This article is obsolete and no longer maintained.

It’s been over one year since the launch of Forex Combo System and its live performance has been very good in spite of the hard times many Forex trading strategies have been through. Forex Combo System has proven to be a very solid expert advisor and ever since the inception of the EA Top, it managed to always hold a good spot. Out of all the Forex robots that have seen the the reader’s browsers on my website, it is probably the most steadily profitable system. Even though it seemed to need nothing more to be a truly versatile automated Forex strategy, the vendor shows us that the system is still being improved: the ending month of the year brought an unexpected gift to all its users, a new major version that incorporates a whole new strategy, bringing the total count to four different strategies in a single product, rivaling an EA portfolio.

If you don’t already have it, it might be a good idea to consider getting it now:

Buy Forex Combo System

For those buying via the giant link above this paragraph instead of 2 live accounts you will get 3 (by contacting the vendor after the purchase and mentioning you bought through eareview). This deal is exclusive to eareview.net.

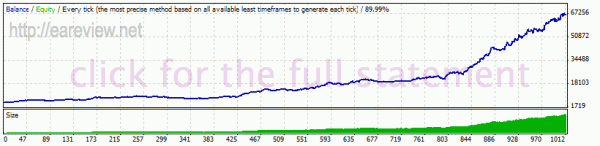

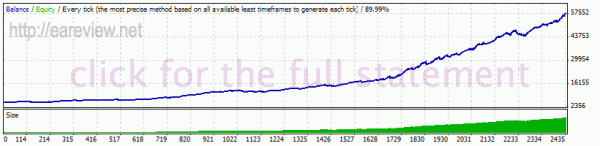

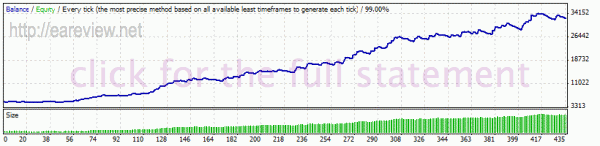

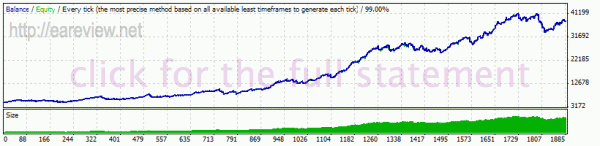

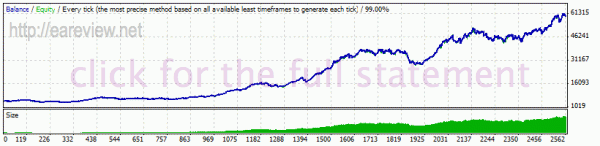

Some of you might know that I’m using the Forex Combo System license to its full extent and running three different live accounts with it. The first one was started in September 2010 and it’s only running the EURUSD EA:

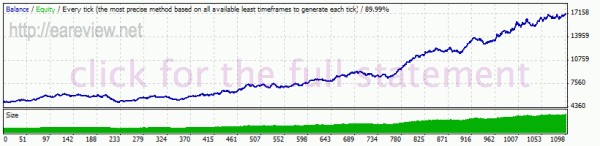

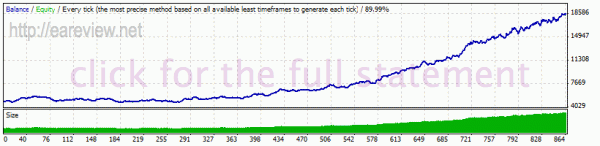

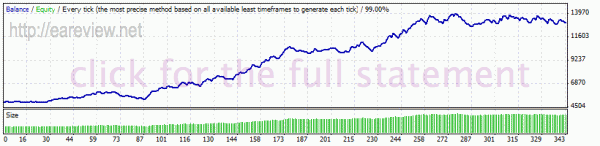

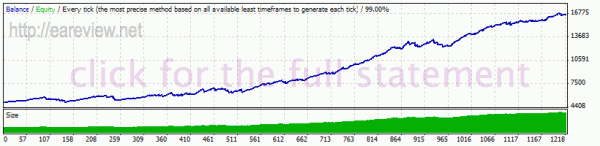

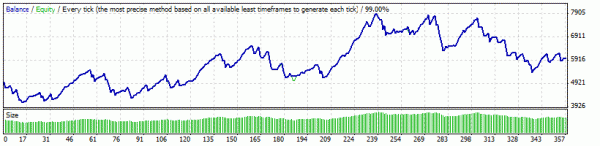

The second was started when the GBPUSD version was launched, in March 2011. I had a hunch that the GBPUSD EA performance wouldn’t be on par with that of its EURUSD counterpart, so I decided to run it separately. This account is only running the GBPUSD EA:

