With the growing popularity of Million Dollar Pips, broker performance seems to come up at every other comment and there are a few things that not many people know, things that should be very relevant when trading such an EA.

A quick glance at the ECN innards

First of all, most brokers (probably all) that are labeling themselves ECN/STP are not in fact an ECN themselves. They are just using STP (Straight Through Processing) to forward your trades to a liquidity provider who actually is an ECN.

An ECN (Electronic Communication Network) is somewhat like a fair. It acts as the meeting point for major liquidity sources, banks for instance. If someone has a standing order to go long at 1.40000 on EURUSD at Deutsche Bank that cannot be handled internally, the ECN might find him someone willing to go short at that price at Goldman Sachs and “match” the orders. You can think of an ECN as a hub where many major liquidity sources get connected to find counterparties to the orders they cannot handle internally.

The value of a particular currency is determined by supply and demand, just like any other commodity. When supply exceeds demand, the price goes down; when demand exceeds supply, the price goes up. Think CHF: many people saw it as a safe haven in times of crisis and converted their fortunes in Swiss Francs. As more and more people were buying CHF, its value was increasing. This lead to the currency becoming very valuable and from an EURCHF that was well above 1.6 in 2008, three years later we’ve seen it go as low as 1.0, as the CHF was strengthening and the EUR and USD were losing ground. While the first impulse might be to think that it’s a good thing for Switzerland (“oh, they got such a strong currency!”), this is not really the case. Switzerland has an economy that is strongly based on exports and naturally, when a country exports stuff, it doesn’t get paid in its own currency, so when Switzerland was exporting e.g. potatoes in the European Union, it was getting let’s say 1 EUR per kilogram in 2008 and it’s still getting 1 EUR per kilogram in 2011. The problem is that in 2008, the potato exporter was getting 1.6 CHF for each EUR and in 2011 they’re getting 1 CHF (well, 1.2 after the Swiss National Bank intervention). Not only does this affect the economy, but it also greatly hurts all the exporters directly because, of course, the company who exports potatoes has to decrease its buying price and ultimately the producer ends up with a lower income. Bottom line is that it’s very harmful to their national economy, but I digress.

Getting back to our sheep, I was saying that the value of a currency is determined by the supply and demand. Similarly, the value of a currency pair is determined by the price the people are willing to sell at and the price the people are willing to buy at, which translates to pending orders. The difference between the sell price and the buy price is, of course, the spread. Contrary to what the brokers would like you to believe, the spread will never be 0 because if the price people are willing to sell at gets matched by the price people are willing to buy at, the ECN always executes such orders internally, since that is its whole point. As buy and sell orders are executed, the price moves depending on the volume. If there is an EURUSD ask of 1.40000 with a volume of 1 mil, a bid of 1.39990 with a volume of 1 mil and someone comes with an order to buy 2 mil at 1.40000, the volume at the ask price gets exhausted and the difference of 1 mil becomes the volume at the new bid of 1.40000, effectively moving the price up. To extend the Swiss example above, when the Swiss National Bank intervened on 06.09.2011, they simply bought all foreign currencies until the CHF decreased to the value they desired. Taking the case of EURCHF, it means they matched all the EURCHF short offers up to ~1.2, which probably amounts to an incomprehensibly large amount of money.

So, what an ECN does is mixing and matching all these orders and ensuring that each of them gets filled as good as possible. Since the ECN never takes the other side of a trade, their only income consists of the periodic fees (e.g. monthly rates) and commissions they charge. ECN software is extremely complex and in all likelihood nobody will ever want to develop something like that as a plugin for the Metatrader server. As such, MT4 brokers are merely forwarding trades from the MT4 server via a bridge to their liquidity providers who are the actual electronic communication networks.

To paint a more clear picture, Metaquotes (the vendor of the Metatrader software) is a huge player in retail Forex, but when it comes to the inter-bank market, nobody is using their software and consequently all retail Forex brokers who want their customers to be able to use the popular MT4 platform have to use a third party bridge software to connect to major liquidity providers.

MT4 ECNs

So, what difference does it make if a broker is an ECN or merely forwarding trades to an ECN? Well, if nothing interferes, from the retail Forex point of view it doesn’t really make much difference as the speed is usually good enough for the average trader.

