This article is obsolete and no longer maintained.

As the title suggests, this is a system that consists of several subsystems, three to be more precise. The description that would best fit it would be “three separate EAs merged into one”. As you will probably conclude yourself after some further reading, despite the uh… rather uninspired title, the result could be described as “handsome” as far as EAs go. It’s easily one of the most solid automated trading systems that I’ve seen.

The EA only trades the EURUSD pair on the M5 timeframe, but it appears the indicator timeframes are hardcoded. I found this out while backtesting by accident on M15 and noticing I’m getting the same results as I did on M5. That’s a good way to foolproof an EA – even if the customer mistakenly runs it on a chart with the wrong timeframe, it will still perform as it should.

The author was graceful enough to provide a copy for review plus running a forward test and has been very helpful every time I contacted him. If he’s running the EA support the same way, you can expect prompt and helpful replies. On the same topic, there are new versions constantly (I started backtesting 1.42 and no more than a week later the current version is 1.44a), which probably means the author is actively working to fix any issues that show up.

Strategy

Forex Combo System incorporates three totally different strategies:

- A scalper strategy that attempts to capture small market movements. It sets to take profit at 21 pips, but it doesn’t shy from closing the positions early if the market isn’t going its way, sometimes resulting in less than 21 pips profit, sometimes in a small loss. Its stop loss is at 300 pips which might seem huge, but it almost never gets hit – the EA usually closes the positions way before they get there.

- A breakout strategy based on the ATR (average true range) indicator. Simply put, a breakout occurs when the price exceeds some given boundaries; in many cases, such breakouts are continued by moves in the same direction as the breakout. The ATR indicator measures the average range that a currency has during a given period, which, coupled with the current market data, gives a dynamic upper and lower boundary. So, the breakout strategy is dynamically adapting to the market conditions and watching for starting trends, using a trailing stop for its positions and a take profit target of 500 pips, which is occasionally reached, although most trades are closed by the trailing SL. By contrast to the scalper strategy, the initial stop loss of this strategy is very tight: 30 pips, which typically leads to several losses in a row followed by a big win which more than offsets the losses.

- A reversal strategy where a market channel is determined and the price is expected to reverse and start a new trend once it reaches the channel boundaries. This strategy has a stop loss of 70 pips and a take profit target of 160 pips, but all positions that go into profit are sporting a trailing stop. As it would be expected, this generates some losses, but also some wins, being quite well into the positive after all is said and done. Most positions are closed by the trailing stop, but some of them reach their profit target. It’s worth noting that this strategy only operates (aka only opens trades) between 22 and 01 GMT.

The parameters for each strategy can be modified, but I would not recommend doing that as they work perfectly fine as they are.

Website

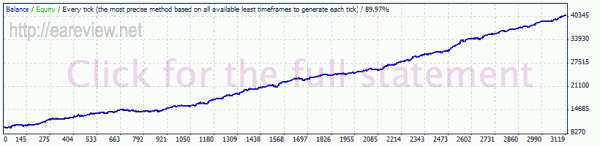

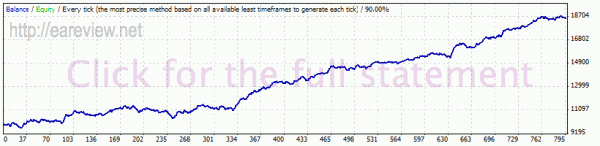

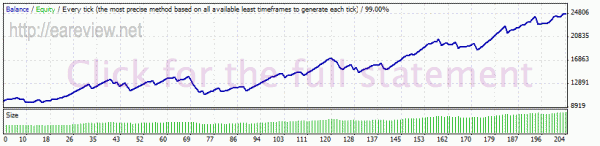

When it comes to marketing bullshit, I would describe the Forex Combo System homepage as lackluster. It only features relevant information and not an overwhelming lot of it at that: a few backtests spanning 6.5 years, a three minute video of a slightly overleveraged visual backtest and a forward test, with the results and trading privileges verified by myfxbook. Below is an up-to-date balance graph from myfxbook, which looks quite awesome at the time of this writing, 3 months after its start:

I was quite pleased with not having to add excessive wear to my mouse wheel with kilometers of scrolling through fake testimonials and similar marketing crap.