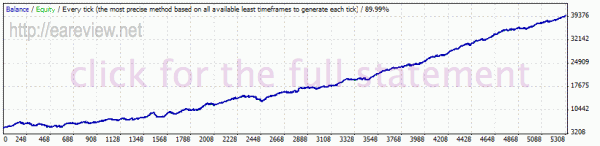

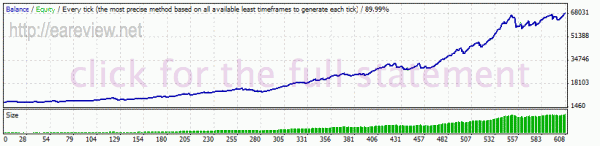

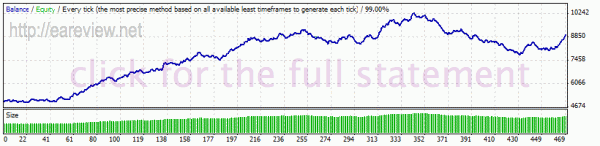

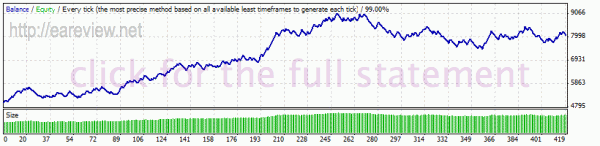

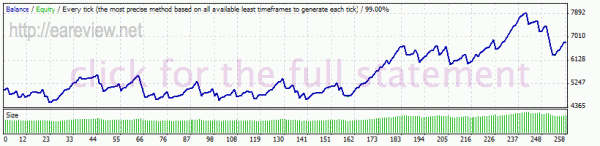

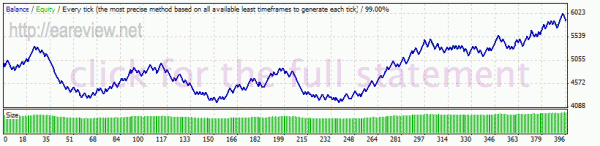

Finally, the third account was started soon after the launch of the EA Top – Best Forex Robot page in August 2011 because many people were wondering why are there two separate Forex Combo System accounts in there. This version is running both the EURUSD and the GBPUSD EA:

Before we dive in, let me explain the whole thing with the 4th strategy, named EuroRange. It’s a rather simple system: it tries to capture the (rather large) price movements that occur during the European session by identifying an existing trend and opening a long or short position at 7AM GMT, a position with a relatively tight stop loss (~50 pips for EURUSD, 60 pips for GBPUSD) that gets a trailing stop once it goes into profit.

So, before applying the new update to my Forex Combo System accounts, I set out to find out more about the new strategy, about what changed in the other strategies and to see which accounts should I upgrade and what should I expect after upgrading. Since the new version was launched very recently, there’s no better way to find this out than backtesting so I defined a suite of tests that I wanted to run and went ahead with it. Given the current backtesting speed of the robot, which was somewhat reduced in the new version, it took about a couple of weeks but the whole ordeal is finally done and the results are here for your viewing pleasure.

I was planning to revise my original Forex Combo System review and update it with the new version backtests as I did in the past when new versions were released, but given the number of backtests that I ran for this new version, I felt it would clutter it to a point where nothing would be clearly understandable anymore so I decided to simply write a new post instead, but I’ll keep it on the short side since it’s Christmas today.

As I usually proceed, I started with the history center data backtests, starting from 1999 and ending with 2011.

Metaquotes history center data backtests

For all the history center data testing, the spread was set to 1.5 for EURUSD and 2.0 for GBPUSD and the GMT offset was 2 with DST enabled. As many of you know, some 2011 data is missing from the Metaquotes history center (about 3 months), so the backtests will also miss that part.

EURUSD history center data

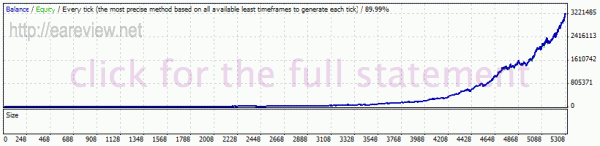

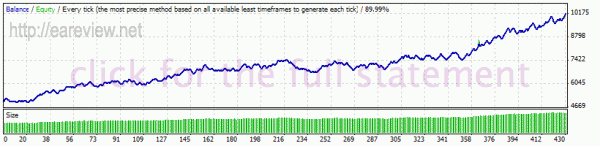

All 4 strategies, EURUSD history center data

I usually try to keep the max drawdown below 20%; in this case it was a bit above that but the risk of 2 suits me just fine. While the output of the backtest above certainly looks good, I decided to also run a fixed lot backtest to have a more comprehensible representation of the balance curve progression through the 12 years of the backtest.

