This article is obsolete and no longer maintained.

Part of a rather large EA family by the same author, all of them named after various characters and story elements from the legend of King Arthur and The Knights of The Round Table, Sir Lancelot is an EA that attempts to capture trend movements.

Just like the Lancelot character in the story had certain flaws (an adulterous affair with Guinevere comes to mind), the EA has its grey areas as well: the indicators shipped with it are the same indicators that are commercially available from SniperForex. The reputation of the Sniper Forex system is quite good and it’s said to be one of the decent manual systems available; if you’re interested, they are offering a free trial. The indicators are a copy of the above mentioned package, renamed in a rather uninspired manner (Sniper Trend A is now named STA for instance), which actually led me to observe the similarity. Further inspection reveals that they’re copied line by line, having even the expiration date still in there; it’s funny that the copyright info has been changed. If I were in the stealing code business, I’d have the decency to do it thoroughly and I’d implement the code directly in the EA. Oh well… I guess it’s very complicated to sue someone for EA or indicator copyright infringement and it’s definitely not free to do it so the Sniper Forex author is most likely not going to bother.

Furthermore, the EA bears a vague resemblance to Funyoo’s Sniper Forex EA but at least in this case, if any of the code was “borrowed”, the author had the decency to rewrite it. It’s hard to say for sure if Funyoo’s EA, which is much older than Lancelot, has been anything more than a source of parameter inspiration when writing Sir Lancelot.

The author, Bernard Balan, appears to be a Canadian in his fifties. Some google action reveals that he was a reputable email spammer some years ago. See this article on CBS News, quite an interesting read in itself, where it is mentioned he used to be a truck driver then a pinball machine mechanic (from truck driver to EA coder… quite the career change), also the DSL reports news item about his 2004 retirement. He was apparently making a decent buck from that business but most likely competition and spam filtering took their toll on his scheme, making him switch to a more lucrative business that’s also making him easy money. If I’m not mistaken, back then he seems to have been using the nickname Merlin, while for some reason his posting on various forex forums now appear under the nickname Pheniox. Even his MyFXBook stats are using the same nickname, which is quite funny considering the discussion that can be seen on the Indo-Investasi forum where he first kisses his own ass then denies being the EA author – what a peculiar nickname coincidence, right?

The EA is protected with a scary system. That is, the system consists of scaring the users into not giving the EA to other people. The author tells the customers how they can be identified if they pass the EA to others and so on, basically scaring them shitless with concepts they don’t really have a grasp of. The only protection-related element is the serial that is compiled into each copy of the EA and that can indeed be used to identify the customer; however, given the widely spread availability of ex4 decompiling, I don’t think that poses a problem for even the slightest EA literate individuals. A particularly funny piece of code taken from the EA is:

Alert("Connecting to server... please wait Downloading new settings!");

Sleep(10000);

Alert("Connected!");

Don’t sweat it if you fail to see what’s funny about that.

Sir Lancelot v4 came with a more elaborate protection/optimization feature: it was making a weekly download of the settings file from the author’s ftp server, using a DLL with a username and password built-in. Not much of a protection: the original settings were multiplied by 100 and then changed according to the file that was fetched from FTP. That file never actually changed so the settings were always the same, but nevertheless it was being fetched weekly and configuring the EA to do it was quite a pain in the behind. Furthermore, in later versions this feature was removed due to the author’s inability to make it work on various versions of the Windows OS.

What’s interesting is that he manages to inspire – and I quote a friend here – “religious fervor” in his users, who are extremely active on his forum and despite being bullshited sometimes and often getting products that are slightly unfinished and only partially tested, seem to be eager to join the bandwagon and play with such things on their accounts.