Parameters

The EA configuration is quite extensive, to the point that it might confuse the new user. However, the defaults are perfectly fine, the only required change being on the money management parameters.

The manual manages to be brief and to the point. The installation procedure is detailed in a few pages, after which the EA parameters are described, with a range suggestion for each of the numeric parameters. There is no explanation on how changing each of these parameters affects the operation of the EA and if you insist changing any of them despite my recommendation, I suggest backtesting thoroughly.

It’s worth noting that the EA supports fixed lots as well as dynamic money management, using a percent of the account available margin, so you should keep in mind that if you run another EA on the same account with Forex Combo System, the lots traded by the latter will be lower when the other EA has trades open.

I’m a supporter of very conservative risks, so I’m going to suggest limiting the dynamic money management to 2 for each system.

The manual explains the money management quite thoroughly and recommends that you avoid trading it with an account less than $1000 and that you should select your trading volume keeping in mind that it’s possible to encounter 5-6 consecutive losses of 60-70 pips. In my opinion, this perfectly describes the behavior of the EA: you should be prepared to take some losses while waiting for the big wins, even though most of the time the losses from one of the strategies will be compensated by the other strategies winning.

Naturally, it’s possible to trade it with an account of less than $1000 by using cent accounts, such as those provided by LiteForex or FXOpen (micro). I’m running the forward test of this EA on an FXOpen account.

Backtesting

I haven’t even touched the individual strategy parameters while backtesting the EA. Like I said, I don’t recommend changing those and I leave backtesting as homework to you if you intend to do that. Most of the tests use the default fixed lot size unless otherwise mentioned. The 1999-2010 backtests have been done using an FxPro terminal with Metaquotes history center data. The other tests were done using Dukascopy tick data. Unless otherwise noted, the spread used was 1.4 pips.

Edit 24.12.2011: If you’re looking for backtests of a more recent version, check out my Forex Combo System revisited – version 3 article.

The version used for all backtests was 1.42.

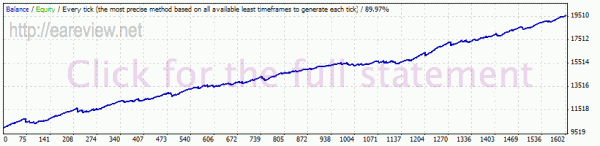

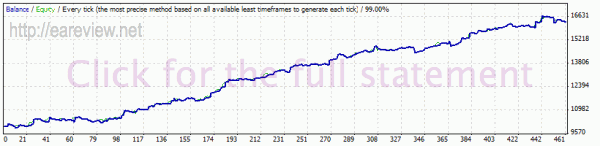

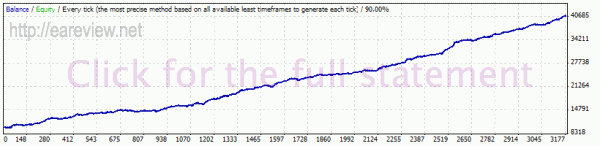

Naturally, the first backtest I made was 1999-2000 with the default settings.

The performance is simply awesome. The EA “only” wins around 2/3 of the trades, but the average win almost equals the average loss. I was quite amazed and thinking the low spread (1.4 pips) I used is the reason it performs so well, I attempted a backtest on the same period using a spread of 3 pips, which is more than any broker should have. If your broker has 3 pips spread on EURUSD, you should seriously consider switching to a different broker as soon as possible.

