This article is obsolete and no longer maintained.

Hailing from Mother Russia, a scalper that strikes me as peculiar, to say the least. The minute I run it, I get a ton of gibberish comments on my screen. Turns out it has a language parameter which defaults to Russian and which you must change to English, unless you understand Russian and have a MT4 with the correct charset installed. It operates in the M15 timeframe on EURCHF, EURGBP, EURCAD and… GBPCAD – now that’s a rather scarce cross that many brokers don’t even feature. Alpari, FXDD, Jade don’t have it, but I was able to spot it at FECH, Forex.com and FIBO. I’m still debating whether to backtest this pair or not, seeing that I don’t have tick data for it and there’s no history center data spanning a decent interval of time.

The EA comes equipped with an original protection. It has a keyfile that locks it to a particular account and that actually consists of the EA settings, encrypted using the account number and the name on the account. A display of pretty complex programming, even though it could’ve been made a lot better by a few changes here and there.

Edit 26.10.2009: it also trades GBPCHF, CADCHF. The package includes pre-made settings files for various brokers.

Edit 08.10.2010: It’s been almost a full year since I wrote this article. Interestingly, quite a lot of my readers informed me of their purchase of Euronis after reading my review and that it’s still profitable to this day. So, I decided to slightly edit the article to correct some of the facts that changed in the meantime, explain the current distribution system (it’s basically free now, with a twist, more on that later) and to add my affiliate link. Seeing that my forward test is dead for a long time (demo accounts…) I will also replace it with a live account, but let me get into that in the forward test section.

So, the major news item is that now there is an Euronis home page, but there’s a small problem with it: it’s in Russian. Google translate does a fair job on it, so I not-so-proudly present the English version of the Euronis home page – feel free to switch to your preferred language.

I’ll try to explain the basics of the system to avoid any problems that might originate in a potentially incorrect translation. You get to download Euronis for free (just for your information, the latest version at the time of this writing is 4500 so there were some developments on it in the past year). There are some 40 other EAs available, many of which are also free using the same system, but Euronis is by far the most popular. I’m sure by now you’re wondering what’s the catch and it’s quite simple: you have to sign up with one of the brokers mentioned on the site through the introducing broker links available – that’s how the site and the EA authors make their profit. It’s a very fair deal in my opinion: once you signed up for an account using their introducing broker links, you will receive a free key for Euronis that locks it to that particular account. On top of that, you get 70% of the commission generated from your trades, making it a really awesome deal. There are also quite a few refer-a-friend opportunities, the whole site being designed around that idea. The author assures me that the page will also become available in English at some point in the future, but in the meantime you can use the Google translate link above.

There’s also some more news: while the EA does indeed work on a bunch of pairs (EURGBP, EURCHF, GBPCHF, EURCAD, GBPCAD, CADCHF), the author only recommends running it on maximum 3 pairs when using low risk and maximum 2 pairs with medium risk. Naturally, the best performer pairs have been chosen and the EA comes equipped with setting files for each broker supported for EURGBP, EURCAD and GBPCAD, which can be traded in direct mode or in cross mode. For people like me who are challenged when it comes to understanding Russian (in spite of the regime who forced me to take 4 years of Russian classes in school), the EA also comes equipped with an English manual that is not 100% up to date but describes the most interesting part of the settings.

Edit 26.10.2010: One of my readers informs me that the EA is available for trading on any account for $120.

Strategy

It opens positions during the Asian session, according to some rules that I completely fail to understand… actually to be honest I didn’t even try to understand them, but that’s besides the point. It has some interesting features that come into play during the lifetime of a position, designed to minimize any possible losses, but more about this in the backtesting part.

Edit 26.10.2009: it seems to be using a channel and to trade against breakouts.

Cross-over mode

This subsection was added on 19.09.2009.

As the forward test progresses, this strategy is also cleared up. However, it means that the backtests that you’re going to see below for EURGBP, EURCAD and GBPCAD are not what you’re going to see if you run the EA on your account with the default settings. For the 3 currencies mentioned, the cross-over mode is enabled, meaning that the EA will use the signals in EURGBP to trade EURUSD and GBPUSD in a hedge style and similarly EURCAD for EURUSD/USDCAD respectively GBPCAD for GBPUSD/USDCAD. Before MT5 actually has its strategy tester implemented, such a strategy is extremely hard to test and beyond the point of this blog entry, so it remains to be seen how the EA will behave in the forward test.

