This article is obsolete and no longer maintained.

This is a newer EA, launched in the first half of September 2009. It ships with a bonus EA called FX Nitro Low Frequency and a Forex Trading Ebook, which is a rather useless PDF written for the total Forex newbie. Less than 1 month after version 1.0 was launched, we already have version 2.79. That’s disturbing.

Strategy

As I could’ve guessed, it’s a scalper and it opens positions during the Asian session. It only operates on EURCHF, timeframe M5. It’s using various strategies that can be turned on or off, which are all turned on by default. The manual recommends leaving all of them enabled.

FXNitro Low Frequency is also a scalper, but one that trades a lot less often. This one is supposed to be run on EURGBP M15.

Parameters

It has no kind of detection for 4/5 digit brokers, so you’ll have to manually modify all the pip targets if you’re using a 4 digit broker. Nowadays when there’s such a high variety of 4 and 5 digit brokers, any EA should be ready to deal with any of the situations… I guess we can say the programming is kind of lacking, seeing that there are lots of code examples of how to implement this.

We’re overwhelmed with a ton of settings for which I see no point other than optimization, which shouldn’t be the customer’s job. Some of the parameters are poorly described in the manual, some not at all. It’s able to determine the GMT offset automatically based on the system time – apparently the author has been able to find a code snippet for this and toss it in the EA somewhere between versions 1.0 and 2.79. One thing that has to be noted here is that 1.0 is drastically different from 2.79, not only in parameters but also in code, the latter version being almost 4 times bigger than the other one.

It has a money management section of parameters, which even includes Martingale and here I have to quote from the manual:

D) Martingale If you want to risk all your hard-earned money, I suggest you turn it on 😛 Otherwise, just leave it at 0 for the time being.

It seems that the author is aware that Martingale is eventually going to ruin your account, yet for some reason he still left the option there. What the hell could one be thinking, “Oh, wait, maybe some of the customers might have bought this to lose their accounts, not to increase them”? To add fuel to the fire of my discontent about the issue, he manages to insert a “:P” in there – what a failed attempt at humor… when you can afford to joke about the customers’ accounts, which your program is supposed to manage, something is definitely wrong.

Homepage

The website of the EA seems to have been created from a “make money selling an EA” template. It’s full of marketing bullshit and it features a movie that auto-starts as soon as the page loads. I was scrolling down and suddenly a voice booms out of my speakers “lies, lies, lies, lies!”. I stopped it immediately, but I have to agree with it, at least when it comes to the content of the page. In a nutshell, it’s designed to make the forex illiterate think that he can quit his job next month and make a living by buying this particular EA.

The author also has a blog and reading its about page is quite conclusive when it comes to the attention paid when building the website. The blog entries stop soon after the EA release.

There’s no trace of any backtest, much less forward test or live account statements. The only statement I could find was by reading the blog. When compared with the backtest results (see below), it looks a hell of a lot different, which makes me think it has been heavily “doctored” to look good. I’d normally paste the data in Excel to find out if he made any mistake while editing it, but it’s too obvious to warrant that much attention. Personally, if I would’ve tried to attract customers, I’d have at least edited a live account statement instead of a demo. On top of that, his demo statement spans 9 months, while most brokers close the demo accounts after 3. Smells fishy already.

Backtests

For the backtests, I enabled the IncreaseLots function and used 0.05 as MaxRisk. I’ve left everything else on default, as the manual suggests. All the tests were conducted using the Dukascopy tick data, with the spread set to 3.0 pips.

Version 2.79

Naturally, I started the test with 2.79. I used an EURCHF FXT spanning from 01.03.2008 up to 01.10.2009.

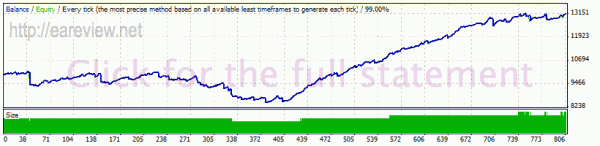

01.03.2008-01.10.2009 backtest

For the whole date range, the test looks almost ok.

However, if you look closely, you can split it into 3 zones:

- before 01.12.2008

- between 01.12.2008 and 01.07.2009

- after 01.07.2009

So, I proceed to perform 3 separate tests, for each area, to see what actually happens in more detail.

Before 01.12.2008

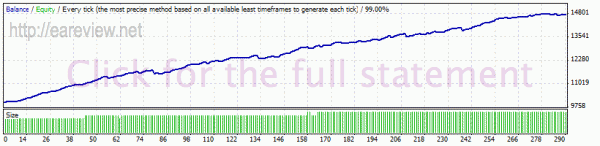

Between 01.12.2008 and 01.07.2009

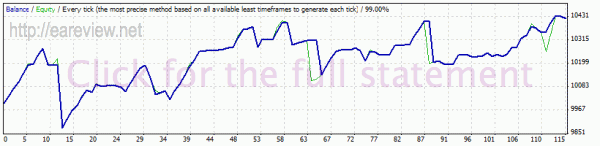

After 01.07.2009

The results speak for themselves.