Although it didn’t perform as good as it did on the previous backtest, having a slightly lower profit factor and a bit more relative drawdown, its balance curve is almost the same. Come to think of it, since two of the strategies it uses are breakout and reversal, both of which employ market movements of quite a lot of pips, the spread doesn’t matter that much, so I shouldn’t have expected this one to perform much worse… but still, it performs very well even on extremely high spreads.

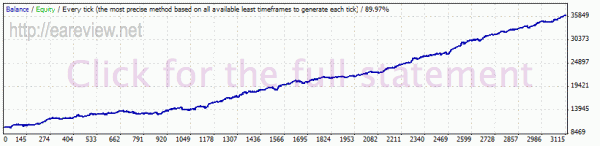

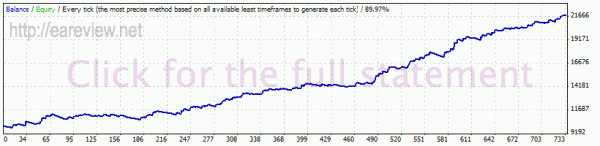

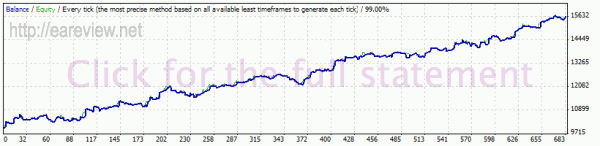

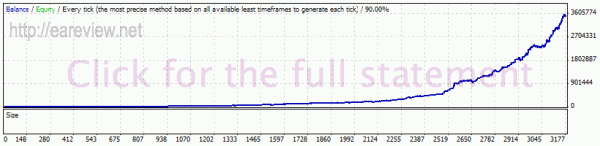

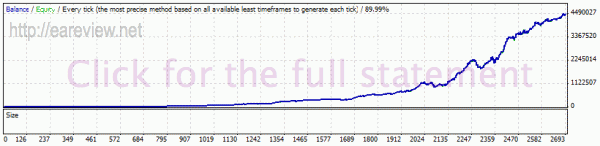

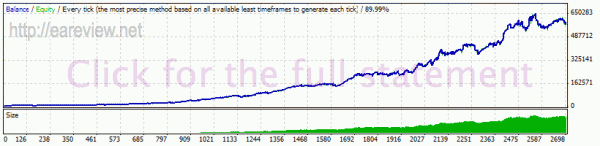

Moving on, I attempt a test with money management enabled. I configured 2 percent for each strategy, just like I configured my forward test account (more on that below).

Although the balance amount reached at the end of the backtest is staggering despite the low risk used, you should ignore the amount displayed. What’s relevant from this backtest is:

- The drawdown

- : the resulted maximal drawdown was a bit above 17%. This means that should you use

- with the money management percent set to 2 as I suggested and as I am using it, you should expect a drawdown of 20% at most. You should be psychologically prepared for such an event and you should know that in the long run it’s going to make money even though it will suffer temporary setbacks.

The profit factor

- : 1.96 is quite high. It indicates that almost twice as much money was made from winning trades than was lost from losing trades.

The balance curve

- : the EA has good periods and less good periods. Occasionally, it might take some time until the EA catches a big move. Sometimes there are whole weeks during which the balance seems to just zig-zag up and down, but in the end, it’s worth waiting through such times. If you buy the EA, it might happen that the market will start a big movement and it will take advantage immediately, but then again it might happen that the market is going through a slower period, in which case you shouldn’t feel discouraged – in all likelihood, it will come through for you, that much is clear from the backtests.