I was speaking about the author’s results on myfxbook.com and almost forgot to mention the “king arthur” incident. To make a long story short, the author posted the results of a “King Arthur” system showing a through-the-roof balance curve with all the information hidden (open/closed trades, broker and so on); the system owner, Pheniox, claimed that he wrote it for some European banks and that it was not available for sale due to the programming agreement, but obviously used it as a scheme to draw the people’s attention to his other EAs, thus getting more potential customers; other myfxbook users found out that the results were from using the investor login of the FX Genius Robot (a $2000 scam, but that’s a different topic); following that, “king arthur” was promptly removed when the Einstein systems appeared on myfxbook, matching its results. It is now replaced with a system called “Jsut for fun” (the spelling error isn’t mine), again with hidden open trades and history, claimed to be a working system developed by the same author…

The EA is supposed to trade 7 major pairs on the H1 timeframe, but for v6, the author only recommends trading EURUSD and USDCHF. It’s worth mentioning that the author’s myfxbook forward test is admittedly running v1, on what I believe to be a M30 timeframe (since it only opens the trades at the start of a bar and it seems to be opening at XX:00 and XX:30, I figure it might be running on M30 there). Even more, as of late, it seems to be opening trades even within the bars so I might be wrong or perhaps it has hardcoded timeframes, who knows.

Strategy

As I previously mentioned, the EA attempts to catch trend movements. It does so according to the stolen Sniper Forex indicators and it uses a trailing profit together with a configurable profit target as an exit method, with a scalping “fallback” where it locks some profit pips. The strategy is designed to trade around the clock, but trading Monday and Friday is disabled by default and the latest available manual (which is for v4… v5 and v6 are released without one) recommends keeping them this way.

Website

FXReports is home to Sir Lancelot and all the Knights of the Round table family of EAs. Unlike most forex EA sites, it is not overly loaded with marketing gimmicks, but it’s instead featuring plenty of spelling and grammatical errors, even the “Automated” in the site title being misspelled as “Autmated”. Since I’m currently acting as grammar police, I can’t help being mean here – I guess that is to be expected from someone with a truck driving background, even though in the end it’s the EA profitability that counts.

There’s also a forum with a lot of information and postings from the customers and a potential buyer would do well to read it. It’s to be noted that the author is constantly making posts on the forums, being quite involved in the community.

The EA is among the not-so-cheap category, being stamped with a $365 price tag. It’s particularly worth mentioning that there is no refund policy.

Parameters

Since the latest available manual is the v4 one, I’m checking that out when identifying which parameter does what. Some of the parameters described in there are missing from v6, which is a step forward towards running with out of the box settings and no configuration headaches.

Sir Lancelot has automatic GMT configuration with the possibility of setting it to manual, which seems rather useless seeing that by default it operates 24 hours per day. Perhaps it’s used for determining whether it’s GMT Monday or Friday, which it avoids. It also has a time configuration session, where you can input the start and end hours of operation and which only makes sense if you want to optimize the EA. Further, it has a section that allows the user to configure the operation of the EA during each day of the week, with Monday and Friday being disabled by default as repeatedly mentioned earlier.

For some reason, even though it has code for detecting the number of digits in the EA, it has a parameter for configuring it. If you set it to 5 and you’re on a 4 digit broker, it will warn you.

There is a money management option that allows setting the lot size as a percent of the balance or setting a fixed lot size. It’s auto detecting whether the broker is using one or two lot digits. Before I forget to mention it, the EA is ECN compatible, however it doesn’t have any error handling for order sending errors which might create problems in certain situations.

Other settings are the PipLock for the “scalping” mode and also some settings that allow hiding the EA SL from the broker. It’s worth noting that the risk is configurable as a percent of the account balance, with the EA closing the trades when the equity drops over 5% of the balance. The 5% is of course configurable, but it applies to all the positions open in the account it’s run on, so it will interfere with running other EAs on the same account. You can set it to only close its own trades in such a situation, but still, it’s not funny knowing that another EA you’re running opens trades that are at a loss and Lancelot is closing your trades because of that. Guess it’s not particularly friendly to being run with other EAs on the same account when this mode is enabled.

It also has a martingale lot increase implementation with a very low default increase coefficient which in v6 is disabled by default, the author openly discussing it on his forums as being dangerous to use.

Scrolling further down through the parameters, I can find various alerts from email to acoustic and a throng of settings that I don’t want to change , since I recognize some of them as the default ones for the Sniper Forex indicators. Moreover, they’re even being labeled “DO NOT ALTER THESE SETTING !” – I know it should be “settings” but it’s an exact quote – making me wonder why they’re there in the first place since it’s not the customers’ job to optimize the EA.

