This article is obsolete and no longer maintained.

Sometimes I picture the Forex investor as a sailing ship drifting through an everlasting night on perpetual stormy waters. Each wave that strikes it is a scam EA, there are waves everywhere as far as the eye can see and the storm is unrelenting. Once in a while there’s a lifesaver lighthouse, an EA that has good potential for profits, but these are few and far apart and the ship must dodge all the scams it encounters in the meantime, in spite of the strong marketing & hype wind, a true hurricane that threatens to rip its sails apart.

I believe Forex WindFall to be such a lighthouse, which is naturally the reason for this writing, but that’s not where I was getting with the figure of speech. Some people contacted me worried that I’m no longer writing, but that’s surely not the case. It’s just that I’m trying to write articles exclusively about EAs that display a profit potential, but they are literally lost in a sea full of scams; unfortunately, it’s not every day that I find an EA that meets my review criteria and even when I write an article about such an EA, I’m not always right. But, then again, that’s what the forward tests are for.

Leaving the rant aside, Forex WindFall is a scalper. Not the usual Asian scalper, though: it’s the second EA that manages to bring profits by scalping around the clock. I doubt it’s mandatory for 24 hour scalpers to begin with a W (WindFall / Wallstreet) but so far it seems trendy. Speaking of names, WindFall sounds like a fantasy novel town, despite the fact that there’s a real town named Windfall in Indiana. For some reason it reminds me of Icewind Dale and Winterfell, very likely because of the recent popularity increase of Martin’s series caused by the new Game of Thrones HBO show which by the way is quite good, although not as good as the books. Anyway, I doubt that’s the origin of the name and in all likelihood neither is the Windfall comic character but that’s quite irrelevant to our purpose.

Strategy

Forex WindFall runs on the M30 timeframe on two currency pairs with very high liquidity: EURUSD and GBPUSD. Its trades are always opened on the start of an M30 bar and they are always assigned a stop loss and a take profit target. For GBPUSD it’s 102.5 pips SL and 11.5 pips TP, while for EURUSD it’s 62 pips SL and 13 pips TP, values that are actual at the time of this writing; the EA fetches these from the server so they might change in the future. This leads to the theoretical risk/reward ratios of 8.91:1 for GBPUSD and 4.76:1 for EURUSD, but even though these may seem high, most of the trades are closed before they hit either SL or TP. Considering the average win/loss in pips, the risk/reward ratios for the full history center data range was 1:2.68 for GBPUSD and 1:2.47 for EURUSD. Sure, a SL is hit every now and then but the chance is rather low: calculated using the history center data backtests, a bit over 2% of the GBPUSD trades and less than 5% of the EURUSD trades ended up at stop loss. The TP target is hit a lot more frequently, but predominantly the positions are closed in-between, typically with a profit and sometimes with a small loss.

The average number of trades per day exceeds 1, but that is not to say that there won’t be days without a trade or days with more than 2 trades. Since it only opens a single position at once for each currency pair, it is fully compliant with the NFA rules.

Parameters

The EA does not feature a lot of settings. Most of its parameters deal with the lot size, there’s also a parameter for setting the maximum allowed spread and a parameter for setting the trade target deviation (concept explained in the manual together with the other parameters, but which you’d be better off leaving alone). There is a GMT offset that you must configure manually, but from what I understand from the author this is used only for doomsday news such as an EU crisis, in which case trade is disabled from the server. The “regular” news that might have an impact on trading are merely displayed on the chart (for instance, the NFP payroll alert was displayed some 24 hours in advance, with the precise date and time) and it’s up to everyone to stop trading if they choose to. The author assures me that the EA is doing good even when it runs on such news days (which is also confirmed by the backtests) but since many people like to stop their trading on such days just to be on the safe side, the chart display with upcoming news can be helpful. So, if you’re trading Forex WindFall, it’s important to bear in mind that even though there might be an upcoming news displayed on the chart, the EA will not stop trading by itself and it’s up to you to pause its activity.

Beside the potential upcoming news, there are a few other items of interest displayed on the chart, such as the current money management settings and the license status.

If you run the EA, note that you have to select the manual lot size or configure automatic money management, otherwise the EA will simply not take any trade.