However, one thing that we have to have in mind is that even if they are forwarding trades to an ECN, there’s nothing at all that stops the brokerage from padding the spread or slightly messing with the execution. Like I said, your trades do NOT go directly to the ECN, they get passed through an MT4 server and I’m sure some brokers take advantage of this fact to help tip the balance their way via the tools readily available for this purpose.

In essence, ECN/STP MT4 brokers have an account with a liquidity provider and the trades they make there have a real money impact. If you get slipped 0.1 pips and they don’t get slipped at all, it’s an extra 0.1 pips for them, a cost that essentially comes out of your account balance. I’m sure there are brokers that don’t employ such methods but currently it’s very hard to tell because it’s close to impossible to measure this and because for each customer that says all is good, there is another customer that says everything sucks.

ECN lot sizes

In the past few years, we can see a trend of ECN/STP MT4 brokerages that offer trading with a minimum lot size of 0.01 and a lot increment of 0.01. Since one standard lot is 100000, that means you effectively trade 1000 when trading 0.01 lots.

While this may seem an awesome feature, there’s something wrong with it. To the best of my knowledge, not a single ECN liquidity provider will allow trades sized below 10000. On the contrary, some of them have a higher minimum: for instance, as far as I know, Currenex has a minimum of 40000, which is the equivalent of 0.4 MT4 standard lots. So, what happens with the trades that don’t reach this threshold? It’s simple, two things can happen:

- The MT4 broker keeps them in-house, acting as a market maker.

- The MT4 broker waits until their exposure is above the minimum trade amount of their liquidity provider and then passes it on, eating all the losses or profit incurred prior to forwarding it.

The same applies to trades that are sized in amounts that will leave a remainder when sent to the liquidity provider: from a trade of 1.15 lots, 1.1 (110000) will be STP’ed to the ECN while the rest of 0.05 will be kept in-house for further processing.

I’m telling you this because I know ECN brokers have lowered their balance requirements and many of you sign up and trade lot sizes that fit this bill perfectly since smart money management for balances around 1-3k dictates having low lot sizes. If your broker is keeping trades below 0.1 lots in-house and you’re always trading below that amount, it means they’re always trading against you and any profit you’re making is their loss. Your brokerage won’t be too happy about that and will likely do something about it.

Sure, some brokerages might be piling up the small amounts and forwarding them to the liquidity provider when possible, but it will often happen that they still remain with leftover exposure that they cannot forward. In some cases, these trades will be matched between their clients, but that occurs barely a little more often than flying pigs migrate in flocks.

So, if you really want your trades to be fully STP’ed to the ECN liquidity provider on such brokerages, you have to make your lot size a multiple of 0.1 (and if they have Currenex as their only liquidity provider, you’d have to make your positions at least 0.4 lots). I realize this is not an option for people with a low balance, depending on the EA they trade and/or manual trading style; so, what I am saying is that if you’re always trading lot sizes below 0.1, you might be paying commissions to trade on a so-called ECN broker which is in fact a counterparty to all your trades just like any MM broker.

Commission free ECNs

One more thing that you should be wary of is MT4 brokers that call themselves ECN but have no commission. There is no single ECN liquidity provider that will work without a commission and that can only mean two things:

- They are padding the spreads, which is typically worse for you than paying a commission.

- Their price feed might come from an ECN broker, but they’re acting as market maker.

If your broker claims to be ECN and they have two types of accounts, one with commission and the other without commission, you can be pretty sure that the account type without commission is actually not an ECN account, but most likely a MM account.

STP brokers

Like I said above, STP stands for Straight Through Processing. The definition of this is that the orders are processed with no human intervention and they’re automatically executed by the computer. While this process is subject to regulation depending on the regulatory authority, you have to be very careful: if your broker is STP and not regulated, there’s nothing stopping them from using plugins such as the fabled Virtual Dealer. Moreover, if a broker says they’re STP, that does NOT mean that they’re not also a market maker. There’s nothing that says STP can only occur with a liquidity provider, so they might simply be market makers without a dealer even if they are regulated.

Also, if a broker is registered with some kind of random financial authority, it does not necessary mean they are regulated. There are not many regulatory bodies that are actually keeping an eye on what the brokers do.

PrivateFX

It’s time to offer some more details about the private brokerage that I use to run forward tests.

Since it’s using non-standard lot sizes (10000 instead of 100000) and the minimum traded lot size is 0.01, it all computes to a minimum trade size of 100. There is no liquidity provider that would take such a trade, so the broker operates fully as a market maker with a commission of $0.5 per 10k lot round-trip (which is the equivalent of $5 per standard lot). It’s using the FXOpen feed so the spreads are very good.

