This article is obsolete and no longer maintained.

At last, another EA that doesn’t involve scalping. Made by a British couple (and when I say couple, I mean that they seem to be husband and wife), it’s an EA that has a somewhat strange mode of operation. Some of the customers suggest on Donna’s forum that it should have been named Losealot, but I decide to ignore that comment and go on checking it out.

Speaking of that forum, I took the time and read all 21 pages of the Winalot & EAzeGor thread. The most noticeable presence is that of the authors, Hilary and Jeremy, posting as “Easy EA”. The level of support provided there is unprecedented and they take the time to explain many of the inner workings of the EA as well as some less known aspects of the Forex market. However, they suddenly stop manifesting their presence there during the beginning of September. From their posts, it becomes obvious that they both have a background as traders (claiming to have 50 years of experience together) but they don’t seem to have a very strong background in programming. The latter is also obvious from the fact that they were unable to implement automatic GMT time detection and from the bugs I encountered; also, the EA protection, while implemented in a DLL, is far from being remotely serious. There are rumors about the authors releasing “decoy” pirated versions just to fish personal data of potential users, but I can’t verify that.

Furthermore, when the EA starts losing, the authors take the time to encourage their users with very good explanations of the EA drawdowns. The posts are very fluent and there are almost no grammatical errors… I’ve rarely seen such coherence in a forum, I’m impressed. Guess that didn’t really help patch the holes in the customers’ accounts, though.

The EA has two versions: a monthly subscription based “trial” that costs £20 and a fully licensed version that costs £200. While the trial version is only trading GBPUSD, the expensive one also has built-in settings for USDCAD & USDJPY and comes equipped with a do-it-yourself optimizing guide. Taking a glance at this document leads me to think that the EA is highly curve-fit, but let’s not jump to conclusions.

Before I’m through with the intro section, it’s worth noting that although a Winalot version 7 has been promised during summer, with bells and whistles that would make it not lose anymore, it was never released. Instead, a new EA called WinPro was launched. What happened to the users that purchased the full Winalot license at launch? They’re left with an EA that’s very much like a forgotten baby, no further updates seem to be provided. These customers paid the full price, stoically taken the losses the EA managed to produce in the meantime and are now forced to pay the subscription price for the new EA if they want a fixed Winalot. Unlike these customers, there are the fortunate ones that only paid for the subscription-based trial and probably managed to run it almost for free for an extended time due to the policy of providing the next month free if the EA does not bring profits.

Strategy

As long as the market is open, it will open positions every day at a given time (2:05 AM UK time for GBPUSD) and it will calculate the profit target and the stop loss as a percent of an ATR-like indicator. Just as it should be expected of real traders, the authors realize that no magic number will work in all situations (I’ve seen an EA that used 93 pips as profit target and that’s not a lone example…) and let these numbers be adjusted dynamically, as a function of recent market behavior. While I salute this initiative, what’s the meaning of trading at 2:05 AM? I fail to see any logic behind that seemingly random picked time. While the authors explain other workings of the EA on the thread mentioned above, this particular aspect remains unclear and it’s my supposition that they landed on it by backtesting just like they mention in the optimizing document (6 months optimization for the time & tp/sl settings?).

Combined with the above, it has a money management mode which allows it to opens lots using martingale position sizing, featuring a fixed percent risk mode as an alternative. The martingale element can also be disabled.

Since it attempts to trade along trends, I’ll classify it as a trend-trading EA.

Website

The EA home is located on the author’s site, among the other EAs. There’s a wide range of backtest reports, which all end in June 2009. There’s also a statement that ends on 31.07 and that shows some profit. There’s an USDCAD forward test that behaved rather well and that starts from 03.08.2009. However, the other tests (GPBUSD for example, which looks very bad at the time of this writing) are mysteriously cut to the current month and the blame for that is placed on the MT4 client settings reverting, as if it wasn’t easy enough to change the settings and perform the upload again.

Unlike many other EA sites, the Winalot home is not a full of marketing bullshit, but contains a rather concise description of the product and its features.

Parameters

The manual does an ok job of describing the parameters, but some of them are only briefly described and it’s mentioned that they should be used during optimization, but there’s no description of their boundaries or the effect of changing their values.

I first tried to test the EA using the FixedRisk settings, but due to a bug, this did not work correctly in backtesting. Since my time is better spent elsewhere, I didn’t bother much trying to locate and fix the problem and instead I tested with the default settings.

The Risk parameter defaults to 50.0, but when you read the manual, it is totally unclear how it works. The only thing that can be deduced is that the higher the risk, the higher the position sizes. The default of 50 is advertised to result in drawdowns of around 30%, so clearly it doesn’t mean that every trade will risk 50% of your account.

There are other parameters, that allow the customer to change different aspects such as specifying the maximum lot size, controlling the martingale factor, the maximum number of open positions or manually entering the UK offset, as well as useless parameters such as choosing whether the current balance & equity is displayed on the chart and if so, which color should it use.

Backtesting

For most of the tests, I left everything on default except the UK_Offset parameter. Since I used Dukascopy data in most of my tests and I’m not entirely sure if the EA should follow the GMT time or use the DST of UK, I did most of the tests with the UK_Offset set to 0 then to 1. As you will see below, the differences aren’t that big.

Even though with such high stop loss & take profit as the EA has, testing it on history center data is not a problem, I did most of the tests using tick data. The timeframe of the backtest doesn’t matter because the indicator periods are hardcoded into the EA and the results are the same regardless of the timeframe selected.

