note that they’re on two different brokers and as far as I can tell, that’s correct

I am pretty convinced this is an intentional sabotage of the v3 results and a lie to the members of the room, some of whom actually jump anyone daring to make a negative comment on the EA thread.

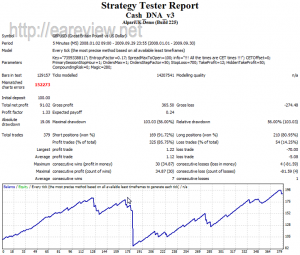

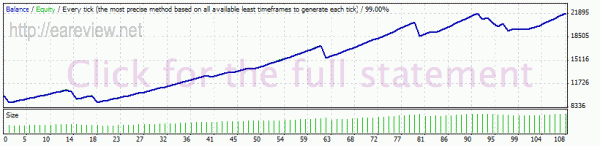

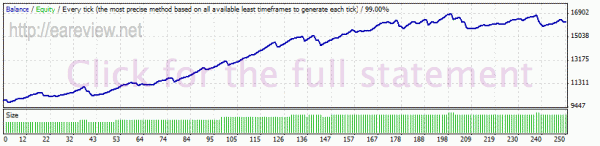

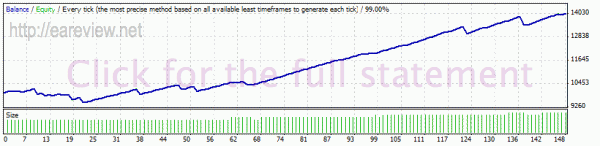

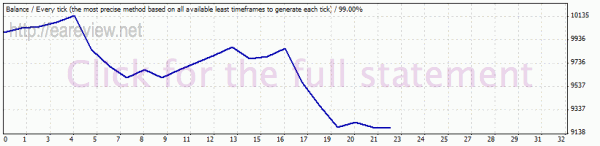

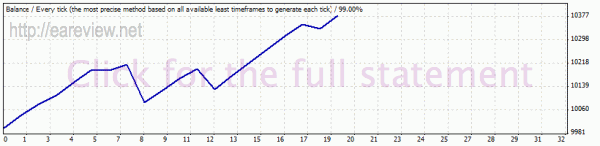

I did a quick backtest to compare the v1 and v3, here are the results:

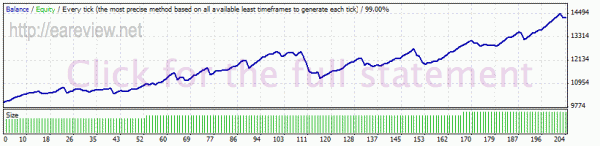

Almost identical. Where’s the bug? Oh wait, there’s none, it’s just sand in the eyes, an excuse for the drawdown to cover the overleveraging aspect and I’ll get more in details about that further on. As a bonus, even though we’re not in the backtesting section yet, here are the tests for v2 and v5 on the exact same data, same period:

It also seems quite fishy to me to suddenly & dramatically change the strategy like that at the first sign of a drawdown, but it’s his EA, not mine. Note that v5, where the average session was removed, is performing worse than the previous versions.

In effect, the drawdowns I mentioned were caused by a totally different thing. The v3 EA configured with the v3 settings can open up to 10 trades in theory, but of course, in practice we have the limits of margin, so probably 5-6 total for a 1:100 leveraged account. The issue at hand is that I’ve seen it having open positions like this:

- long EURUSD

- long EURUSD

- long GBPUSD

- short USDCHF

- short USDJPY

At the hardcoded default 10% account balance being risked per trade, that’s an absolutely insane situation. All of the open positions are shorting USD and no more trades can be opened due to insufficient margin, so even a rather small USD move against them will result in a 50% account drawdown. Granted, it didn’t happen. Yet. But similar situations have happened and resulted in >30% drawdowns.

Edit 22.10.2009: as can be seen from the comments below, FXiGoR mentions that the risk is no longer set at 10% of the account balance, but the current risk percent is not mentioned. If it’s 5%, just like in the results from his backtest, such an unlikely situation as the one mentioned above can result in a maximum drawdown of 25% which is almost acceptable, given the chances of it to happen.