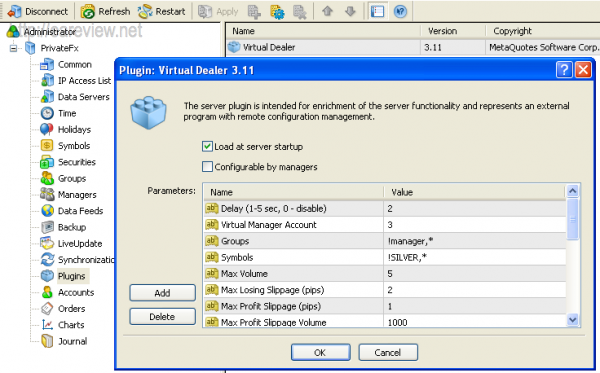

As you might already know, PrivateFX is STP, meaning there is no human intervention, just like I mentioned above. However, since there’s obviously no regulation and it needs to match real live conditions, it is using the Virtual Dealer plugin (fact that should also answer questions about tweaking the execution) with a reasonable configuration:

Naturally, I can’t post the Virtual Dealer plugin guide here, but a google search (try “virtual dealer filetype:pdf”) is bound to pop it up within the first page of results, at least it does at the time of this writing. The guide contains some nice examples that will provide some very good insight into how the plugin works.

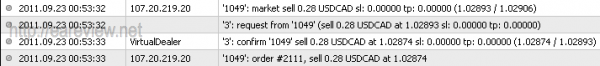

To illustrate an example, here’s how the Virtual Dealer plugin operates, as it shows up in the server logs:

Note how the MT4 client tried to open short at 1.02893, the plugin waited for a second, the price went down in the meantime and the order was opened at 1.02874, with a slippage of 1.9 pips against the client.

The reason MDP was thriving on PrivateFX is that stop orders generally don’t get slippage when the broker is operating as a market maker, in spite of the execution times of over 1 second. From now on, I changed its settings to no longer use stop orders and hard stop trailing, which should result in more frequent slippage and it should hopefully reflect the performance on other brokerages.

Finally, please do not contact me about opening an account with PrivateFX as I will not be able to accommodate your request. The arrangement I made to be able to run it does not allow me to accept accounts for anyone else nor does it allow me to open accounts with someone else’s money.

Conclusion

Not everyone’s experience with a broker is the same. While some people always trading 1.0 lots may have an awesome experience, someone else trading 0.01 lots may have a hard time with identical trades. The reverse also applies and I’ve heard multiple cases where MM brokers were actively targeting people with high balances and traded volume.

Since this writeup originated in Million Dollar Pips, it’s only fair to end it on the same note. This EA has become very popular lately, more popular than it would be healthy, which lead to many people trading it on every suitable broker. So, what happens? Naturally, the demand is much higher than the available volume so this leads to slippage. In many cases the slippage amounts to as high as several pips, which should tell everyone that the traded MDP volume is extremely large. At this point, it might be that you’re better off trading MDP on an honest MM broker than on an ECN. If you’re not having good results, it might be even better to start looking into an EA that is not so sensitive to spread & execution.

Since it’s always first come, first served, some people will get no slippage but many others will, so if you’re getting slipped with MDP on your ECN broker, it does not necessarily indicate foul play… Your broker might be completely honest and yet “give” you slippage on a popular EA simply because the liquidity gets used up too fast. Do not be too quick to judge based on limited experience or hearsay.

There are some rumors that the high frequency traders are taking the other side of MDP trades and in my opinion they are totally unfounded. Think about it: if the HFT people were taking the other side of your trades, there would be liquidity and there would be no reason to get slippage. High frequency trading cannot make your trades have slippage unless they trade large volumes in the same direction you’re trading, in which case they will almost always have a better speed than you and “eat up” the available liquidity.

Sure, it’s possible that someone with an awesome speed and liquidity access implemented the MDP strategy on a different platform and is hogging all the liquidity at the EA entry points, but I doubt it. I think there are simply a bit too many people trading it. Just take a look at any forum featuring an MDP thread and think that for every MDP customer that posts a comment, there are many others that don’t.

So, do I believe Million Dollar Pips has potential? Yes, I do, but I’m also 100% certain that it’s definitely not going to show positive results for everyone.