Edit 26.10.2009: the crossover mode is designed to avoid paying excessive spreads on cross pairs by trading them through the dollar pairs. You only need to use this mode if the cumulative spread of the dollar pairs is lower than the spread of the cross pair (e.g. the spread of EURGBP vs the spread of EURUSD plus the spread of GBPUSD).

Website

This EA totally fails when it comes to the marketing aspect. It doesn’t seem to even have a homepage that I could find. The only advertising of the EA is done on several forums (forexforums.org, forex2u.com) and it sounds very much like “all your base are belong to us”. It gives the distinct impression that it has been translated using Google. The guy who sells it is admittedly not the author and he seems to have absolutely no clue about it nor any interest to sell it. He is also selling a ton of other Russian overpriced EAs.

The above paragraph was removed on 08.10.2010 as it no longer applies. Also, there are more than 2 investor logins available now and some of the info is slightly outdated (I’m talking about the ending date of the backtests), but if you check out the forward test at the bottom, you will notice that its performance is just what one would expect given the backtests from the original article which are still visible here.

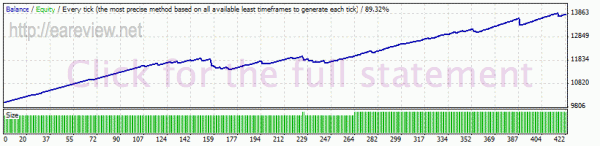

What strikes me as odd is that there are two investor logins, but their balance curves are not being exploited at all. I’ll take the liberty to post the statements here, it’s free publicity for them after all.

The huge spike at the beginning of the statement above is due to some account transfer operations. The whole thing looks very nice, doesn’t it? Note that I only used the history since 22.06.2009, which is specified as starting date for Euronis.

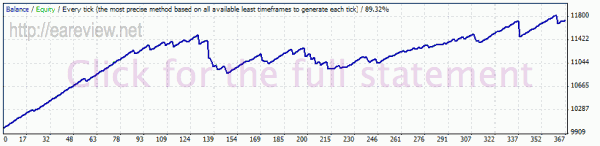

The 2nd live account seems to have been liquidated at the beginning of october 2009, everything having been withdrawn. Still, it did joyously well while it was running Euronis. The weird up-down areas are due to withdrawals and deposits.

If you want the investor usernames, passwords and IPs, they’re available at the Euronis home page.

The EA is being sold through plati.ru (lose the google translator if you understand russian) and states that so far only 10 copies sold, at least 2 of which being the cheap ($100) limited version. No wonder, with a price tag of $990. Later edit: a more careful inspection reveals that all 10 (at the time of this writing) are sales of the cheap version, it was at the bottom of the page.

Edit 26.10.2009: according to a reader, the only limitation of the $100 version is that it is restricted to a single account.

Parameters

It’s featuring lots upon lots of parameters, so many that I can’t even be bothered to verify that they’re all described in the manual. Luckily, the user isn’t expected to control everything and .set files are provided.

A notable aspect is that it has parameters to control the on-chart display, which is really uncommonly well done. It’s showing the trade times, the last trades, error messages, trades, current spread, average spread, open/close slippage+spread and so on in a nice log that scrolls up, with a configurable size. This is an extremely nice feature that I simply love.

It’s worth mentioning that the EA code is absolutely lovable. The programmer obviously has extended experience writing EAs that trade live and considered every little thing that might come up such as retrying the trades when they fail, taking open/close slippage into account, autodetecting the min lot and min lot increment and of course the number of digits. I’m forced to add a “nice code” tag for this EA.

Edit 26.10.2009: the parameters are indeed described in detail in the manual, although the translation is a bit loose at times. Nevertheless, every single controllable option is described and the way it affects the operation of the EA.

Backtesting

All the tests were done using tick data, except the GBPCAD test where I had to use history center data. I used the default .set files everywhere in my tests. The only things I changed were the LotsPercent and MaxLotsPercent which were in all cases set to 5, with the exception of the first test. Other than that, I disabled the on-chart display to speed up the tests.