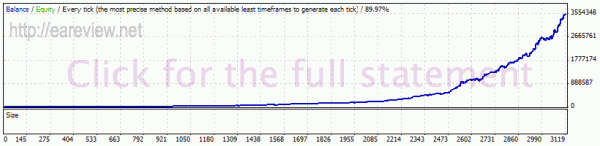

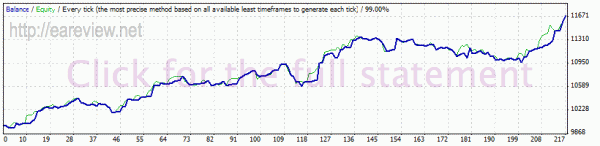

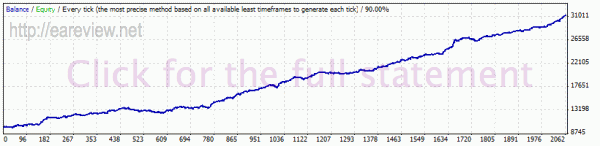

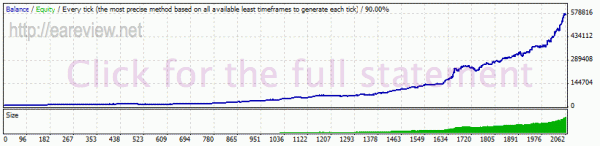

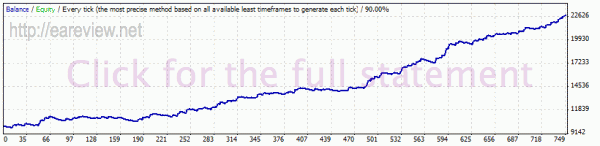

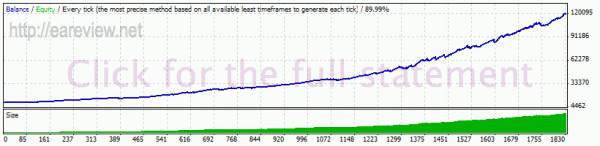

The EA features an aggressive money management system, meaning that once it takes a loss, it increases the lot size for the next trade. This can be turned on and off for each system and it’s turned off by default. In absolutely all cases where I’ve seen such an option, turning it on was a bad idea but let’s see what happens when it’s turned on for Forex Combo System:

Just like I thought, the drawdown increased quite a lot: by over 60%, from 17% to 28%. Sure, the ending figure is quite a few times higher, but do you have the stomach for such potential drawdowns? To state the obvious, if you’re trading this live, I do not recommend enabling the aggressive money management option. It’s likely more trouble than it’s worth.

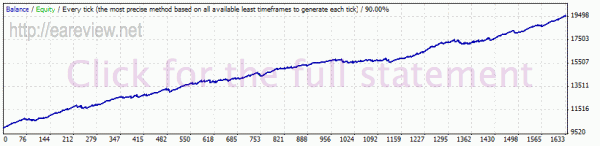

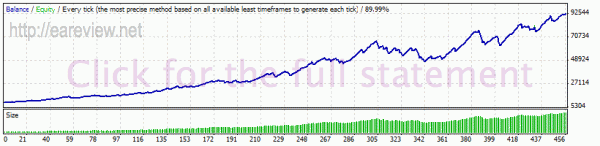

But let us move on and inspect each system individually.

While I was thinking that disabling one of the systems might improve the performance, it’s pretty obvious that each system easily holds its own. There’s no need to disable any of them.

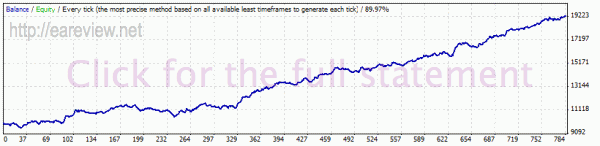

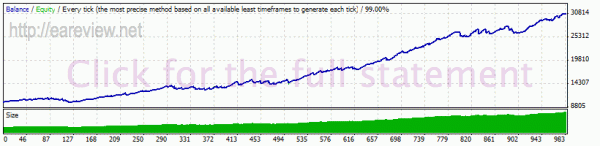

To finalize the backtesting, I also performed some Dukascopy tick data backtesting – those who read my previous articles have become used to it and I would rather not disappoint them if I have a choice.

