This article is obsolete and no longer maintained.

Although it sounds like a cousin of the by now famous Megadroid, I’m being assured they’re not related in any way, other than the fact that both of them are Asian session scalpers.

You’re perhaps wondering why would I write a review about yet another scalper when there are so many scalpers out already. The answer is quite simple – there are two things that set it apart from the crowd: its track record is thoroughly proven in a long forward test and, unlike all the other scalpers out there which only work when backtested starting from 2008-2009, this one is actually profitable in backtests on the whole data range available from the Metaquotes History Center.

To sum up, Forex Megabot is an Asian session scalper, trading exclusively on USDCAD, equipped with an elaborate protection that locks it to a single demo and a single live account for each customer. It should be noted that using a web interface, the customers can change at any time the live or demo account the EA is locked to, but it can only be run on single account of each type at any one time. The author was kind enough to provide a review copy.

Strategy

The EA opens positions according to some voodoo strategy that I didn’t even attempt to understand and it’s quite successful with it. It has a very narrow trade window, between 22 and 23 GMT, so it won’t trade every single day. It features a time-based exit, which seems to close the positions after a while if they don’t get any closer to their take profit target. By default, its positions have a take profit target of 8 pips and stop loss of 50 pips – a ratio of approximately 1:6, which is quite awesome when compared with other scalpers floating around, with stops at hundreds of pips from the entrance. Take the Forex Combo System for example – its scalper component has a ratio of around 1:14 (21:300), but in the particular case of this EA, there is a good mechanism for closing the trades before they hit SL.

Website

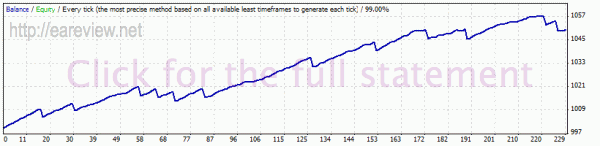

The Forex Megabot homepage contains the typical marketing flood of information, but it also sports some thorough backtests, including a 10 year backtest which is what drawn my attention to it coupled with the forward test. It even has 99% backtesting that’s probably using my Dukascopy tick data method, which seems to have taken a bit of popularity among the EA vendors nowadays, despite the fact that it’s probably against the Dukascopy agreement to post such results as marketing material. Like I mentioned, the most interesting detail on the website is the forward test performed on a real account: it’s started in January 2010 so it’s over 9 months old at the time of this writing and even though there aren’t a lot of money in the account, the balance curve looks amazing and the account is fully verified by myfxbook:

I know it’s totally irrelevant when it comes to the EA, but I can’t help mentioning that I liked the way the download page and account change page are integrated with the design of the site. There is, however, a minor inconvenient that I ran into when switching accounts: you can’t see the live and demo account numbers you have currently configured which had me confused a bit because I switched a few times and at some point I no longer knew which account is active and the EA was graceful enough to stop working in the middle of my backtest when I performed the account change. As anyone would expect, the backtest was almost finished after having run for several hours and I had to restart it 🙂

Parameters

The EA doesn’t feature enough parameters to confuse the newbie user and according to the manual the default settings are good for trading with a “reasonable risk” (that’s an exact quote). In my opinion, the reasonable risk is a bit too high, but then again I’m a big fan of low risk. As it’s expected from any decent EA nowadays, it’s able to calculate the GMT offset on its own and it’s clearly able to work on any type of broker (be it ECN, NDD/STP or market maker) no matter if they’re using 4 or 5 digits. Like I said above, the setting that you should take a look at is the RiskLevel (if you decide to keep money management enabled, that is), which I would recommend setting to 1 – it’s the lowest possible and it seems only integer values are possible. My forward test (more about it below) is also running with the RiskLevel parameter set to 1.

Other notable parameters include a take profit setting, a stop loss and a recovery option (with some additional recovery settings) which reminds of the Megadroid recovery system and which I would not suggest enabling. Even the manual recommends the same; speaking of which, each parameter is covered in the documentation accompanying the EA. I don’t think it’s a good idea to change the SL & TP defaults either – I haven’t tried playing with them, but the website also presents a decent looking backtest with TP 14 and SL 50. There’s also a setting for the max spread which is configured to 3.5 pips by default; the best brokers have around 2.0-2.5 pips during the Asian session, but I believe quite a lot of brokers have 4 pips, which is probably too high for the EA given the initial 3.5 pips setting. I was going to run the forward test on FxOpen but it has 4 pips USDCAD spread, so I ended up running it on LiteForex which features a constant 3 pip spread for the currency pair.