Backtesting

I did quite a lot of backtesting for this EA. I used the default parameters almost everywhere, any exceptions being noted. Some of the tests were done using history center data and an Alpari UK terminal, some were done using a JadeFX terminal and Dukascopy tick data. I’ll try to mention which test is using what data; if I somehow forget, just check the strategy report.

So, let’s start with EURUSD and USDCHF, the pairs recommended by the author for v6.

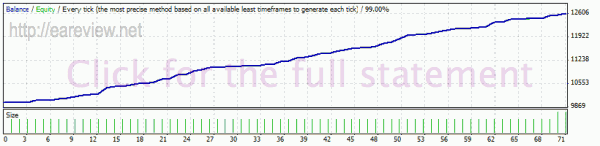

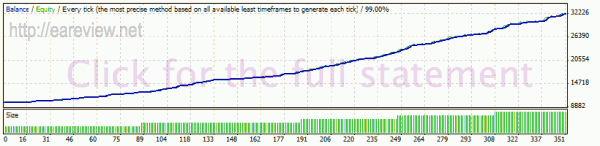

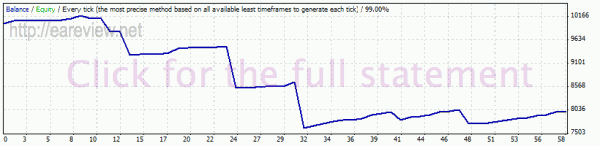

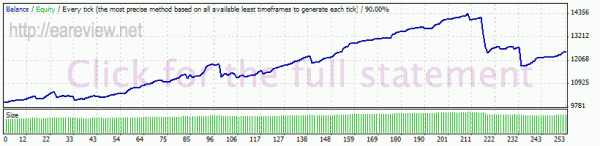

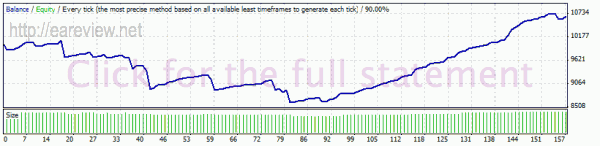

EURUSD H1 2008.06.01 – 2009.11.17, tick data, default settings

That’s looking pretty darn good, but given the low number of trades, the extremely high winning percent and the fact that the EA was released very recently (after the end of the data I’m using), I’m guessing it’s slightly over optimized on the period or perhaps even curve fit. I’m making a mental note to test a longer time interval later.

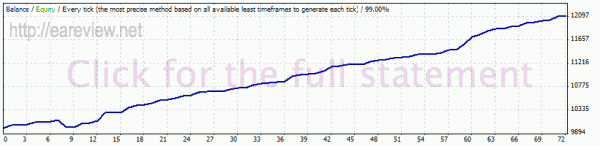

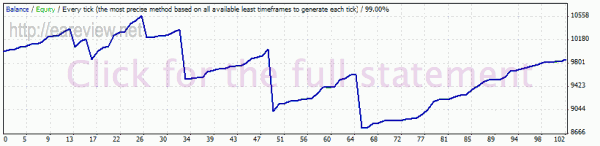

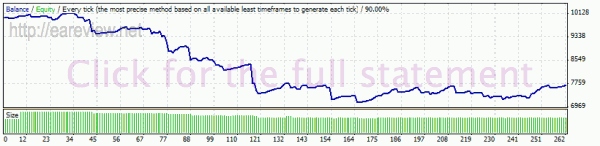

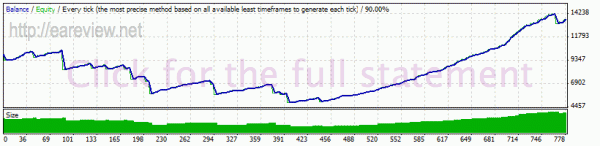

USDCHF H1 2008.06.01 – 2009.11.17, tick data, default settings

Yet another backtest that looks quite impressive, but it raises the same suspicions as the EURUSD balance curve did.

So, let’s try to backtest it on the past (almost) 9 years. I would’ve backtested it on the past 10, but frankly I typed 2001 instead of 2000 by accident and I can’t be arsed to do all the backtests again because of that. On top of it, as you will see below, they’re conclusive enough.