Here’s some free advice for FXiGoR, to avoid such embarrassing situations in the future: add a filter that prevents opening orders if too much risk is placed on a single currency, e.g. if there’s an open long EURUSD and an open short USDJPY, don’t allow opening a new long GBPUSD, but allow opening a short GBPUSD position. This would also give you room to re-enable the averaging session.

It is worth noting that the EA trades very differently from broker to broker so while running it on a broker may result in very good trades, an account at a different broker might be taking losses at the same time, running the same CashDNA version with the same settings. While the members’ statements were posted, they were sporting wild differences. My best guess as to why this happens is that they failed to take into account the fact that the daily bars close at different hours for each broker. Nevertheless, it provides some difference between the trades taken by each member of the room and assuming the performance is constant, it evens out in the end; as a bonus it reduces the risk of any potential liquidity problem if traded with very large accounts.

Website

As mentioned above, the EA is run in a so-called “room”. Since the amount of members is very low, FXiGoR is able to help everyone using shared desktop tools, which is a very nice feature. However, the EA is NOT being sold.

A subscription model is employed, where every member of the room has to pay a monthly fee of 89€ AND a manager’s fee, billed at the end of the month from the account winnings. Due to this reason, running other EAs on the same account is prohibited. The commission fee percent used to be a very large number, but I see the posts have now been edited and it’s no longer mentioned, probably due to the poor performance as of late.

It’s mentioned that

The risk or Maximum draw down you can have is smaller then 1/10 of the total profit you will make over a year trading. In other words the Reward/Risk ratio over 1 year trading is bigger then 10.

This is a very inventive way of avoiding to tell you that you actually risk a ~50% overnight account drawdown, as detailed above, since the fixed & hardcoded risk per trade is set at 10% of the account balance.

Edit 22.10.2009: in the meantime, it looks like FXiGoR appealed to his better judgement and reduced the risk percent to an unspecified value, however the statement above is still very ambiguous and I’m not yet informed of the new risk percent.

Other than this, what’s mentioned there is pretty fair, feel free to read it yourself. Of note is the fact that the room started with open statements of all the members, but they have been removed, again, most likely due to the large drawdowns suffered lately.

If I had to sum everything up in a word, it would be “overconfidence”. Overconfidence in the EA performance & past results leading to the overleverage of the accounts, overconfidence in the protection, overconfidence to such a level it became contagious when coupled with the excellent performance the EA exhibited during its first week.

Regarding the business model, when the EA is making money, the members have to pay the manager’s fee as a procent of the winnings, but naturally if the EA is losing FXiGoR is not going to pay them a percent of that. There is however a “guarantee” – if the EA doesn’t make at least 20% profit on your account during a given month, you no longer have to pay the 89€ monthly fee, but that’s little comfort, seeing that the minimum account balance required to trade it live is 5000$ and the risks are huge. In a nutshell, it’s equivalent to overleveraging the members accounts in order to accomplish risk-free trading for FXiGoR (he gets paid when the EA is bring a profit, but he doesn’t actually risk any drawdown).

Parameters

There’s only a few parameters to be configured and they are all preconfigured very nicely for each currency using template files. This must be the easiest way to run an EA I’ve seen. The user doesn’t have to change anything and if you ask me, this is the way a professional EA should be set up – you install it and it works out of the box, without having to read and understand 30 settings worth of manual, wondering what would be better for each of them. Bonus points for CashDNA for this approach. I sure hope others follow the example.

Backtesting

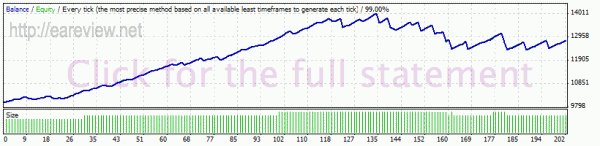

In my backtesting, I used v5 everywhere with the default settings supplied for each pair. The only thing changed was the risk, from 10% per trade down to 3%, because I didn’t want to have hypothetical millions of dollars as results, polluting the graphs, and 3% is a decent risk figure that would be quite sane for a live account. Of course, tick data was used since we’re dealing with a scalping EA.