Website

The WindFall homepage is functional and very simple. In fact, I could even describe it as austere. The potential buyer can see some backtests spanning the 2005-2011 time interval and a live forward test started on 26.05.2011, fully verified by myfxbook, which I’m also going to link here for convenience:

In a nutshell, you won’t find any marketing gimmicks such as videos or testimonials. What you will find is an easily browsable list of the EA features, together with a merged backtest display that nicely updates according to the risk you select, plus a few detailed backtests.

For existing customers, there are sections where the EA can be downloaded and the authorized accounts changed, as well as an online manual and a form designed for support queries.

Backtesting

I began by selecting a target average spread and I chose a round figure of 1.5 pips for EURUSD and 2.0 pips for GBPUSD. Even though many Forex brokers have a lower average spread, there are those who have a higher average and these spread settings felt good.

I played with the risk setting a bit and decided to go with 5%. As you will see below, this results in acceptable drawdowns and good monthly returns. I tried 3% first, the drawdown figures were naturally better but the monthly return was a bit too low (below 5%). I even started the forward test with 3% but after the first trade I increased that to 5% as well.

Naturally, all backtests were performed with AutoCashManagement enabled. All the other settings were initialized with their default values, except the GMT offset which was set to the correct value even though it has no impact whatsoever. Almost forgot: I also changed the max lot size parameter to accommodate the growth over the whole backtest period. All the backtests were performed using a GO Markets terminal.

We get an 18.91% relative drawdown, which might seem high, but which gets more than compensated for by the returns. The winning ratio is almost 84% and we have an average profit trade to average loss trade report of 1:2.19, with a nice profit factor of 2.37. The average annual return on investment is around 70% but it varies wildly, from 22% in 2001 to over 113% in 2005. Of the total 1851 trades taken, 16.10% were losses, of which only 92 trades were actual SL hits, representing less than 5% of the total number of trades.

The relative drawdown was lower for GBPUSD, only 11.64%, which is quite normal seeing that we have a higher percent of profitable trades (over 86%) and a much lower percent of SL hits, only 53 of the total 2394 positions (about 2.2%). The higher percent of winning trades and the lower percentage of SL hits is very likely a consequence of the wider stop loss (102.5 pips for GBPUSD versus 62 pips for EURUSD), but despite all these the GBPUSD backtest yielded a lower yearly return on investment, averaging around 60%. The average win/loss ratio was a bit worse than EURUSD, 1:2.64 and the profit factor was 2.34, almost the same as for EURUSD.

I mentioned I chose risk 5 over risk 3 due to the returns and I want to get into details a bit. So, I merged the history center data backtests for 3% and separately for 5% risk. After normalizing the lots to a 10k starting balance, the average monthly return was 481 for risk 3 and 811 for risk 5, so 4.8% respectively 8.1%. Since many people contact me with questions along the lines of “how do I get 100% returns per month” (by the way, the answer to that is “you can’t, at least not without risking too much and eventually blowing the account”), I figured it’ll be more interesting to choose the variant that resulted in slightly higher returns, even though the drawdown is also proportionally higher (10% for risk 3 vs 16.7% for risk 5, with normalized lots of course). If anyone is interested, I made available an archive that contains all the backtests with risk 3.

Since we’re dealing with a scalper, tick data backtests are mandatory. The first tick data backtests I made are meant as a direct comparison to the history center data backtests so I used the same conditions: no commission, spread 1.5 for EURUSD and 2.0 for GBPUSD.

Tick data is always more accurate and in my experience, all EAs perform at least slightly worse in such backtests. Forex WindFall is no exception. Don’t get me wrong, it still has very nice returns – about 55% yearly average – but the drawdown is now a bit larger, 20.31%. The profit factor sits at 1.89 now and the winning ratio remains about the same, over 83%.

GBPUSD is no exception either: the EA also performed slightly worse on tick data despite the fact that the profitable trades were over 87% of the total, more than the percentage for history center data. The drawdown ended up at 14.3%, the average profitable trade:average loss trade report was an even 1:3 and the profit factor was 2.28. Overall, very nice performance on GBPUSD, too.