Since each of the tick data backtests is done for a shorter period (2007 starts with march, 2008 spans the whole year while 2009-2010 is using the data up to 16.09.2010), it’s now a lot easier to see what I meant about the EA having periods where it just zig-zags around and then periods when the balance is steadily going up. Should you buy Forex Combo System, keep in mind that you should expect such a balance graph on your account, not an overnight increase.

I accidentally made the three tick data backtests with money management enabled before noticing and remaking them. If anyone is interested, they are in this archive, which also includes a 2009-2010 EURUSD backtest with a spread of 2 pips instead of 1.4 – I just had to try it, but there’s almost no difference. Once again, if your broker’s spread is higher than 2 pips on EURUSD, you should seriously consider finding a new one.

US problems

Edit 14.11.2010: since version 2.1, the EA has built-in support for the NFA rules. There are two options that have to be enabled: No_Hedge_Trades (prevents the opening of trades in the opposite direction of any existing trades) and NFA_Compatibility (I assume it implements the FIFO rule by only allowing a single trade at a time). Most US brokers implement both the hedging and the FIFO restriction in the terminal, so you would need to enable NFA_Compatibility. However, Andy’s post in the comments below outlines a few notable exceptions:

- IBFX and MB Trading implement the FIFO rule in their backoffice. That means that it doesn’t matter which trade you close first in the MT4 client (if you have more than a trade opened), thus you don’t need to enable the NFA_Compatibility option, but only No_Hedge_Trades.

- ATC, FXDD and FXCM have both the FIFO rule and the no hedging restriction handled in their back office. This means that you can use their MT4 terminal just as you would use it on a non-US broker, without any kind of restriction. Naturally, the leverage is still limited to 1:50, though.

I made a couple of backtests with 2.3 with the NFA compatibility option enabled. While I will outline the major differences between these results and those obtained while backtesting with the same options disabled, please see the section below for the other 2.3 tests if you want to compare them in more detail.

The first backtest I ran was using a fixed lot size and all the default settings (well, except the hedging & NFA compatibility option, even though I’m pretty sure the NFA compatibility option prevents hedging anyway). The EA is quite profitable, but when compared with the same test with the two settings disabled, it came a bit short. Most noticeably, the drawdown increased from less than 6% to 9%; the profit factor decreased very slightly, but the profit at the end of the test was also lower and the average winning trade went down while the average loss went up. In a nutshell, if you can run it without the NFA compatibility option, do that.

The second backtest was the same as the first, but with money management on – risk was set to 2% for each system. The idea was to compare the resulted relative drawdown to further emphasize the difference. The drawdown difference becomes quite noticeable now: from less than 16% in the “normal” backtest to over 23% in this one. Just like in the previous comparison, Forex Combo System 2.3 with the NFA compatibility settings disabled is simply better in every aspect.

I guess what I’m saying is: even though Combo System is still a good EA with the NFA settings enabled, if you have any option to run it with NFA compatibility off go for it.

I won’t delete the rest of this section, just in case someone is already registered at a broker that is not among those mentioned above and wants to run all three systems unhindered.

This section was added on 17.10.2010, since I got quite a lot of feedback from US citizens and I can easily empathize. The situation there is dire; for the occasional reader that is not aware of the situation, it can be summed up as follows: in theory, US citizens can only open accounts with US brokers, which are severely restricted by the FIFO and no hedging rules (which means, to a certain extent, that you can’t have more than one trade per currency pair).

Unfortunately, when all three systems are traded, Forex Combo often hedges its own trades from the separate systems and almost never respects the FIFO rule, that’s just its nature.