The time-based exit can also be turned on/off and there’s also a stealth mode, enabled by default; as long as this stealth mode is on, Forex Megabot doesn’t send the SL/TP/order comment to the server and handles them locally. While this might be a good idea if you want to hide the EA from the broker (it appears the magic number is also different for each account the EA runs on), in my opinion it’s better to turn it off. There are situations when you’d want a SL, no matter how far it is from the market; if your VPS or the computer you run MT4 from goes down while you have a trade open and there’s no SL/TP on the server, you never know what could happen. Unless you’re using a broker that is known for petty cheating (which is a bad idea to begin with), I recommend disabling stealth mode, just like I did in my forward test.

The EA comes with a simple installer that seems to detect some of the MT4 installations but not all of them. I have more than I can count and (of course) it detected precisely those that I didn’t want to install to, but I was able to manually browse to the folders I wanted to add and select them as installation targets. I guess it’s quite convenient for the newbie user, but I found it unnecessary. I would download the files separately rather than using an installer, but that’s just because I’m paranoid and reluctant to run anything that includes executable code. I run all the EAs that have a DLL in a virtual machine 😀

Backtesting

When it came to backtesting, this EA got me totally puzzled. I forward tested it on demo for over a week before writing the review and when I tried to backtest the same week, I got different trades. Naturally, I asked the author about it and he informs me that the “Market Adapt” system is causing this behavior and that backtesting Forex Megabot is only indicative at best.

Also, the EA had me jumping through a lot of hoops before I could actually do some backtests. The first version that I received was way too slow to be backtested – due to the protection, backtesting was only doable in visual mode; I attempted to backtest a single day and it took almost an hour. The 1.0 version is much faster, though, but backtesting is not as straightforward as you might think: if you want to backtest it, you need to have an USDCAD chart open, with the EA attached to it. Moreover, the EA seems to be contacting the server every now and then, rechecking authentication, so if you switch to a different account in the middle of your backtest (using the webpage provided for that purpose), it’s very likely that the backtest will just stop trading after a while. Basically, it’s not possible to backtest it from multiple accounts simultaneously – one can only backtest it from the account they enabled it for. Thank god I wrote that multiloader.

Furthermore, just like the author mentioned, my backtests don’t even resemble the forward test from the Megabot site, yet the trades from my demo forward test were a perfect match. So, even though I went through with the backtests because my reviews would be somewhat bland without them, I wouldn’t put too much emphasis on the results, one way or another.

So, these being said, all my backtests were done with an FxPro terminal, however, because the EA seems to be capped at 100 lots, I modified the FXT files to allow a minimum lot and lot increment of 0.01; otherwise, when using money management, the balance curve would shoot through the roof in the 1999-2010 backtest with the default settings. I disabled stealth mode, seeing that it’s no use in backtesting and for most of the tests I used a fixed lot size. The spread used for all the tests was 2 pips, unless otherwise specified.

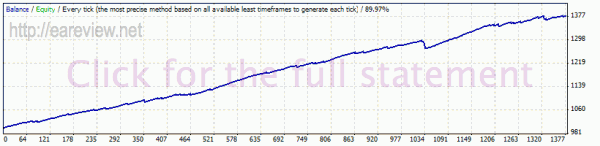

The fixed lot backtest on the whole range of available historic data looks amazing for a scalper. Sure, there was a small hiccup around mid 2007, but other than that I couldn’t expect a better result. Over 95% of the trades are profitable and the profit factor is a staggering 3.25. The drawdown displayed is also very low, but it’s safe to ignore it seeing that it was a fixed lot backtest.

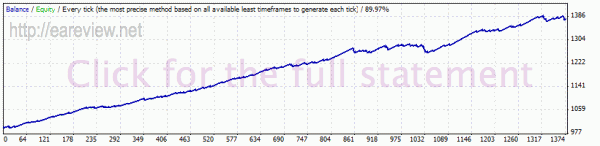

For the next backtest, I disable the TimeExit setting to see what happens if the orders fully run their course.

Looks like the author knew what he was doing when adding this setting. When it’s disabled, the balance curve no longer looks as good and the drawdown is slightly increased. I recommend not disabling TimeExit on your live account.

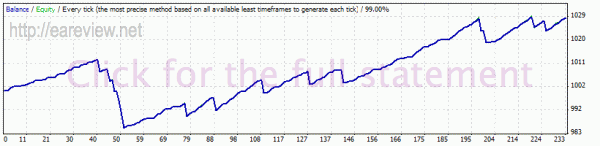

I also made a backtest with RiskLevel set to 1, the lowest risk setting available.

Even though the trades taken in the backtest don’t really match those taken in the forward test, the drawdown displayed here shouldn’t be ignored – it’s still possible to encounter similar drawdowns when trading live, which is why I wouldn’t advise setting the RiskLevel above 1.