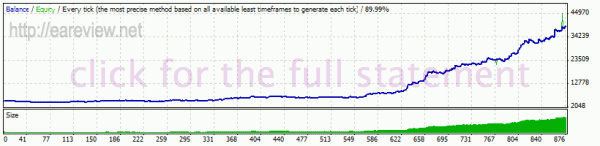

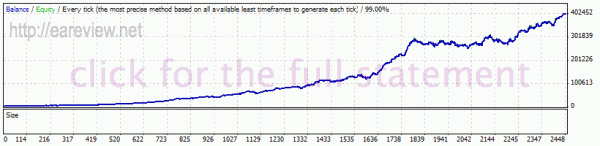

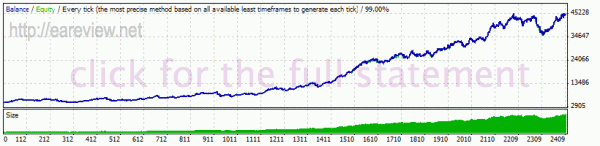

All 4 strategies – fixed lot size, EURUSD history center data

This looks much clearer than the first balance chart. For me, this was enough to persuade me to upgrade the EURUSD EA to 3.0: compared to the backtest of the first version I tested (1.42), this one has a lower drawdown and better returns.

I also ran individual tests of each strategy for those who want to compare them in detail with the older backtests.

Strategy 1 – Scalper, EURUSD history center data

Strategy 2 – Breakout, EURUSD history center data

Strategy 3 – Reversal, EURUSD history center data

Strategy 4 – EuroRange, EURUSD history center data

This is the strategy that was added in the new version so I was very curious about it.

Clearly, it’s able to hold its own when running solo. It’s definitely not a miracle strategy, but it’s profitable and it complements the others nicely.

GBPUSD history center data

All 4 strategies, GBPUSD history center data

Actually, although this one looks a bit better than the 2.42 GBPUSD backtest, it really isn’t. The drawdown (32%) is worse and the end profit also decreased.

Just like I did with the EURUSD EA, I ran a fixed lot backtest.

All 4 strategies – fixed lot size, GBPUSD history center data

The largest drawdown seems to be somewhere at the start of the test, so the figure mentioned above doesn’t need to be a very big concern – the market has changed vastly since 1999-2000 but a drawdown exceeding 30% cannot be easily ignored given the rather cautious risk settings I went with.

I’ve also performed individual tests for each strategy for GBPUSD history center data.

Strategy 1 – Scalper, GBPUSD history center data

Strategy 2 – Breakout, GBPUSD history center data

Strategy 3 – Reversal, GBPUSD history center data

Strategy 4 – EuroRange, GBPUSD history center data

…and this where it gets interesting. Obviously, the EuroRange strategy isn’t really doing all that good on GBPUSD, it seems to be much worse than the other three. In fact, I was even wondering why was it also added to GBPUSD when it struck me: it must be optimized for the recent market conditions, starting from 2007-2008, so I went ahead with a 2007-2011 history center data backtest to verify my hypothesis:

Indeed, this seems to be the case. This backtest looks much better and its drawdown is below 12% whereas it was over 40% in the 12 year backtest.

Dukascopy tick data backtests

For the tick data backtests I used the real (variable) spread and a commission of 0. I was planning to run a second identical set of tick data backtests with a higher commission but given the time needed to do that and the fact that the differences would’ve been rather small, I decided not to do it after all.

EURUSD tick data

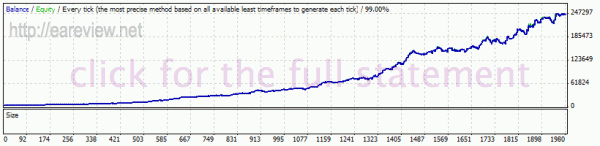

All 4 strategies, EURUSD tick data

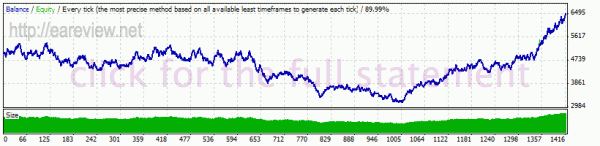

At this point, I came up with the idea of comparing all the four strategies versus the older three strategies, so I also ran such a backtest.