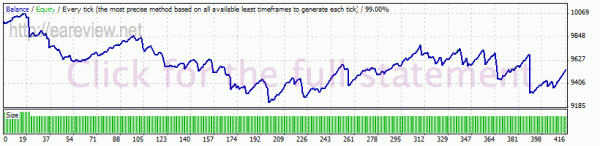

Default out-of-the-box EURCHF settings, spread 3.0 pips, 01.01.2009-10.01.2009

This looks way too sexy. Rather big drawdown, though, almost 20%, so I’m thinking I’ll test it with a risk that would suit a live account, with the lots set at 5% and the max lots set to the same value. Although it does have a very interesting money management algorithm, I don’t fully understand it so I’d rather let it test with a fixed percent.

I can’t help but notice that it’s using a trailing take profit, just like the one I was laughing at in my Forex Equity Builder review. And it’s using it to great effect to limit the losses. Man, do I feel dumb now.

These being said, let’s proceed to the next test, which is the same as this one, but with a reduced risk.

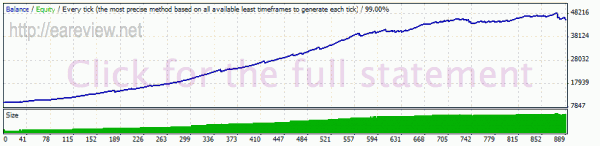

EURCHF risk 5%, spread 3.0 pips, 01.01.2009-10.01.2009

Now this is really nice. 6% drawdown and the account was almost doubled in less than an year. Let’s see what happens when we’re increasing spread a bit…

EURCHF risk 5%, spread 5.0 pips, 01.01.2009-10.01.2009

No longer looking that good, but surprisingly it’s still profitable. It doesn’t bring such a nice profit as the one running with spread 3, but it still does very nice. Yet, if your broker is giving you an average spread of 5 on EURCHF during the Asian session you should probably start looking for a new one.

Let’s see how it would’ve behaved in the previous years, setting spread back to 3.

EURCHF risk 5%, spread 3.0 pips, 01.01.2008-01.01.2009

EURCHF risk 5%, spread 3.0 pips, 01.04.2007-01.01.2009

Doesn’t look that good. It starts to go well in autumn 2008… Come to think of it, most scalpers behave in a similar fashion. I hope one day I’ll figure out why that is… Could it be the crisis? I couldn’t say. Then again, I’m not an economist and I’m not that good at figuring out the market conditions.

Is it curve fit? Hard to say. I fathom it’s not curve fit, but I couldn’t explain why I think it isn’t. Perhaps I’m just being hopeful.

Let’s move forward to EURGBP. The EURGBP, EURCAD and GBPCAD .set files have CrossOverCheck enabled, which is a feature that reminds me of Triangular Arbitrage. I didn’t try to figure out exactly what it does, but fact is it only works in a forward test since MT4 backtesting doesn’t give you bid/ask prices for a different currency than the one you’re trying the EA on. I disabled this feature for the backtests.

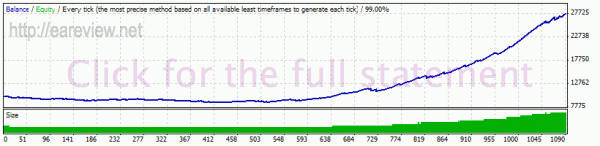

EURGBP risk 5%, spread 2.0 pips, 01.01.2009-01.10.2009

The part after 26.05 looks a bit suspect, so I perform a test from that date to get a more clear idea of what happens in there.

EURGBP risk 5%, spread 2.0 pips, 26.05.2009-01.10.2009

Looks like I was correct, it doesn’t look as good as the first part of the year, but it’s not that bad, either.

I expect it to perform on 2007-2008 just like it did in the EURCHF backtests, starting to perform well in late 2008.

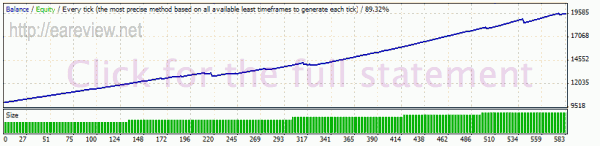

EURGBP risk 5%, spread 2.0 pips, 01.04.2007-01.01.2008

EURGBP risk 5%, spread 2.0 pips, 01.01.2008-01.01.2009

As I expected, it started performing nice in 2008, although earlier than I thought it would.