However, I thought of a workaround for it which may or may not work for you, but I’m inclined to believe it will. Most brokers will let you have additional accounts without any questions asked, so what you can do is open two more accounts in addition to your main account, split the balance three ways and run each strategy on its own account. This way, there are no more hedging/FIFO problems (check the individual backtests, there’s no more than one trade at a time per system) and you still run all three systems at once. One thing that you have to adjust in this case is the risk: since your balance was divided by three, each strategy has to have a risk coefficient multiplied by the same number. So, if you were going to run it with 2% risk for each system, you have to use 6% if you separate them as described above.

If your broker starts asking questions when you ask for a couple more accounts, just tell them you want to try a different strategy on the second account and that you have a newborn whom you believe to be the reincarnation of Nostradamus and intend to trade according to his bowel movements on the third account. Should that fail, just open an account for your wife and your newborn (use the grandparents as substitutes in case you lack a newborn or wife) and you’re set. On the opposite end of the spectrum, there are some brokers that simply let you open extra accounts automatically from the web account management interface.

Here’s where we run into another problem: the EA is limited to two live accounts. No need to worry, though – I’ve worked out an exclusive eareview.net special deal with the developer: all the customers buying Forex Combo System through the affiliate links in this article get three live accounts instead of two!

Version 2.3 backtests

As you might know already, a few defaults were changed in 2.1:

- The SL of the scalper was changed from 300 to 110. Even though the scalper rarely closed at more than -100 pips, this should help reduce the drawdown.

- The breakout TP was reduced from 500 to 300. In most cases it’s closed by a trailing stop anyway, but when the TP is hit this change will probably save some pips that would have been otherwise lost while the market would retrace back to the trailing stop.

- A new parameter was added to the reversal and breakout strategies, ATRTrailingFactor. It’s not documented, so I may be wrong, but it appears to control the trailing stop of each strategy as a multiplier of the H1 ATR.

- Last but not least, the NFA options mentioned above were added.

Of course, this calls for some new backtests and some readers already asked for them, so here they are.

To make it easier to compare, I backtested using pretty much the same settings as I used in the original backtests.

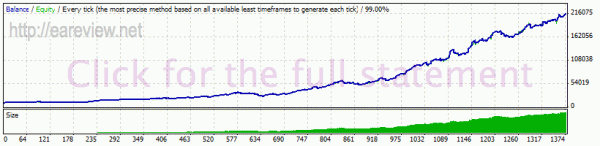

Compared to 1.42, Forex Combo 2.3 has a lower relative drawdown and a profit factor that is 0.01 higher. Although there’s no huge difference, it’s obvious that 2.3 performs better. Let’s see more about that drawdown.

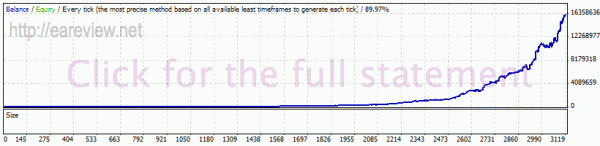

When money management is enabled, the drawdown and profit factor difference becomes a lot more visible. 2.3 has a drawdown that is lower by almost 2% (from 17.7% in 1.42 to 15.78% now). The end profit is only a wee bit higher and other than the drawdown the backtests are extremely similar. I guess it can be safely said that besides the NFA compliance additions, the only change in 2.1 was an attempt to lower the potential drawdowns. Can’t say how this is going to behave in the future, but even if we only look at the new SL for the scalper it seems to have better prospects.

While the backtest was running, I noticed there was a drawdown that lasted from march 2002 until march 2003. Sure, there were no big losses in the meantime, but my point is that there can be (and likely will be) extended periods of drawdown and if you’re running the EA you should be prepared for it. It might suddenly boom like it did on my account in the first month, but it also might just hover around for a while as it seems to be doing at the time of this writing.

Anyway, I also remade the tests for each individual system.

As it should be expected given the SL change (300 to 110), the scalper system has a greatly reduced drawdown (from 4.3% in 1.42 to 2.72% in 2.3, meaning it went down by almost 40%). A side effect is the profit factor, which went a bit down in 2.3, from 1.82 in 1.42 to 1.78 now. Still, that’s merely a minor inconvenience when we look at the improvements in the drawdown area.