3 strategies: 1 – Scalper, 2 – Breakout, 3 – Reversal, EURUSD tick data

Although the balance curve of the 3 strategies is a bit smoother and the relative drawdown of all 4 strategies is a bit worse, the profits are much higher in the latter case due to the compounding. Looks like EuroRange is a more than welcome addition to the EURUSD EA.

Strategy 1 – Scalper, EURUSD tick data

Strategy 2 – Breakout, EURUSD tick data

Strategy 3 – Reversal, EURUSD tick data

Strategy 4 – EuroRange, EURUSD tick data

I would’ve expected this one to look just like the history center data backtest, but lo and behold, it doesn’t. I checked the trades and was able to match most of them but for some reason there are extra trades (or to put it a different way, missing trades) in both of them. I’m not sure what to make of it, the outcome is quite different. I’ll enable it live and watch its performance there.

GBPUSD tick data

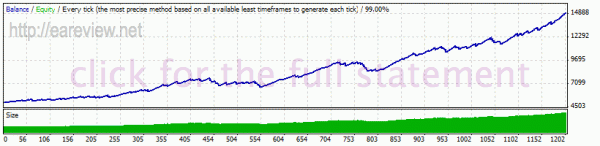

All 4 strategies, GBPUSD tick data

3 strategies: 1 – Scalper, 2 – Breakout, 3 – Reversal, GBPUSD tick data

On GBPUSD, just like on EURUSD, Forex Combo System performed better when running all its 4 strategies. However, it was only slightly better, the difference was nowhere near as high as it was on EURUSD.

Strategy 1 – Scalper, GBPUSD tick data

Strategy 2 – Breakout, GBPUSD tick data

Strategy 3 – Reversal, GBPUSD tick data

Strategy 4 – EuroRange, GBPUSD tick data

In a similar way to the EuroRange strategy EURUSD backtests, this doesn’t really look much like its history center data counterpart. Once more, I’ve compared the backtests a bit and I see trades that were taken in one but not in the other… I still can’t explain the differences but I don’t really like the outcome of this test when using tick data. It remains to be seen how it does in forward testing.

In my older review, when backtesting the GBPUSD Forex Combo System I noticed that it performs slightly better when setting the GMT manually to the broker’s summer GMT offset plus 1. So, I had to check whether that was still standing.

Just as a reminder, the tick data that was used to run the backtests was created with GMT 0 and no DST. All the backtests below are using GMT+1.

All 4 strategies, GBPUSD tick data, GMT+1

The outcome seems to be more profitable than running the same with GMT 0. Ironically, as you will see below, the 2 backtests that depend on the GMT offset were not actually better, but most likely a synergy effect was applied and boosted the profitability.

Strategy 3 – Reversal, GBPUSD tick data, GMT+1

As it turns out, the observation I made in the past regarding the different GMT offset no longer stands. This is not really significantly better than the one with GMT 0.

Since EuroRange is another strategy that relies on the GMT offset, I also backtested it with GMT+1 to see what the effect would be.

Strategy 4 – EuroRange, GBPUSD tick data, GMT+1

EuroRange, too, does not seem to be better nor worse than the backtest with GMT 0. Its GBPUSD implementation wasn’t doing very good to begin with and it remains at the same level.

Conclusion

Clearly, the most profitable strategies by far remain the EURUSD scalper and breakout, together with the GBPUSD scalper. Close behind in profitability is the EURUSD reversal, followed by the GBPUSD breakout and EURUSD EuroRange. Finally, I’m not a big fan of the remaining strategies, GBPUSD reversal and EuroRange.

All in all, Forex Combo System v3.0 is a nice upgrade. I am going to apply the new version to my forward tests and simply keep them as they are when it comes to the running pairs: one on EURUSD, one on GBPUSD and the last one running both pairs. I will use the default settings with 2.0 risk for each strategy, but I will no longer keep all strategies enabled: for GBPUSD, I will disable the Reversal and EuroRange strategies, for both accounts where it applies.

For those who just scrolled down to the conclusion and don’t have the expert advisor yet, I’m reposting the buy link:

Buy Forex Combo System

Keep in mind: buying through this link entitles you to an extra live account license.

Finally, no matter if you run Forex Combo System or not, you should keep an eye on its performance in the EA Top – Best Forex Robot – it’s definitely one of the most interesting expert advisors that I’ve seen so far.

Comments are closed.