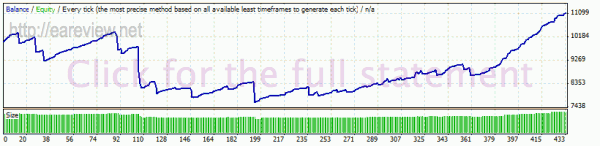

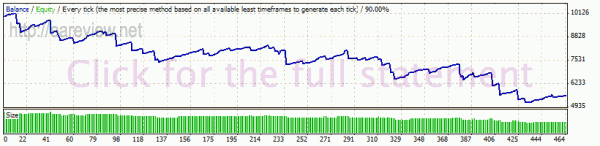

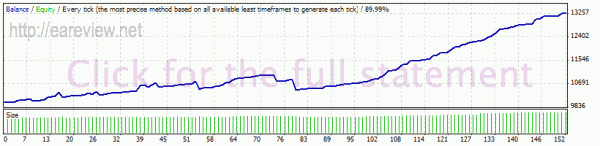

EURUSD H1 2001.01.01 – 2009.11.26, history center data, default settings

The EA is a sore loser until January 2005 when its performance starts to get slightly better. It starts behaving even better at the beginning of 2006 and its performance culminates with the segment starting in June 2008, during which it has no significant losing trades. As a side note, it’s easily visible that the trades taken on the history center data almost coincide with the trades taken on the tick data (for the overlapping time intervals, of course).

But let’s see what happens when backtesting the EA on USDCHF using the same time interval.

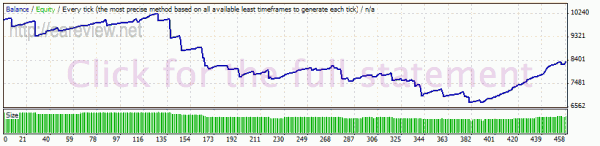

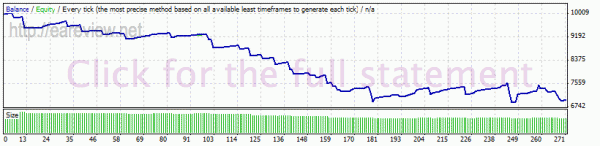

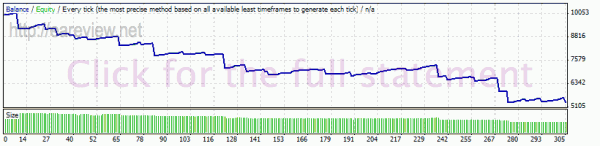

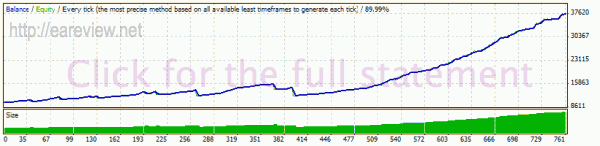

USDCHF H1 2001.01.01 – 2009.11.26, history center data, default settings

This looks kind of bad. The EA keeps losing and losing and only starts being profitable in June 2008. What a funny coincidence, my tick data FXT started exactly on 06.2008. Am I dealing with a curve fit EA? Pretty hard to say now, but it will be obvious after a couple months of forward testing. If it keeps winning, it’s probably just a very nice periodic optimization; if it starts losing, it’s going to be pretty clear it was curve fit.

I’m curious about the advanced strategy parameter and I decide to give it a try on tick data.

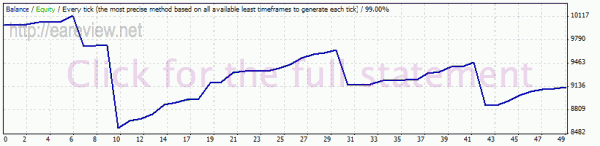

EURUSD H1 2008.06.01 – 2009.11.17, tick data, advanced strategy

The balance curve resembles closely the one from the backtest with the default settings, but the profit is higher. It seems to just open 5 trades instead of 1 each of them with the lots calculated based on the balance percent configured in the money management section. This means that if you wrote “2” there your total risk (for lack of a better term) will be 2*5=10, amplifying both gains and losses. Since this test only spans the optimized period, the effect in losses is not visible at all, but the effect in the ending balance is pretty noticeable. Sometimes it seems to exit the positions different from each other, but essentially it seems to work very similar to the normal strategy.