Nothing much to be said about the breakout strategy. The TP change doesn’t have a major impact. In 1.42, the profit factor was 1.80 and the relative drawdown 6.99%; in 2.3, we have a slightly increased profit factor – 1.86, but also a slightly increased relative drawdown – 7.11%. Don’t really know what to make of it… it’s definitely not a bad change, but it’s not something that I would write home about.

What’s strange is that the reversal system has a slightly lower profit factor and a slightly higher drawdown. Pretty weird, but it’s likely caused by the fact that the new backtests also include october 2010. Just like Stephen J posted today in the comments, the reversal system is kind of the weaker link in the system, having a lower profit factor than the other two systems while having a larger drawdown. I guess some people might want to disable it, but I’m not making any recommendations and I’ll keep it enabled in my live test.

GBPUSD

Starting from 07.03.2011, Forex Combo System also runs on a new pair. Before you ask, the answer is no, it was not released as a gift for the International Women’s Day.

Anyway, not only did it stir my curiosity about its performance, but several readers also asked for an update to the article so I proceeded to backtest it a bit and look into what it’s capable of.

First of all, after a few mails exchanged with the author, I got the recommendation to backtest it on Alpari with a GMT offset of +2, even though Alpari is at +1 when DST is not in effect. As such, I proceeded to backtest using an Alpari MT4 terminal with history center data and a spread of 2 pips, disabling the automatic GMT setting of the EA and using a manual offset of 2.

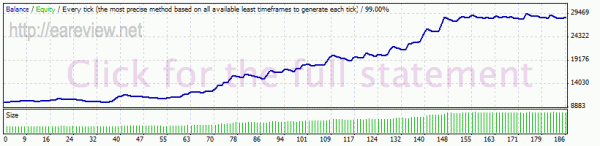

The overall performance is good, but the maximal percentage drawdown sits at over 23% in spite of the low risk used in the backtest. Just to compare, the EURUSD 1999-2010 EURUSD backtest using tick data and the same risk of 2 resulted in a drawdown of 17%.

Let’s take a look at the performance of the individual components.

It’s pretty obvious that the scalper is the best performer of the three. The drawdown in the backtest with all systems enabled seems to come mostly from the breakout and reversal components, but the synergy compensates it nicely – when used alone, the reversal system has a maximal drawdown of 30%, while when working together with the other two systems it was only 23%.

Before proceeding to tick data, I also performed a backtest on history center data with all strategies enabled but with a GMT offset of 1 instead of 2.

Even though the drawdown is lower (18%), the balance curve is a lot more undecided – if I may say so – and the resulting profit is several orders of magnitude smaller than the one obtained from the GMT+2 backtest.

Naturally, I also ran some tick data backtests. To reproduce the Alpari conditions as best I could, I configured a GMT offset of 1 and I used the European daylight saving rules when generating the FXT files, while the EA was backtested with a GMT offset setting of 2. The spread used was fixed at 2 pips, identical to that used in the history center data backtests.

The performance is very much in line with the results obtained by backtesting on history center data. It’s noticeable that the drawdown is higher and that the synergy effect worked the opposite way in this backtest. I was curious as to how come this happened because the data should be mostly the same; as it turns out, the small differences in the data resulted in wildly different trades. Even though I’ve been able to match some of the positions opened in the two backtests with all the systems enabled (history center vs. tick data), most of the trades were quite different. I guess this also accounts for the differences we’ve been seeing with the EURUSD version from a broker to another.

As in the history center data backtests, the scalper is the best performer, but the breakout and reversal systems are also able to nicely hold their own.