Note that due to a bug in the EA leading to large amount of repeated modify orders, some of the strategy results files are excessively large. In these cases, I uploaded them in ZIP format and clicking the graph will let you download the archive. It is also mentioned which ones are provided in this format.

I started the first set of backtests at 01.09.2008 because from my previous experience, that’s when scalper EAs start to be profitable. Let’s see how it performs.

EURUSD 01.09.2008-01.10.2009 spread 2.0 pips

So far, my assumptions are confirmed: EURUSD performs rather bad until the end of 2008 when it starts becoming quite profitable.

GBPUSD 01.09.2008-01.10.2009 spread 3.0 pips

On GBPUSD it’s even worse than EURUSD, it’s performing not so good until January 2009.

USDCAD 01.09.2008-01.10.2009 spread 3.0 pips

USDCHF 01.09.2008-01.10.2009 spread 3.0 pips

Both USDCAD and USDCHF seem to be peforming okish even in late 2008.

USDJPY 01.09.2008-01.10.2009 spread 2.0 pips

If you ask me, despite what the numbers say, if I’m looking at the balance curve, I can say that USDJPY performs the worst. It’s only natural, seeing that the Japanese news are typically released *gasp* in the Asian session. It’s probably not the best pair choice for any Asian session scalper, yet the EA manages to scrape some profit.

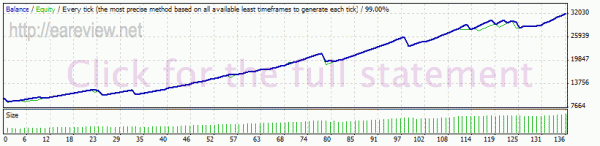

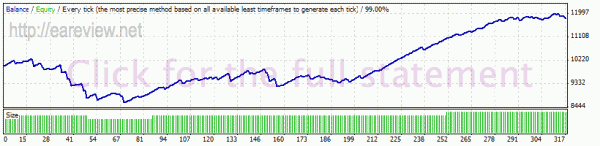

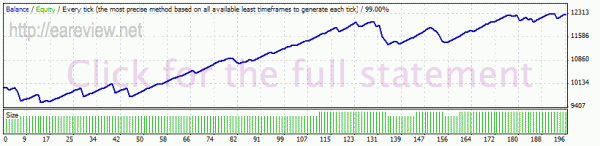

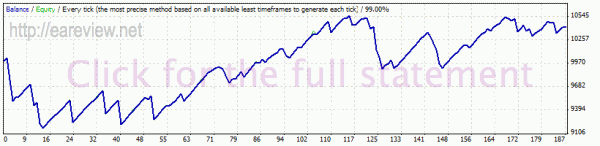

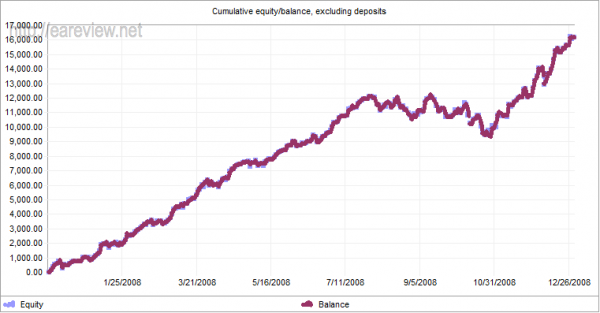

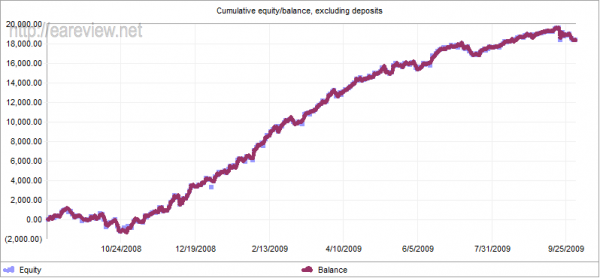

Here’s the result of the above strategy reports, merged:

Let’s see how it performs if we widen the spread by 2 across all pairs. Note that it’s within the MaxSpread trading parameters for each pair.