USDCHF H1 2008.06.01 – 2009.11.17, tick data, advanced strategy

In a similar way, the effects are visible on the USDCHF optimizated time interval – the balance is sensibly higher than the one in the backtest using the default strategy.

I also backtested both strategies using history center data on the same time interval (wider than the one used with tick data), to make it clear how the advanced strategy amplifies both gains and losses.

EURUSD H1 2007.01.01 – 2009.11.01, history center data, default settings vs advanced strategy

I guess that’s indicative of the extra risk taken when enabling the advanced strategy (drawdown 6.04% vs. 27.14%), but just for further evidence (and also because I already saved both anyway and don’t want them to go to waste), I’m posting the USDCHF backtests.

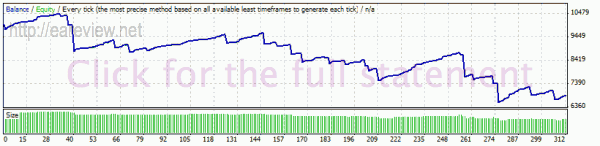

USDCHF H1 2007.01.01 – 2009.11.01, history center data, default settings vs advanced strategy

It’s even more obvious here, drawdown 6.79% vs. 59.73%. Scary.

Since it is mentioned on the webpage that it’s supposed to trade 7 major pairs and since the v4 manual mentions several other currency pairs, namely GBPUSD, EURGBP, EURCHF, USDJPY and EURJPY, I decide to perform some backtesting on these as well. Please note that the author only recommends running v6 on EURUSD and USDCHF and for good reason as you will be able to see below.

Extra tests

These don’t really need any comment so I’ll just post the backtest results.

GBPUSD H1 2008.06.01 – 2009.11.17, tick data, default settings

GBPUSD H1 2001.01.01 – 2009.11.26, history center data, default settings

EURGBP H1 2008.06.01 – 2009.11.17, tick data, default settings

EURGBP H1 2001.01.01 – 2009.11.26, history center data, default settings

EURCHF H1 2008.06.01 – 2009.11.17, tick data, default settings

EURCHF H1 2001.01.01 – 2009.11.26, history center data, default settings

USDJPY H1 2008.06.01 – 2009.11.17, tick data, default settings

USDJPY H1 2001.01.01 – 2009.11.26, history center data, default settings

EURJPY H1 2008.06.01 – 2009.11.17, tick data, default settings

EURJPY H1 2001.01.01 – 2009.11.26, history center data, default settings

Guess it can be run on 7 pairs indeed, but that doesn’t necessarily mean it will end up in a happily-ever-after finale.

Since there are some rumors of it working on M30 and it seems that the author’s v1 forward test is also running on this timeframe, I feel compelled to try a couple of backtests myself.

M30 tests

EURUSD M30 2007.01.01 – 2009.11.01, history center data, default settings

Granted, it’s not the timeframe the EA is intended to be run on, but it looks totally hopeless. If v1 works ok on M30 it must be quite different from v6. Nevertheless, that version is not the testing subject of this review so I decide to stop looking into it any further.

USDCHF M30 2007.01.01 – 2009.11.01, history center data, default settings

Although this one does look a bit better than the EURUSD M30 backtest, it’s still not very promising. If you’re running this EA, I’d recommend sticking to H1.

Conclusion

It’s very hard to say at this time whether it’s curve fit or not, which is why I decided to run a forward test. Given the author’s past and the fact that the indicators used by the EA are plainly stolen, I think informed potential customers are facing a rather difficult decision, especially with the EA price being $365, which is nowhere near cheap. However, it’s clear that the author did put some work into the EA and if it’s still going to be profitable after several months of forward testing, it’s definitely going to be worth a look if, like many others, you’re not concerned about ethics and only profitability matters to you. Anyway, before you make a decision, keep in mind that there’s no refund policy.

Forward test

The Sir Lancelot v6 forward test is running on Alpari UK on the following pairs and timeframes:

- EURUSD H1, default settings, money management enabled, 2%

- USDCHF H1, default settings, money management enabled, 2%

Details

Version tested: 6

Homepage: FX Reports

Pairs and timeframes (profitable in backtesting):

- EURUSD H1

- USDCHF H1

Comments are closed.