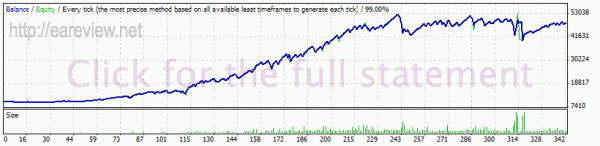

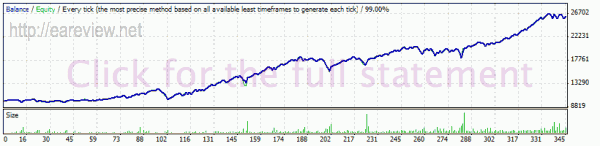

GBPUSD 01.06.2008 – 01.10.2009 offset 0

Looks just like I thought it would when I read the optimization manual. It appears to be curve fit. Perhaps the authors don’t know it, but it seems to be suffering from an extreme case of overoptimization. It starts performing well during August 2008 and it stops performing well during June 2009. After that, it simply fails to perform. It’s not losing, but not really duplicating the performance exhibited in the optimization period.

But let’s try it with the offset set to 1.

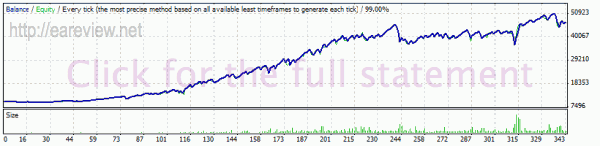

GBPUSD 01.06.2008 – 01.10.2009 offset 1

Not much difference, but the part after June does look slightly better. Perhaps this is the correct offset. Perhaps not. The improvement in performance is pretty far from convincing me to even think of running it on a live account.

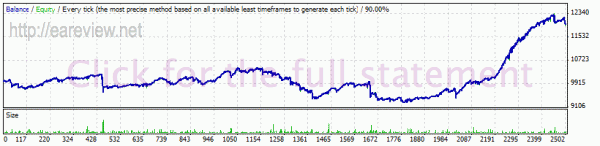

Seeing that a 1 year period is somewhat short for such an EA, I decided to test it for the past ~10 years and start the backtest in 2000, using an Alpari client and history center data.

GBPUSD 01.01.2000 – 29.10.2009 offset 1, Alpari UK, Risk 5

This backtest lasted for over 60 hours. Perhaps the UK offset should’ve been 2, but I’m pretty sure it wouldn’t have made a big difference. I’m sure as hell not going to repeat it with offset 2. My computer is pretty noisy and even though it’s in a different room, I can hear it when going to bed. Sleeping with it running is not among my turn ons, so I’ll pass on running another backtest that will last as long as this one.

I changed Risk to 5 and MaxLots to 1.0 out of fear that it will crash the account on the way. It looks like it might have done just that at the beginning when it increased the lots to a fairly high value, if it had a Risk setting of 50, but it’s hard to tell without running the backtest again with the changed settings.

I stick to my earlier conclusion, it was heavily optimized for a given time interval, it can be observed in the balance graph pretty clearly. It performs very randomly outside those boundaries. You could probably open a trade at 2:05 AM every day, tossing a coin to determine direction, and you’d have very similar results.

Let’s see what happens with the other two pairs the EA is optimized for.

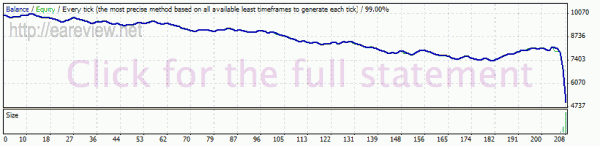

USDCAD 01.06.2008 – 01.10.2009 offset 0

The martingale factor says hello. The EA gets stopped out within a couple of months of the start date of the backtest. Guess it’s not a very safe money management technique. Then again, what’s new about martingale being unsafe…

USDCAD 01.06.2008 – 01.10.2009 offset 1

This looks pretty decent. Not only didn’t it drive the nose of the balance curve in the ground, but it actually brought nice profits and it no longer looks curve-fit. Still, given the performance exhibited on GBPUSD, I wouldn’t trust it with a live account, at least not until the authors care to explain the logic behind opening trades at precisely 6:15 AM for this pair (or the trade opening times of the other pairs, for that matter). Why not 6:05 or 6:12?

USDJPY 01.06.2008 – 01.10.2009 offset 0

This looks just sad. I wonder whether it was indeed optimized for this pair. Or perhaps I did something wrong? Doubt it, but one never knows. I’ll try it with offset 1.

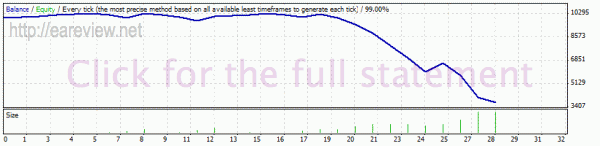

USDJPY 01.06.2008 – 01.10.2009 offset 1

It manages to top the bad performance it had when using offset 0 by crashing the account. Running it on this pair might not be a very good idea, after all.

Conclusion

Despite the authors’ temporary involvement into the community and their seemingly good intent, the EA seems to be only marginally profitable, if at all. The USDCAD pair shows some promise, but if you do intend to use the EA on that pair, I’d advise running some more backtests than I did here. I can’t say with 100% certainty that it’s curve fit, but I’m inclined to believe so. On top of that, the martingale position sizing that it’s using by default is dangerous, there’s no telling if and when your account might be blown to pieces.

Unfortunately, the £20/month version doesn’t run on USDCAD; if it did, at that price it would have definitely been worth it.

Bottom line, it’s a rather cheap EA if you use subscription mode, but you get what you pay for. You might end up waiting forever for updates if you buy the full license, seeing that WinPro is the authors’ new favorite.

Details

Version tested: 6.8

Homepage: easy-ea.com

Forward tests: author’s GBPUSD high risk, author’s USDCAD, author’s USDJPY

Currency pairs:

- GBPUSD

- USDCAD

- USDJPY

Comments are closed.