I’m not going to perform an increased spread test on EURGBP because I’m pretty sure it would behave just like on EURCHF, managing to still pull out some profit. So, moving on to EURCAD, I test it in one go since the tick data starts being available from September 2008…

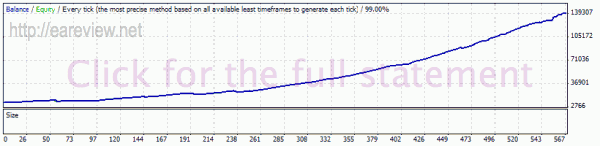

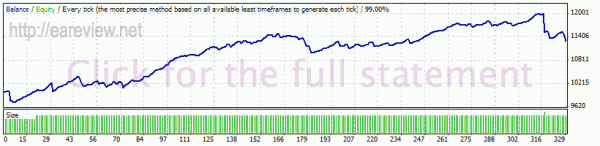

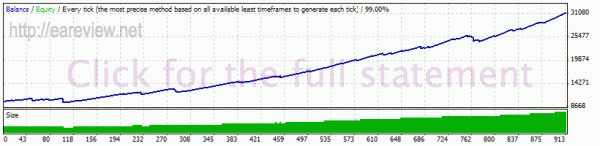

EURCAD risk 5%, spread 6.0 pips, 23.09.2008-01.10.2009

Despite the horrendous spread used, it manages to do well on this pair, too.

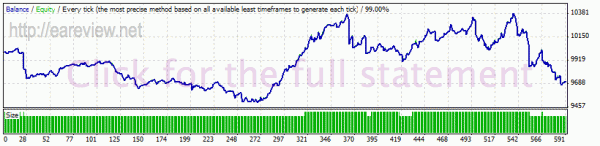

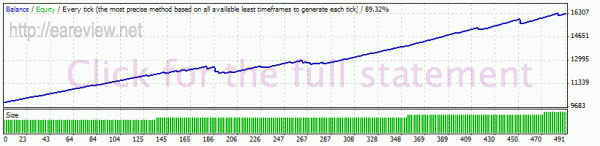

Lastly, I decide to test it on GBPCAD, too, despite having history center data spanning only as far as April 2009. Keep in mind that the data is interpolated so the test is not extremely relevant. The quality is below 90% probably because the history center data doesn’t start from 1st April but a bit later during the month.

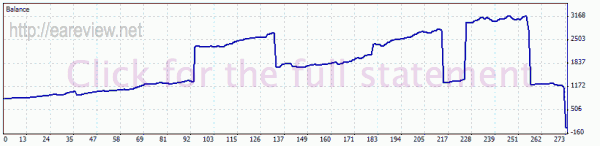

GBPCAD risk 5%, spread 1.0 pips, 01.04.2009-18.10.2009

Looks great, but I wouldn’t rely on the spread of 1 pips that FECH is displaying, it just seems unrealistic for this pair. FIBO is displaying a spread of 10.0 pips and Forex.com of 18.1 pips. I won’t start looking for the GBPCAD spreads at other brokers, but let’s test with spread 3, spread 5 and spread 8 since the max spread it’s configured to trade with is 9.

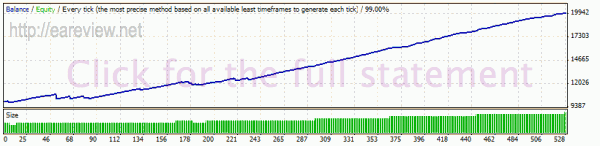

GBPCAD risk 5%, spread 3.0 pips, 01.04.2009-18.10.2009

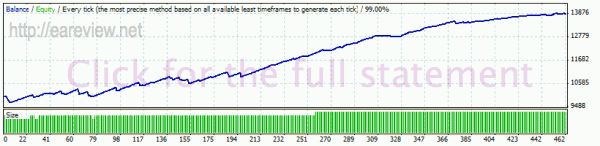

GBPCAD risk 5%, spread 5.0 pips, 01.04.2009-18.10.2009

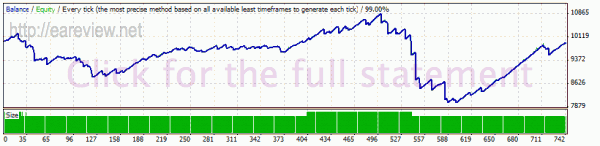

GBPCAD risk 5%, spread 8.0 pips, 01.04.2009-18.10.2009

Obviously, it’s going worse and worse as the spread is widened, but it manages pretty well even with a spread of 8 pips. I stress this again: these GBPCAD results are using interpolated tick data, so they’re quite unreliable, but these backtests should give us an idea of how it behaves on this pair.