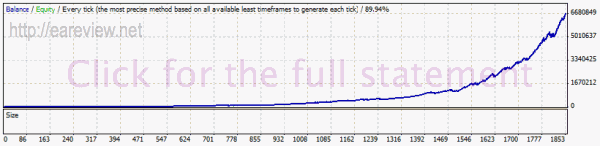

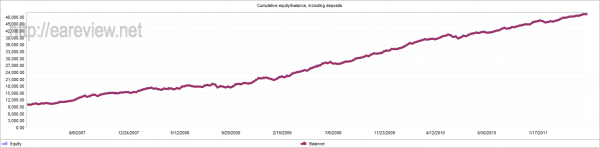

I merged the GBPUSD and EURUSD tick data results and normalized the lots to 0.8 for EURUSD and 0.48 for GBPUSD, the values for risk 5 using a 10k balance. The result was a nice and steady increase:

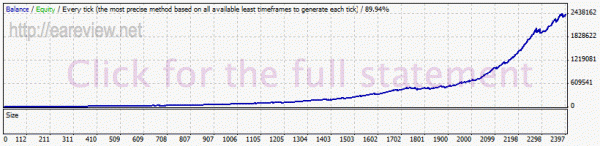

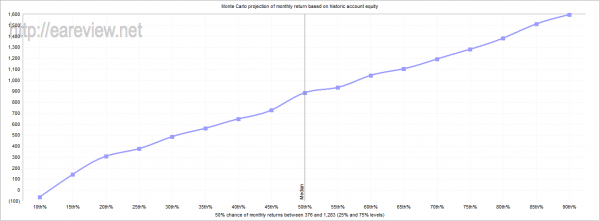

The monthly return was averaging $772 which translates into 7.7% and the peak drawdown was about 18%. I also ran a Monte Carlo Simulation, but don’t rely too much on it – as its name implies, this is merely a simulation:

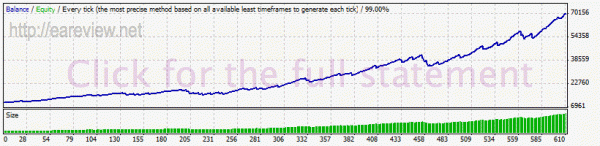

The results are surely impressive, but let’s also take a look at how it would have performed when using tick data with the real Dukascopy spread and a commission of 0.8 pips.

Once again, as expected, we are witnessing a small decrease in the performance. It’s quite normal, given the commission and the fact that the spread was likely higher in the first years of the backtest. The resulting balance curve is almost identical to the fixed spread backtest balance curve, both for EURUSD and GBPUSD, yet in both cases the ending balance is lower, which is mostly due to the commissions. It can be observed that the drawdowns also increased slightly and the profit factors are a bit lower, but in the end, the EA proves it can run just fine even in such a scenario, with a high commission on top of the spread.

Conclusion

Forex WindFall is a solid EA. At the time of this writing, the forward tests are slightly too short to be conclusive, but the EA shows a lot of promise. It doesn’t come exactly cheap, though: it costs $247, but for this price you get to use it on up to 3 live accounts and it’s a lifetime license with free upgrades and without any additional subscription costs. If you’re wondering about refunds, there’s a 30 day full-refund policy.

If you’re going to run it, expect a 4-5% monthly return for risk 3 and a 7-8% return for risk 5. Don’t forget to either set the manual lots to a value other than 0 or to enable automatic money management.

Note 17.02.2013: according to some reports, customer support is unresponsive nowadays.

Forward test

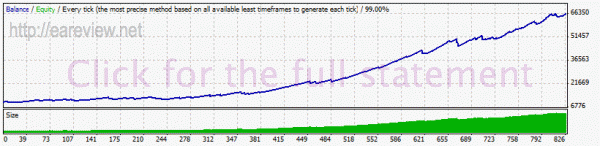

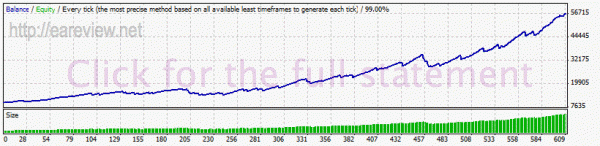

Running on a real money LiteForex floating spread account since 02.06.2011, it was using risk 3 for the first trade but it was adjusted to risk 5 after that:

The forward test was discontinued on 07.06.2014 because the product can no longer be purchased.

Details

Version used: release version (DLL version is 1.0.0.5)

Pairs and timeframes: EURUSD M30, GBPUSD M30

Forex WindFall homepage

Buy Forex WindFall

Comments are closed.