Just to confirm my opinion that recovery mode is always a bad idea, I also performed a backtest with it enabled. The other two recovery-related settings, RecoveryRiskLevel and RecoveryTrades, were set to 2 (double the RiskLevel) respectively 4 (which is the default). I have to mention here that I first attempted using recovery mode with fixed lot trades and for some reason it’s disabled, it only works when money management is enabled.

And, as it turns out, I was a bit wrong. Even though the drawdown is slightly worse than it is with recovery disabled, the profit is quite a bit better. I guess that given the two additional parameters to control recovery mode, one could adjust this setting until even the drawdown was better with recovery enabled, but I would never enable it on a live account nevertheless. The increased risk of such a setting is something that I will always frown upon.

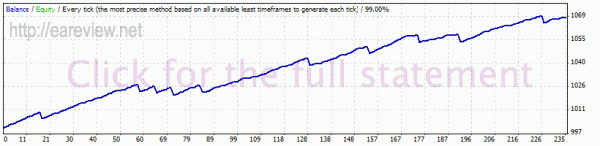

Naturally, I also performed a few tick data tests.

Nothing special here, although the 2007 hiccup I mentioned above is visible much better at the beginning of this test.

This one is better looking, although it’s still nowhere near the live test. It’s quite impossible to find trades from the backtest matching with the live trades, I’ve tried… I’m still at a loss as to how exactly this can happen.

Last backtest I performed was on tick data but with increased spread.

It has a few more losses than the one running on spread 2, but it’s still good. I guess it might be possible to run the EA profitably even with spread 4, yet I wouldn’t do that.

Conclusion

Edit 24.03.2010: apparently, the EA is no longer being commercialized.

Given its $97 price, it’s quite a bargain. Its performance in the forward test is just THAT good. With its trade frequency, I would say it’s best suited to running in combination with other EAs on the same account, forming some kind of EA basket. Forex Megabot also features a 60-day no-questions-asked refund policy via Clickbank so you can’t really go wrong with it.

Forward test

I’ve set up the forward test on a real account opened with LiteForex. I’ve used the default settings with the exception of StealthMode which I disabled and RiskLevel which I set to 1.

Edit 20.10.2010: One month after the article, I can say from personal experience that Megabot is not a frequent trader. Sure, it didn’t take any loss, but during the whole month it only made 5 trades. This was partly my fault as the EA was offline for several days, but it doesn’t change the fact that it trades quite rarely so there’s close to no excitement going on while trading it. Some users report having even less trades than I did, so I guess it also depends on the broker. In conclusion, while it’s a decent EA, it’s not the kind that you should trade exclusively on an account, but rather like I initially recommended, in a portfolio of EAs.

Edit 02.11.2010: Live testing suggests that the risk to reward ratio might not be as good as it might seem from the backtests. It could be just bad luck, but the fact remains: it hit two stop losses in my live test in 2 weeks. My live forward test will not be discontinued, but I advise caution if you decide to trade this live. Given the trade frequency of Megabot, it will take likely take months to come back from the current drawdown. If it doesn’t dig itself deeper, that is. As a side note, the author’s forward test seems to have been discontinued.

Edit 20.01.2011: It seems the product website was moved to a different domain. In the meantime, my live test account recovered very nicely.

Edit 07.02.2011: I have no idea what kind of marketing strategy they’re employing, but after a short seminar on 27.01.2011, the new product page says “you’re too late” while the old one is blank. In essence, it seems it is no longer available for sale.

Edit 18.04.2011: A new seller is commercializing the product. Two months after its re-release it seems to be a serious business and the new owner went as far as restoring access for free to all customers who purchased the product prior to its sales being stopped.

Details & Links

Version used in backtesting: 1.0

Version used on the forward test real account (at the time of this writing): 1.0

Currency pairs & timeframes: USDCAD M15

Forex Megabot homepage

Buy Forex Megabot

Warning: as of November 2011, buying Megabot from the old Clickbank link no longer activates the license. Since it is no longer possible to buy it, Forex Megabot was removed from the EA Top.

In light of the fact that Silver EA is still supported and it seems to be a copy of Megabot that runs on two more pairs, it might be a viable alternative if you’re looking for a good Asian scalper. If you want to buy Silver EA, keep in mind that the whole thing with Megabot and Silver EA is very shady. Also, please note that Silver EA might have an issue related to the GMT offset automatic detection, it went through some problems in my live testing (trading around the clock). Some readers noted that the USDCAD trades of Silver EA are not entirely matching those of Forex Megabot, thus suggesting that the former might have been changed in the meantime.

Comments are closed.