Conclusion

If this EA had a price tag 5-6 times lower and someone who knew how to market it, I guess it could make really nice money from the sales, but at $990 it’s extremely expensive when you think the average forex newbie is starting with a balance that’s typically under 5k. It appears to be profitable and it most certainly deserves a forward test. I can find nothing wrong with it other than the fact that it doesn’t work before mid 2008 and that everything seems to be translated using Google. The real accounts with investor logins are particularly impressive, too. Even if it does stop being profitable, it doesn’t seem like it’d suddenly screw up the account badly, but it would instead show a steady decline, see the previous years for an example.

Edit 26.10.2009: at $100 for an account, however, this EA seems to be even cheap. Quite a bang for the buck.

Forward test

The first Euronis forward test was running on JadeFX since 16.08.2009 until 11.12.2009 on the following pairs and timeframes:

EURCHF M15, using default settings, LotsPercent 5, MaxLotsPercent 5EURGBP M15, using default settings, LotsPercent 5, MaxLotsPercent 5EURCAD M15, using default settings, LotsPercent 5, MaxLotsPercent 5

Changed on 26.10.2009 as follows:

- EURCHF M15, low settings, LotsPercent 10, MaxLotsPercent 20

- EURGBP M15, low settings, LotsPercent 10, MaxLotsPercent 20

EURCAD M15, cross-over settings, LotsPercent 10, MaxLotsPercent 10- EURCAD M15, low settings, LotsPercent 10, MaxLotsPercent 20

GBPCHF M15, cross-over settings, LotsPercent 10, MaxLotsPercent 10

The second Euronis forward test was started on JadeFX on 11.12.2009 using the settings above and v4160. On 06.01.2010, it was upgraded to v4200, using the same settings with the following addition:

- GBPCHF M15, cross-over settings, LotsPercent 10, MaxLotsPercent 20

Edit 06.01.2010: added close date for the first Euronis forward test. Added second Euronis forward test. Upgraded to Euronis v4200.

Edit 30.10.2009: changed EURCAD from cross-over mode to normal mode and increased MaxLotsPercent to 20. The change is due to the fact that the JadeFX EURCAD spreads in the Asian session seem to be lower than the crossover spreads, despite being higher outside the Asian session and on average.

Edit 02.11.2009: GBPCHF removed due to lot sizing issues, see the comments below.

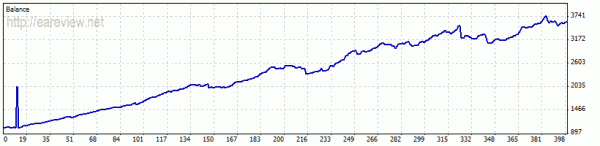

Both forward tests above were closed because that’s what happens to demo accounts are after a while – they go to the little demo accounts heaven (or hell, for martingales) and it’s a pain in the ass to keep restarting them. The old statements are still available on my myfxbook page among a dozen other relics. However, I got the author’s permission to publish the results of one of his featured live accounts on my myfxbook page. I stress this: it’s not my account so I don’t have any control over it, but I thought it’s quite relevant so I’m running a MT4 on it to publish the statement. I’m not sure why the author doesn’t do this on his page, it’d be much better looking and I wouldn’t have to run a MT4 client just to publish the statement. The account was started on 02.03.2010 with $2000 and at the time of this writing it’s sitting at almost $5800. Just like it can be seen in the backtests above, there were some drawdowns, but the EA seems to neatly come out of them and continue scoring profits.

Details

Version tested: 4.160

Euronis home page

English version of the Euronis home page

Pairs & timeframes:

- EURGBP M15 (recommended by the author)

- EURCAD M15 (recommended by the author)

- GBPCAD M15 (recommended by the author)

- EURCHF M15

- GBPCHF M15

- CADCHF M15

Comments are closed.