If I put the GBPUSD EA on a chart right now with auto GMT enabled, it displays GMT+1 because DST is not in effect yet (I’m writing this on 12.03.2011) and naturally this made me have my doubts about the +2 GMT setting in the backtest. So, after all this testing I was still puzzled regarding the whole GMT+1 vs GMT+2 thing and I proceeded to backtest the EA on tick data starting from 07.11.2010 until 01.03.2011. I chose this particular time interval because it’s outside the DST time of the year and if you had the GBPUSD EA back in November and added it to an Alpari chart with automatic GMT offset detection enabled, it would’ve been running with an offset of 1 which would’ve been kept this way until sometime in March.

The only difference between the two backtests above is the GMT offset used and it becomes apparent that despite the fact that the EA would’ve been running with GMT+1, it would’ve performed much better if running with GMT+2. In light of this, I will manually configure the GMT offset for my GBPUSD forward test to whatever the EA says on the chart plus 1 (well, 3 in the case of LiteForex) until the March 27th (which is when the DST shift kicks in) at which point I will switch it back to auto.

Bottom line, the GBPUSD performance is not bad at all, but I like the EURUSD Forex Combo System better. Add to that the fact that the GMT offset thing keeps itching at my mind and you will see why I came to the conclusion that it would be a good idea to open a second, separate forward test account for the GBPUSD version. This will allow everyone to track the performance of each pair individually and set their risk according to the profitability of each forward test. As a side note, if I would’ve decided to run GBPUSD on the same account as EURUSD, I would’ve definitely ran it with risk 1 instead of 2.

Conclusion

If you can hang in there for the zig-zag periods, this EA is a must-have. Even though its price tag does not exactly reside on the cheap side (it’s $299), this is an automated trading system that is totally worth it. The EA is licensed to two live accounts and an unlimited number of demo accounts, however, it’s possible to change the accounts the EA is locked to and the procedure is performed at no additional cost.

Edit 17.10.2010: As mentioned above, through a special deal exclusive to the customers purchasing through the links in this article you can get a third live account license. You can use this Forex Combo System buy link to ensure you are eligible for the offer.

Forward test

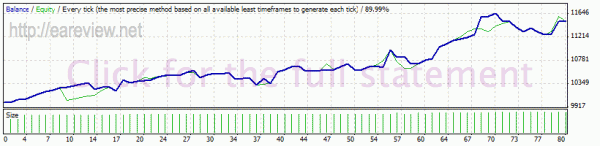

My forward test is running on a real account opened with FXOpen. It’s using default settings, with money management set to 2 for each system. I’m using the myfxbook widget for convenience:

Edit 29.09.2010: despite the very low risk configured (it was trading with the minimum possible lot, 0.1), in less than 2 weeks the account gained over 10% with a drawdown of a bit over 1%. Was it just a lucky period? Most likely. Still, it’s a really impressive feat that the EA performed on a live account, with slippage and everything that comes with the territory. It certainly does not fail to meet the expectations that I came to have after the backtests.

At first I set it up on a Linux system with wine, but I ran into some issues with the GMT offset autodetection so I ended up moving it to a Windows system. Speaking of which, I can recommend ForexVPS – their $35 package includes 768 MB RAM (probably enough to run like 10 MT4 clients or more), they offer free MT4 & EA installation support and they have both US & UK servers.

As of 12.03.2011, I have configured a separate live forward test account for the GBPUSD EA. It’s running on an account opened with LiteForex using the default settings with the exception of the risk which I set to 2 for each system, the automatic GMT detection which is disabled and the manual GMT offset which was configured to 3 for this broker.

Due to its consistent performance and upon the request of many readers, I added a forward test running on both currencies on 22.08.2011. It’s using money management 2 for all systems for both pairs and a manual GMT setting of 3 for GBPUSD only (even though PrivateFX is using GMT+2 and DST).

Details & Links

Version used in backtesting: 1.42

Currency pairs & timeframes: EURUSD, GBPUSD M5

Forex Combo System Homepage

Buy Forex Combo System now

Comments are closed.