EURUSD 01.09.2008-01.10.2009 spread 4.0 pips

GBPUSD 01.09.2008-01.10.2009 spread 5.0 pips

USDCAD 01.09.2008-01.10.2009 spread 5.0 pips

USDCHF 01.09.2008-01.10.2009 spread 5.0 pips

USDJPY 01.09.2008-01.10.2009 spread 4.0 pips

Obviously, some pairs are more sensitive to increased spreads than others. It can be safely concluded that the EA is very sensitive to the spread and execution of your broker. A small slippage and spread widening can be quite disastrous. Overall, it performs worse than Euronis does on widened spreads and if you add up the fees, it ends up costing you an arm and a leg. Euronis would only cost you an arm.

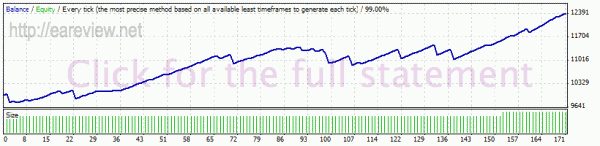

But let’s see what happens when testing it during 2008 with a normal spread. For most pairs I tested from 12.01.2007 until 01.01.2009, except for EURUSD for which the sheer number of ticks during 2008 didn’t permit that, the file being over the 2 GB that MT4 can read – for this pair, the backtest was started at 01.01.2008.

EURUSD 01.01.2008-01.01.2009 spread 2.0 pips

GBPUSD 01.12.2007-01.01.2009 spread 3.0 pips

USDCAD 01.12.2007-01.01.2009 spread 3.0 pips

USDCHF 01.12.2007-01.01.2009 spread 3.0 pips

USDJPY 01.12.2007-01.01.2009 spread 2.0 pips

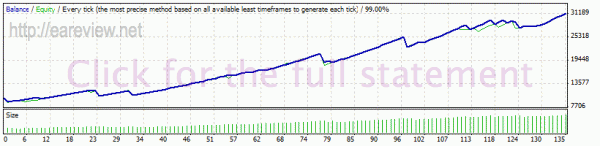

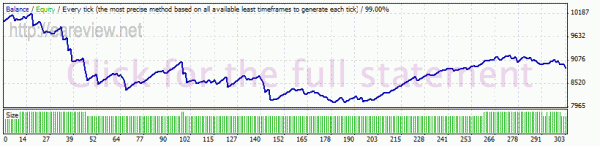

The merged 2007-2008 results:

Edit 22.10.2009: forgot to add the picture above.

Note that the drawdown seen in autumn 2008 is the same drawdown that is featured at the beginning of the 2008-2009 merged graph.

Come to think of it, the drawdown period of autumn 2008 matches the drawdown of the 2009 autumn, when it comes to the time of the year, although it’s probably unrelated or due to background economical causes that I can’t even begin to think of.

The EA seems to have its (very) good periods as well as its bad periods. If overleveraged during the bad periods, it can easily spell disaster for an account. Hopefully for FXiGoR, the current drawdown it’s experiencing (see forward tests below) is only temporary, just like the one in 2008. However, I’m willing to bet that he lost a lot of room members due to it and even had to reduce the commission percent. I figure it’s just a run of bad luck, but it could have easily been avoided by using decent per-trade risk values.

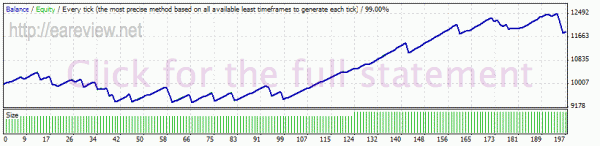

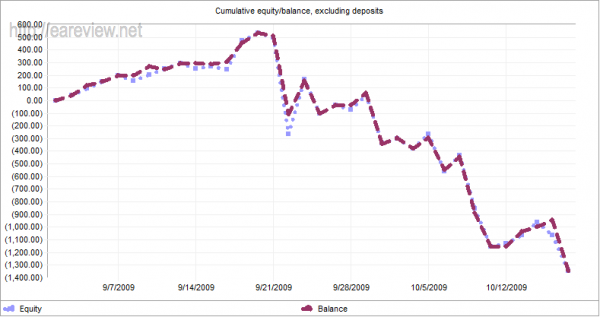

Seeing that I repeatedly mentioned the drawdown it’s currently experienced, let me post the backtest results of approximately the last month and a bit.