Based on the above, I could speculate that it was heavily curve-fit between 01.12.2008 and 01.07.2009. Most likely that’s what the author used as period to run the optimization process. I could even go further and extrapolate that the EA was written during July/August 2009 for the author’s personal use and when he noticed that it’s not getting anywhere, he decided to sell it to make a quick buck, but then again, that’s just assumptions. The date on the most recently compiled indicator is 07.22.2009, kind of makes sense.

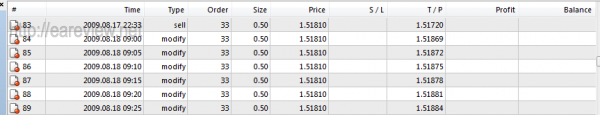

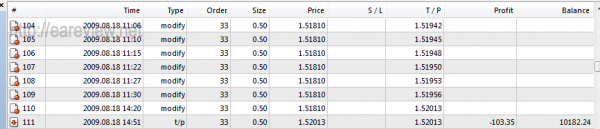

The thing that strikes me is that the author’s trailing stop loss that he’s so proud of is actually a trailing take profit:

…and it continues like that until:

This is one of the weirdest “tricks” I’ve ever seen and I’m thinking it’s a bug… What the hell kind of a strategic move is that? Moving the take profit target below the entry price to take profit in the negative? Why? Just in case the price comes back and the EA risks coming up with a profitable trade? I don’t understand it’s usefulness, but maybe it’s just me.

So, I take a look at a code to verify it’s not a bug and to my surprise it isn’t, it’s the way the author intended it. Since I see that most of the big losses come from this trailing take profit thing, I figure I’ll disable the VirtualSL parameter and test again, starting from July, which is the period where the EA was not really performing any good in the tests above.

And, to my dismay and utter despair, I’m not always right. The VirtualSL which is actually a trailing-take-profit-used-as-a-stop-loss is definitely an improvement, it’s even more shitty without it. It’s definitely an unorthodox method, but it works in this case.

Version 1.0

Before proceeding to test FX Nitro Low Frequency, I figured I should throw a glance on the initial version. This one looks like a whole different EA. It seems a bit similar to FX Nitro LF when looking at the parameters, but it’s nothing at all like v2.79. Some of the functions are the same, but a lot has changed, so let’s see if the results are anything like the newer version.

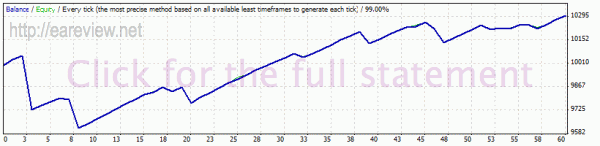

01.03.2008-01.10.2009 test

Surprise, surprise… This one performs much better than the newer version. It’s not impressive, it doesn’t have a sufficient amount of trades and trade frequency to convince, but it’s at least profitable in a seemingly constant way. Add to that the fact that it takes profit at 2 – 2.5 pips and that I used a low spread and you can easily picture that it wouldn’t look so good on a live account due to slippage, widened spreads etc. I suppose the author tried to improve it and failed miserably.

The Low Frequency thing

So, I finally get to the bonus EA… Let’s see what it can do. I test it with the defaults, but turning on IncreaseLot and setting MaxRisk to 0.05. Of course, I’m using Dukascopy tick data; the spread is set at 20 for this pair (it’s for EURGBP, remember?).

Side note: out of curiousity, I tried to test it on EURCHF M15 to see if it was similar to v1.0 and it totally fails, I’m not even gonna bother uploading that backtest.

I guess the author wasn’t kidding, it really is low frequency… Even though it seems to have quite a few winning trades, the total amount of trades is way too low for the winning percentage to be of any consequence, given the fact that the configured spread was low and that it takes profit at 3 pips. Why would anyone want a scalper that trades ~2 times per week for a potential total of ~6 pips? Sure, it’d be great if it had a good winner/loser ratio, but with 80%… it just fails to impress.

Conclusion

If you’re planning to buy it… think twice. If you’ve already bought it, you might want to think of asking for a refund, but from what I gather from the homepage, the author will want proof that it hasn’t been profitable on your live account; if you actually run it live, you risk more than the ~200$ you paid for it. Still, you could give the author a taste of his own medicine and doctor your live statements while using the EA on a demo. Or you could just forget about the money and count it as a forex tuition fee. You’re bound to pay more of these… Then again, I guess pretty much every forex trader did at some point, be it in the form of an EA price or of an account drawdown.

Details

Versions tested: v2.79, v1.0, LF

Homepage: http://www.fxnitro.com/

Pairs & timeframes:

- EURCHF M5 for v2.79 and v1.0

- EURGBP M15 for LF

Comments are closed.