This article is obsolete and no longer maintained.

Originally intended as a manual trading system that only requires little daily attention, Forex Morning Trade also includes an expert advisor that allows you trade it automatically, as it would otherwise require Europeans to wake up at 6AM just for trading and US people to spend their evenings in front of a chart. Naturally, it still includes the manual system rules, but you’ll probably want to use the automatic version nonetheless.

The system is based on the volatility increase that happens at the start of the European trading session and uses a selection of indicators to select trades with a high profit potential. I’ve had my eye on this one for a rather long time, but I never wrote a review simply because I can’t explain its poor performance in backtests prior to 2007 and here’s what I mean:

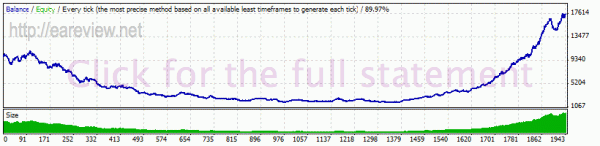

The above backtest was performed using a GO Markets MT4 terminal, using the default settings except the hour which was adjusted to 8 to compensate for the GMT offset.

It is clearly visible that before 2007 this strategy wouldn’t have been much use. At first, I believed Forex Morning Trade to be a clear case of curve fitting, but the fact remains: it has produced profits in a forward test continuously since its live testing was started, which pretty much means that it’s just a valid strategy and there’s no trace of curve fitting. Anyway, I still can’t explain the behavior pre-2007 so a rather long time ago I decided not to write a full review about it, but now that I have the Watchlist page, this is an EA that fits perfectly.

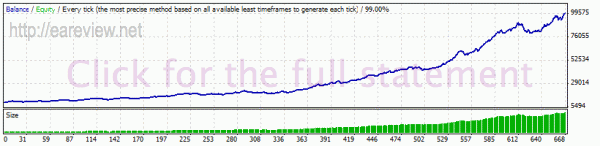

If you want to compare the results, below you can find a backtest using tick data with a GMT offset of 0 (and the hour setting adjusted to 6) with DST shifting according to the European rules. Please note that the maximum lot size has been adjusted for both backtests to allow having a meaningful drawdown figure.

The performance in recent years is obviously good. The only problems it seems to have are at Christmas, which is a period that you shouldn’t be trading any EAs anyway. I recommend disabling all EAs between 20.12 and something like 05-06.01, but if you don’t want to disable all of them, at least do so for Forex Morning Trade.

The product webpage is not very appealing (at least to me), but nonetheless you should check out the results page, which displays the forward test outcome in a rather non-standard manner. There’s also a detailed, nicely put together trading journal updated once per month and recently a new EA has been made available to existing customers, Turbo Morning Trade.

My forward test was started on 27.03.2011 and it’s running on a LiteForex account, with a 2% risk setting. Time will tell if it can keep up with its past performance record.

If it appeals to you and you’re among the remaining 10 people who haven’t bought it already, feel free to use my affiliate link to buy Forex Morning Trade. It goes for $97 and there’s a 60 day refund policy.

Edit 12.05.2012: The forward test was discontinued due to poor performance and drawdown in excess of 50%. My writeup must’ve been a veritable jinx for this EA – it started performing poorly right after I posted it.

Comments are closed.