EURUSD September – October 2009 spread 2.0 pips

GBPUSD September – October 2009 spread 3.0 pips

USDCAD September – October 2009 spread 3.0 pips

USDCHF September – October 2009 spread 3.0 pips

USDJPY September – October 2009 spread 2.0 pips

It doesn’t take a lot of imagination to figure out what actually happened to accounts using 10% risk per trade. Take a look at the forward tests below if you’re having a hard time picturing it.

Edit 22.10.2009: FXiGoR posted backtesting results from using CashDNA with the Dukascopy client on 2009 on all 5 pairs simultaneously in page 22 of the CashDNA thread. They’re also available at mediafire. Of course, the results obtained that way are much more reliable than MT4 backtesting results, even if the latter are on tick data, due to the fact that the Dukascopy client also accounts for variable spreads. If you download that and check out the graphs, you will notice a similarity to the merged 2009 graph I posted. Those tests are made using ~5% risk and the bad period as of late resulted in only a bit over 15% drawdown there. That’s of course more than acceptable given the gains it made before and the fact that it’s almost out of the drawdown already and goes to show that this EA can potentially be quite awesome when used with a low risk.

Forward testing

I set up two forward tests of it a while ago, using v1 and v3. I didn’t upgrade them to v5 because the previous versions are in theory more profitable and also because I’m lazy.

Edit 19.02.2009: removed all old versions. Not only are they not available anymore, but also the new version is quite different, making them irrelevant.

The CashDNA Neutrino v4 forward test is running on Alpari UK since 30.11.2009 using the default settings (5% risk) on the following pairs and timeframes.

- EURUSD M5, default settings

- GBPUSD M5, default settings

- USDCAD M5, default settings

- USDCHF M5, default settings

- USDJPY M5, default settings

Finally, FXiGoR has a forward test set up on 06.10.2009 and I assume it’s running v5 at the time of this writing. His previous forward tests are no longer linked (probably due to the heavy losses).

My tests should’ve been removed a while ago due to the huge drawdown but I’m letting them run because the leverage used is a lot higher than what I would normally use.

Edit 22.10.2009: I stand corrected. An older ATC forward test is still there, now running v9. As could be expected given the backtests, the EA performs very well there and if the risk used was slightly lower, the maximal drawdown would have been lower as well. I also expect the forward tests I set up to eventually get back to where they started and probably higher, but that remains to be seen.

Conclusion

If I had to draw a line, I’d say FXiGoR is way out of luck. It seems like the market started working against him as soon as he was demoing the EA to the potential customers. If it would’ve worked as it did before that, he’d have been a man set for life if he managed to gather 25 customers with a min 5k balance, assuming the original comission percent; if my backtesting conclusion are correct, the EA is quite profitable in the long run, but has recently suffered an extremely bad period. There’s also the option of it being curve-fit, which I strongly doubt having seen it in action.

Bottom line, if the risk is reduced and you see a free spot in his room, it might be a good idea to take it if the management fee percent is set at a reasonable value, but at 10% risk per trade it’s probably not worth it.

Edit 22.10.2009: it appears that the risk was indeed reduced to an unspecified value when the accounts went live (see FXiGoR’s comment below) and I salute that decision. It also appears that the room is no longer limited at the originally intended 25, so if you’ve got the required minimum 5k capital it’s a good idea to head there and ask what the current risk is and also what’s the account manager commission fee percent.

Be sure to check the comments section below the review for extra information and feedback from the author.

Details

Version tested: mostly v5

Homepage: Forum thread

Pairs & timeframes:

- EURUSD M5

- GBPUSD M5

- USDCAD M5

- USDCHF M5

- USDJPY M5

Comments are closed.